A Look at WSP Global Inc.’s Fair Value (TSE:WSP).

We’ll be doing a quick run-through of the valuation method that WSP Global Inc. uses to determine its attractiveness (TSE:WSPYou can use the future cash flows to invest in a potential investment opportunity. We will take these cash flows and then discount them to today’s price. This will be done using the Discounted Cash flow (DCF) model. This may seem complicated but it is actually very simple.

There are many ways to value a company, and the DCF is only one. You can still get answers to your burning questions regarding this type of valuation by visiting the Simply Wall St analysis model.

View our latest analysis for WSP Global

The Method

The two-stage DCF model will be used. It takes into consideration two stages of growth. The first stage generally represents a longer period of high growth that ends at the terminal value. This is usually captured in the second period of steady growth. We need to first estimate the cash flow for the next ten year. If possible, we use analyst estimates. When these aren’t available, we extrapolate the previous cash flow (FCF), based on the last estimate or reported value. Companies with decreasing free cash flow will experience a slower rate of shrinkage. However, companies with increasing free cash flow should expect to see a slowing in their growth rate over the same period. This is because growth tends to slow down more in the beginning years than in the later years.

A DCF is about the idea of a future dollar being less valuable than a current dollar. To arrive at a present-value estimate, we must subtract the sum of future cash flows.

Estimate of 10-year Free Cash Flow (FCF).

|

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

|

|

Levered FCF |

CA$706.2m |

CA$937.0m |

CA$1.08b |

CA$1.21b |

CA$1.31b |

CA$1.39b |

CA$1.46b |

CA$1.52b |

CA$1.57b |

CA$1.61b |

|

Growth Rate Estimate Source |

Analyst x8 |

Analyst x7 |

Est @ 15.51% |

Est @ 11.37% |

Est @ 8.46% |

Est @ 6.43% |

Est @ 5.01% |

Est @ 4.01% |

Est @ 3.32% |

Est @ 2.83% |

|

Discounted @ 8.3% |

CA$652 |

CA$799 |

CA$853 |

CA$877 |

CA$879 |

CA$864 |

CA$838 |

CA$805 |

CA$768 |

CA$730 |

(“Est”) = FCF growth rate as estimated by Simply Wall St

Current Value of 10-year Cash Flow (PVCF). = CA$8.1b

Now we need to calculate the terminal value, which is the sum of all future cash flows over the ten-year period. The Terminal Value is calculated using the Gordon Growth formula. It uses a future annual growth rate equal the 5-year average 10.0% government bond yield. At 8.3% equity cost, we discount terminal cash flows to calculate today’s value.

Terminal Value (TV).= FCF2032 × (1 + g) ÷ (r – g) = CA$1.6b× (1 + 1.7%) ÷ (8.3%– 1.7%) = CA$25b

Present Value of the Terminal Value (PVTV).= TV / (1+ r)10= CA$25b÷ ( 1 + 8.3%)10= CA$11b

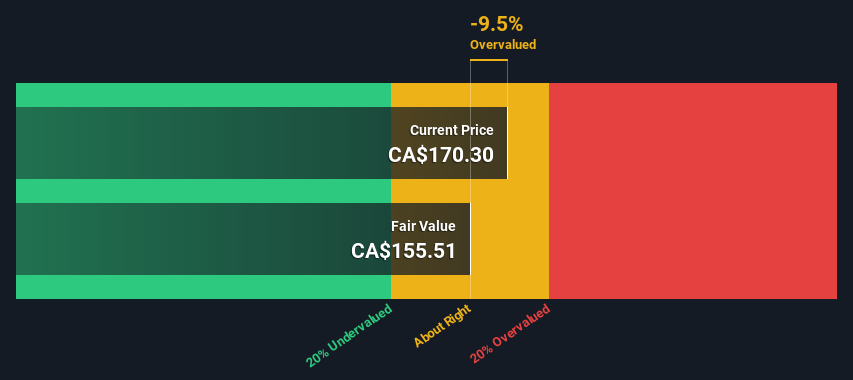

The total value is the sum the cash flows for the next 10 years plus the discounted termin value. This results in the Total Equity Value, which is CA$19b in this example. Next, divide the equity by the number outstanding shares. The company’s current share price is CA$170. This gives it a fair value at the time this article was written. This is an estimate valuation. As with any complicated formula, it’s garbage in, garbage out.

Important Assumptions

We believe that the two most important inputs for a discounted cash flow are the actual cash flows and the discount rate. Try the calculations yourself and experiment with the assumptions if you aren’t satisfied with them. The DCF does not take into account the potential cyclicality or future capital requirements of an industry. It does not provide a complete picture of a company’s potential performance. WSP Global is considered potential shareholders. The cost of equity is used instead of the cost (or weighted-average cost capital, WACC), to account for debt. We used 8.3% based on a leveraged beta of 1.094 in this calculation. Beta is the measure of a stock’s volatility relative to the entire market. Our beta is calculated from the industry average beta for globally comparable companies. We have imposed a limit of 0.8 to 2.0 which is reasonable for a stable business.

WSP Global SWOT Analysis

Strength

Weakness

Opportunity

Threat

Moving on:

While the company’s valuation is an important factor, it is just one of many things that you must assess. A DCF model cannot guarantee a reliable valuation. Instead, it should be used to guide you to what assumptions must be true in order for the stock to be over/undervalued. Changes in the company’s cost-of-equity or risk free rate could have a significant impact on the stock’s valuation. WSP Global has put together the following important factors:

-

There are risksWe found this example: 2 warning signs for WSP Global These are the things you should consider before making an investment here.

-

Future EarningsHow does WSP compare to its peers or the market? Our interactive web site allows you to dig deeper into the consensus number of analysts that will be used in the coming years. free analyst growth expectation chart.

-

Other high quality alternatives: Are you looking for a versatile player? Explore our interactive list of high quality stocks To get an idea of the other possibilities, click here

PS. Simply Wall St keeps its DCF calculations for all Canadian stocks up-to-date every day. If you’d like to know the intrinsic value of any other stock, just search here.

Let us know what you think about this article. Have a question about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article is by Simply Wall St. It is general in nature. Our commentary is based only on historical data and analyst projections. It is not a recommendation not to buy or sell any stocks and does not take into account your financial situation or objectives. Our aim is to give you long-term, objective analysis that is based on fundamental data. Our analysis may not take into account the most recent price-sensitive company announcements and qualitative material. Simply Wall St holds no position in any of the stocks mentioned.

Register for a paid user research session

You’ll receive a Amazon Gift Card – US$30 Spend an hour helping us to create better tools for individual investors. Sign up here