Do Western New England Bancorp’s (NASDAQ:WNEB) Earnings Warrant Your Consideration?

Buyers are sometimes guided by the thought of discovering ‘the subsequent huge factor’, even when meaning shopping for ‘story shares’ with none income, not to mention revenue. Sadly, these excessive threat investments typically have little likelihood of ever paying off, and plenty of traders pay a worth to study their lesson. Loss-making corporations are at all times racing in opposition to time to succeed in monetary sustainability, so traders in these corporations could also be taking up extra threat than they need to.

So if this concept of excessive threat and excessive reward does not swimsuit, you may be extra thinking about worthwhile, rising corporations, like Western New England Bancorp (NASDAQ:WNEB). Even when this firm is pretty valued by the market, traders would agree that producing constant earnings will proceed to offer Western New England Bancorp with the means so as to add long-term worth to shareholders.

View our latest analysis for Western New England Bancorp

How Quick Is Western New England Bancorp Rising?

If an organization can continue to grow earnings per share (EPS) lengthy sufficient, its share worth ought to ultimately observe. So it is sensible that skilled traders pay shut consideration to firm EPS when enterprise funding analysis. Impressively, Western New England Bancorp has grown EPS by 32% per yr, compound, within the final three years. As a common rule, we would say that if an organization can sustain that type of development, shareholders will likely be beaming.

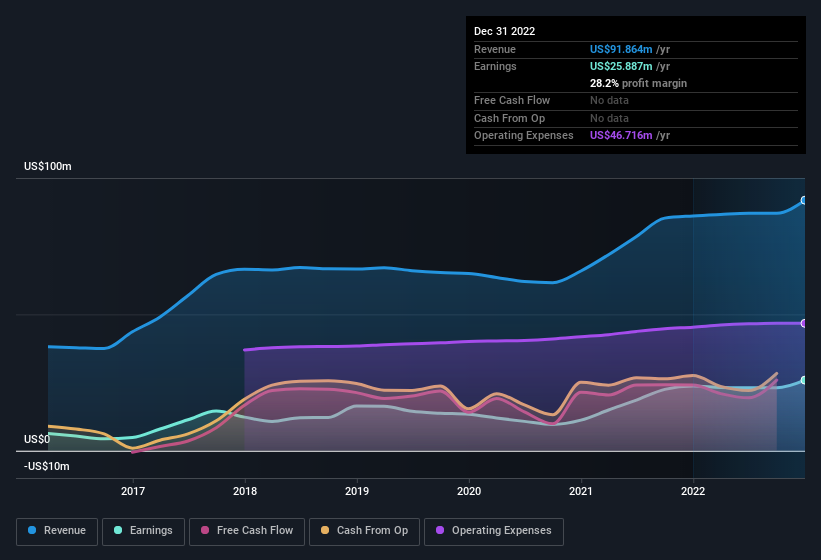

It is typically useful to try earnings earlier than curiosity and tax (EBIT) margins, in addition to income development, to get one other tackle the standard of the corporate’s development. Not all of Western New England Bancorp’s income this yr is income from operations, so consider the income and margin numbers used on this article won’t be one of the best illustration of the underlying enterprise. Western New England Bancorp maintained secure EBIT margins over the past yr, all whereas rising income 6.7% to US$92m. That is an actual constructive.

You may check out the corporate’s income and earnings development pattern, within the chart under. Click on on the chart to see the precise numbers.

Whereas we reside within the current second, there’s little doubt that the long run issues most within the funding determination course of. So why not examine this interactive chart depicting future EPS estimates, for Western New England Bancorp?

Are Western New England Bancorp Insiders Aligned With All Shareholders?

As a common rule, it is value contemplating how a lot the CEO is paid, since unreasonably excessive charges might be thought-about in opposition to the pursuits of shareholders. Our evaluation has found that the median whole compensation for the CEOs of corporations like Western New England Bancorp with market caps between US$100m and US$400m is about US$1.7m.

The Western New England Bancorp CEO obtained US$1.2m in compensation for the yr ending December 2021. That appears fairly affordable, particularly given it is under the median for related sized corporations. Whereas the extent of CEO compensation should not be the largest consider how the corporate is seen, modest remuneration is a constructive, as a result of it means that the board retains shareholder pursuits in thoughts. Usually, arguments could be made that affordable pay ranges attest to good decision-making.

Ought to You Add Western New England Bancorp To Your Watchlist?

If you happen to imagine that share worth follows earnings per share it is best to undoubtedly be delving additional into Western New England Bancorp’s sturdy EPS development. The quick development bodes properly whereas the very affordable CEO pay assists builds some confidence within the board. Based mostly on these elements, this inventory might properly deserve a spot in your watchlist, or perhaps a little additional analysis. We should always say that we have found 3 warning signs for Western New England Bancorp (1 is a bit disagreeable!) that try to be conscious of earlier than investing right here.

There’s at all times the potential of doing properly shopping for shares that will not be rising earnings and don’t have insiders shopping for shares. However for many who take into account these vital metrics, we encourage you to take a look at corporations that do have these options. You may entry a free list of them here.

Please notice the insider transactions mentioned on this article consult with reportable transactions within the related jurisdiction.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to convey you long-term centered evaluation pushed by elementary information. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be part of A Paid Consumer Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here