2 ‘Strong Buy’ Dividend Stocks That Beat This Rate

Stocks were up this week, ahead of today’s inflation data. The gains reflected investor optimism that inflation will continue to scale back – a sentiment that was backed up by the actual numbers.

December’s price rises saw a 0.1% decrease in month-over-month and a 6.5% annualized increase. These numbers were in line with forecasts and indicate a slowing of inflation moving forward.

It is good news that inflation has slowed down. With this scale-back – inflation’s annualized increase is well down from its 40-year high of 9% registered in June 2022 – investors and economists see more reason to believe that the Federal Reserve will also slow down its move toward interest rate hikes. While Fed Chair Jerome Powell has already made it clear that the central bank will prioritize battling inflation, and will keep rates higher, longer, as needed, it’s hoped that the Fed will back off from the recent rapid pace of interest rate hikes. We’ll see for certain later this month – the Fed’s Open Market Committee, which sets the key funds rate, is scheduled to meet on Jan 31/Feb 1.

Whatever the Fed does, investors should look for defensive moves to protect themselves – and that’s going to draw us to dividend stocks – and especially the high-yield dividend stocks. We’ve used the TipRanks database to look up two dividend payers that offer yields that beat the current inflation rate. And even better, they both have a ‘Strong Buy’ consensus rating from the wider analyst community. Let’s take a closer look.

Ladder Capital Corporation (LADR)

We’ll start with Ladder Capital, a real estate investment trust (REIT) focused on the commercial property market. The company’s asset portfolio is valued at approximately $5.9 billion, and is composed primarily of commercial real estate loans and flexible capital solutions. Ladder also manages commercial properties and has a preference for net lease commercial contracts. The company, which has been in business since 2008, describes it’s ‘core competency’ as underwriting commercial real estate credit.

Ladder reported better than expected results in the 3Q22 quarter. The pre-tax GAAP income came in at $31.3million, or 23 cents per share. The net interest income was $28.89million. This is more than $6m higher than the quarter prior. At the same time, real estate operating income slipped about $1 million q/q, to $27.68 million – an indication of the general economic situation pushing up the cost of business.

Of particular interest to dividend investors, however, Ladder’s distributable earnings – which directly support the dividend payment – were reported in Q3 at $34.3 million, or 27 cents per share. This was actually down quarter-over-quarter; the Q2 distributable EPS had been reported at 34 cents – although it was almost double the 3Q21 result of 14 cents per share.

Ladder announced its next dividend payment in December, which will be paid on January 17. The common dividend per share is 23 cents, which is fully covered by distributable EPS. This yields a yield of 8.5% and annualizes at 92 cents per share. This yield is 4x higher than the average among investors. S&P-listed companies – and beats inflation by nearly 2 points, ensuring a real rate of return for investors.

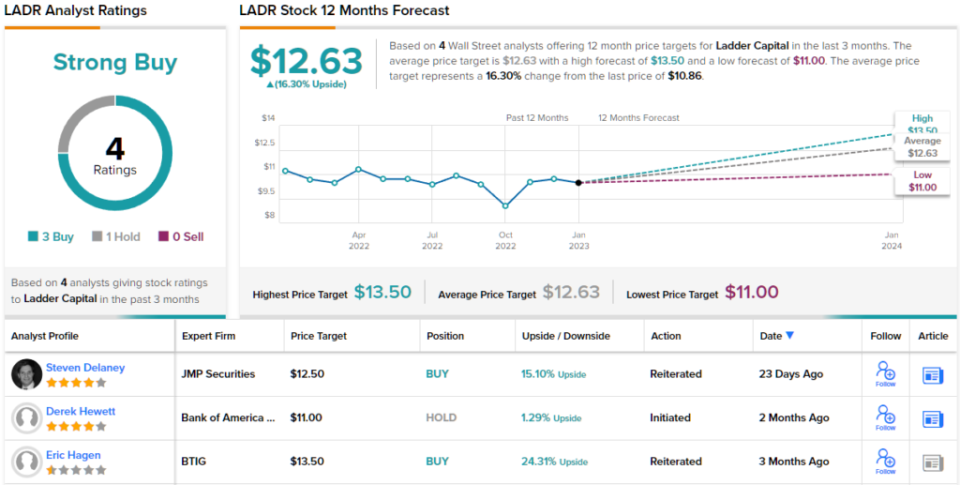

Analyst Steven DeLaney keeps an eye on JMP Securities’ LADR and takes a bullish stance on the stock. He believes the company is well positioned to survive whatever difficulties the economy has in store – and to bring solid results for investors.

“Ladder started lending more aggressively in 2Q21 when market conditions became attractive following the initial COVID disruption in early 2020, but the company is now slowing lending once again as the economic picture has deteriorated. DeLaney stated that the company has more liquidity and should be able to capitalize on any market opportunities in the first half 2023, once the Fed ends its current tightening cycle.

“We believe LADR Shares offer an attractive investment opportunity in the next 12-24 months as the company executes its primary goals for core transitional loan portfolio expansion and harvesting gains on seasoned Net Lease Real Estate Assets, which should result to improving distributable earnings up through 2023,” said the analyst.

DeLaney gave the stock an Outperform rating (i.e., a bullish outlook) and he is now following this bullish trend. With a price target of $12.50, DeLaney gives the stock a Buy rating. This suggests a 15% upside potential for the stock in one year. The stock has a potential total return profile of 24% based upon the current dividend yield as well as the expected price appreciation. (To watch DeLaney’s track record, click here)

Overall, Ladder has picked up 4 recent reviews from the Street’s analysts, and these reviews include 3 Buys and 1 Hold (i.e. Neutral) – for a Strong Buy consensus rating. The stock sells for $10.86. Its average price target is $12.63. This implies a 16% rise over the one-year horizon. (See LADR stock forecast)

Rithm Capital (RITM)

Rithm Capital, an additional real estate investment trust, is next. Rithm was restructured in summer 2021 and is now an internal-managed REIT. It operates at both the mortgage lending end and the mortgage services end of the business. The company’s portfolio includes loan originations and real estate securities as well as residential and commercial mortgage loans. MSRs account for approximately 26% of the company’s portfolio.

Rithm’s total portfolio currently stands at $7.53 billion in net equity, and the company manages $35 billion in assets. Rithm reported more that $153 million in income for the 3Q22 financial results. earnings Available for distribution, at 32 cents per common shares. This figure – which backs up the dividend payments – was up ~5% y/y, from $145.8 million, and easily covered the $118.4 million in common share dividends paid out in Q3. For a January 27 payment, the next dividend was announced at December’s end, at 25 cents per common shares. The payment annualizes to $1, and yields 11.3%, over 5x the average on the broad markets – and almost 5 points above the official readout for December’s annualized rate of inflation.

All of this brought Rithm to the attention of B. Riley analyst Matt Howlett, who says of the company: “Although the current macro backdrop presents challenges, RITM has cut costs, established interest rate hedges, and de-risked the balance sheet. We believe that CEO Nierenberg will be able to both protect the company in a downturn and position it for new opportunities. We believe that the current valuation is attractive, with RITM trading at 0.74x its reported book value. We also expect dividend coverage through our modeling horizon (2024).”

Howlett rates RITM a Buy and assigns a $12 price target to quantify the potential for 36% upside over the next year. (To watch Howlett’s track record, click here)

Overall, 7 Wall Street analysts have weighed in on RITM stock lately and their reviews are unanimously positive, backing up the stock’s Strong Buy consensus rating. RITM currently trades at $8.82, with an average price target $11.71. This suggests a 33% increase in one-year earnings. (See RITM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: These analysts’ opinions are theirs alone. This information is for informational purposes only. It is crucial to do your own analysis prior to making any investments.