2 Shares in Mason Hawkins’ Longleaf Companions Fund Strategy 52-Week Lows

The markets usually are not even a month into the brand new yr and some shares in Mason Hawkins (Trades, Portfolio) fairness portfolio are already buying and selling close to their 52-week lows.

Because the market continues to cope with inflation and rising rates of interest, two shares within the gurus fairness portfolio have dived.

In distinction, after posting a -19.44% whole return for 2022, the S&P 500 Index has gained round 5% to this point this month.

Southeastern Asset Administration, the funding agency based by Mason Hawkins (Trades, Portfolio) in 1975, manages the Longleaf Companions Funds. To attain long-term capital development, the Memphis, Tennessee-based agency invests in a considerably concentrated variety of undervalued corporations which have robust stability sheets and good administration groups.

The third-quarter 13F submitting confirmed Longleafs fairness portfolio consisted of 40 shares as of the three months ended Sept. 30, 2022, which was valued at $3.97 billion. The holdings have posted largely constructive performances to this point in 2023, with solely three of the highest 20 positions declining.

As of Thursday, the 2 shares which have collapsed to close their lowest costs in a yr had been Douglas Emmett Inc. (NYSE:DEI) and Lumen Applied sciences Inc. (NYSE:LUMN).

Buyers ought to be conscious 13F filings don’t give a whole image of a corporations holdings because the reviews solely embody its positions in U.S. shares and American depository receipts, however they will nonetheless present helpful data. Additional, the reviews solely mirror trades and holdings as of the most-recent portfolio submitting date, which can or is probably not held by the reporting agency immediately and even when this text was revealed.

Douglas Emmett

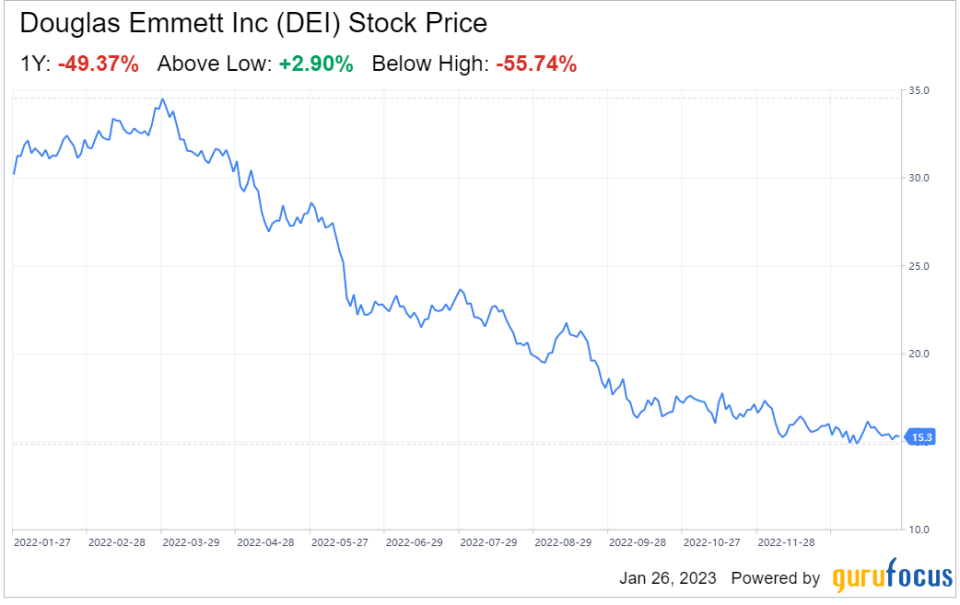

Douglas Emmetts (NYSE:DEI) shares have tumbled almost 50% over the previous yr. The inventory is at the moment 3.74% above its annual low of $14.72.

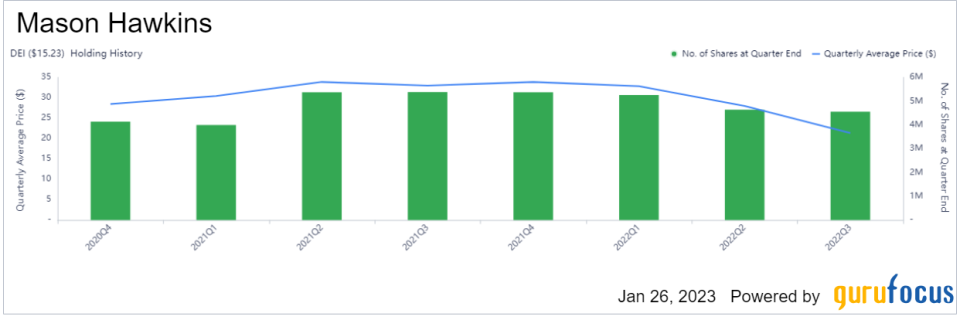

The fund at the moment holds 4.5 million shares of the corporate, which characterize 2.05% of the fairness portfolio. GuruFocus estimates it has misplaced 41.05% on the funding, which was established within the fourth quarter of 2020.

The Santa Monica, California-based actual property funding belief, which owns workplace buildings and house complexes, has a $2.68 billion market cap; its shares had been buying and selling round $15.24 on Thursday with a price-earnings ratio of 29.31, a price-book ratio of 1.04 and a price-sales ratio of two.74.

In its commentary for the fourth quarter of 2022, Longleaf famous that whereas the inventory declined in a difficult yr for workplace actual property, there was significant insider shopping for of the deeply discounted shares. Moreover, Douglas Emmetts board accepted a $300 million share buyback plan to reap the benefits of the steep value disconnect.

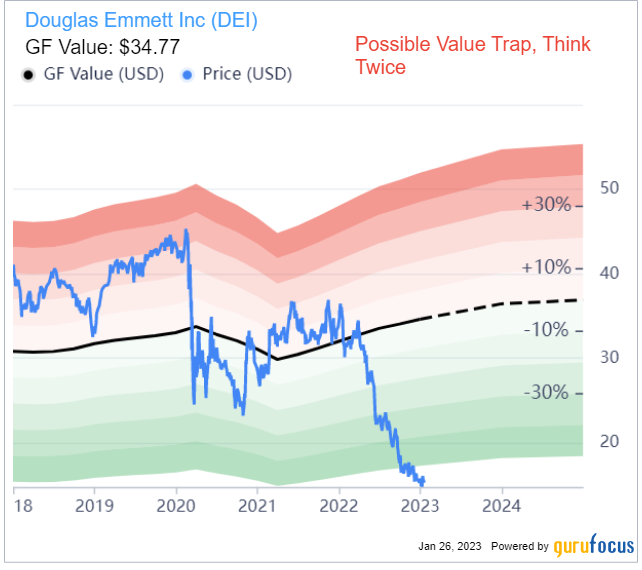

Unsurprisingly, the GF Worth Line suggests the inventory, whereas undervalued, is a attainable worth lure because of the poor enterprise surroundings. The worth metric, which relies on historic ratios, previous monetary efficiency and analysts future earnings projections, cautions potential traders to do thorough analysis earlier than making a choice.

Additional, the GF Rating of 66 out of 100 suggests the corporate has poor future efficiency potential. Whereas Douglas Emmett acquired a excessive profitability ranking, the expansion and GF Worth ranks had been extra reasonable and the ranks for monetary energy and momentum had been low.

Of the gurus invested in Douglas Emmett, First Eagle Funding (Trades, Portfolio) has the biggest stake with 6.84% of its excellent shares. Ron Baron (Trades, Portfolio) and Diamond Hill Capital (Trades, Portfolio) even have important positions within the inventory. Extra guru shareholders are Chris Davis (Trades, Portfolio), Jim Simons (Trades, Portfolio) Renaissance Applied sciences, Caxton Associates (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio).

Lumen Applied sciences

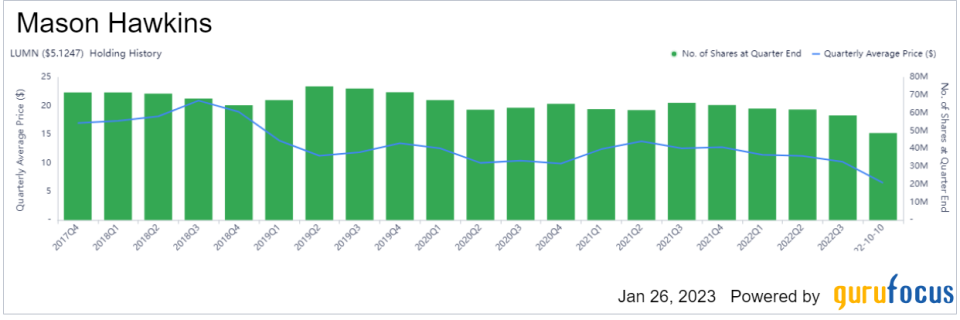

Shares of Lumen Applied sciences (NYSE:LUMN) have declined greater than 55% during the last 12 months. The inventory is at the moment 4.33% above its yearly low of $4.96.

The fund owns 58.63 million shares of the corporate, making it the biggest holding with a weight of 10.75%. GuruFocus knowledge exhibits Longleaf has misplaced an estimated 48.76% on the long-held funding.

Referred to as CenturyLink previous to September of 2020, the telecommunications firm headquartered in Monroe, Louisiana has a market cap of $5.30 billion; its shares had been buying and selling round $5.13 on Friday with a price-earnings ratio of two.56, a price-book ratio of two.23 and a price-sales ratio of 4.39.

In its fourth-quarter commentary, Longleaf famous that Lumen was a high detractor for the interval. Whereas the corporate had a historical past of managing prices and producing regular free money movement beneath its earlier CEO, natural income and money movement have been disappointing lately. Together with new CEO Kate Johnson, the announcement of its deliberate sale of its European enterprise and a brand new inventory repurchase program, the fund stated, The current strikes are making a clearer enterprise combine and stronger stability sheet.

Based on the GF Worth Line, the inventory is a attainable worth lure at the moment.

Additional, the GF Rating of 60 signifies the corporate has poor future efficiency potential. Though the rankings for profitability and GF Worth had been reasonable, the expansion, monetary energy and momentum ranks had been low.

With 4.71% of excellent shares, Hawkins agency is the companys largest guru shareholder. Different high guru traders of Lumen embody Jeremy Grantham (Trades, Portfolio), Arnold Van Den Berg (Trades, Portfolio), Greenblatt, Mario Gabelli (Trades, Portfolio), John Hussman (Trades, Portfolio), Jeff Auxier (Trades, Portfolio) and Mairs and Energy (Trades, Portfolio).

This text first appeared on GuruFocus.