Following a 61% decline over final 12 months, latest positive aspects might please THG Plc (LON:THG) institutional house owners

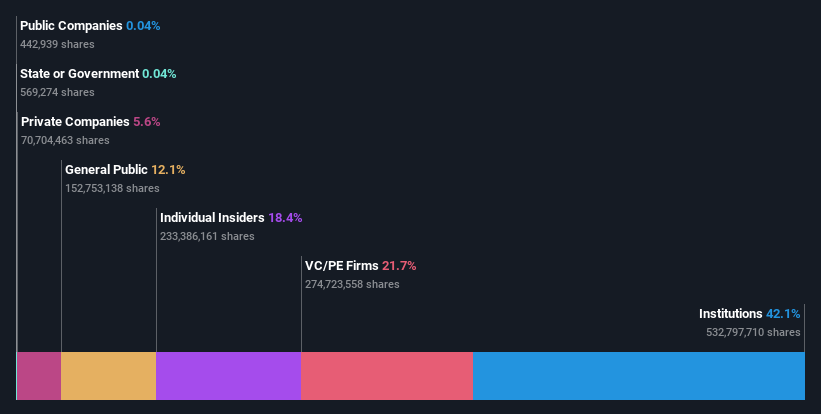

If you wish to know who actually controls THG Plc (LON:THG), then you definately’ll have to have a look at the make-up of its share registry. And the group that holds the most important piece of the pie are establishments with 41% possession. Put one other method, the group faces the utmost upside potential (or draw back danger).

Final week’s UK£56m market cap achieve would in all probability be appreciated by institutional buyers, particularly after a 12 months of 61% losses.

Within the chart beneath, we zoom in on the totally different possession teams of THG.

See our latest analysis for THG

What Does The Institutional Possession Inform Us About THG?

Institutional buyers generally examine their very own returns to the returns of a generally adopted index. So they typically do contemplate shopping for bigger corporations which can be included within the related benchmark index.

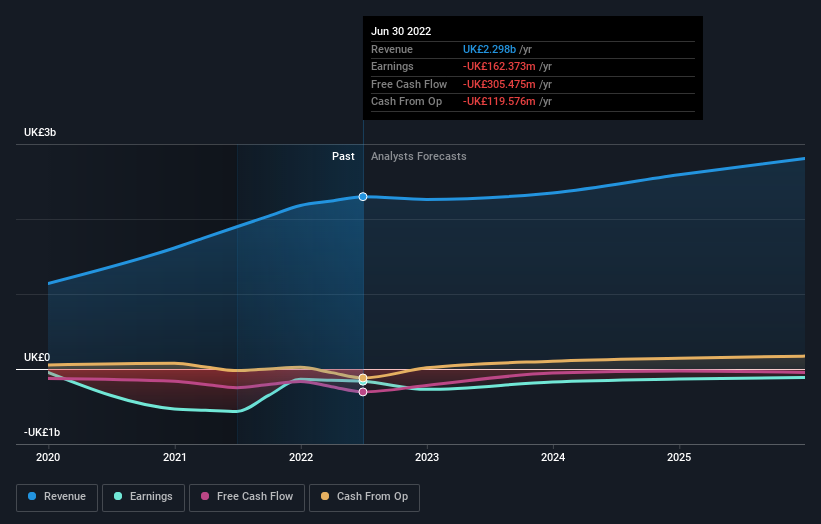

As you may see, institutional buyers have a good quantity of stake in THG. This implies some credibility amongst skilled buyers. However we will not depend on that truth alone since establishments make unhealthy investments generally, identical to everybody does. It isn’t unusual to see a giant share worth drop if two massive institutional buyers attempt to promote out of a inventory on the identical time. So it’s value checking the previous earnings trajectory of THG, (beneath). After all, needless to say there are different elements to think about, too.

THG just isn’t owned by hedge funds. Taking a look at our information, we will see that the most important shareholder is the CEO Matthew Moulding with 15% of shares excellent. For context, the second largest shareholder holds about 8.7% of the shares excellent, adopted by an possession of seven.7% by the third-largest shareholder.

We additionally noticed that the highest 10 shareholders account for greater than half of the share register, with a number of smaller shareholders to stability the pursuits of the bigger ones to a sure extent.

Researching institutional possession is an effective strategy to gauge and filter a inventory’s anticipated efficiency. The identical may be achieved by learning analyst sentiments. There are an affordable variety of analysts masking the inventory, so it is likely to be helpful to seek out out their combination view on the long run.

Insider Possession Of THG

Whereas the exact definition of an insider may be subjective, virtually everybody considers board members to be insiders. Administration in the end solutions to the board. Nonetheless, it isn’t unusual for managers to be government board members, particularly if they’re a founder or the CEO.

Insider possession is constructive when it alerts management are considering just like the true house owners of the corporate. Nonetheless, excessive insider possession also can give immense energy to a small group inside the firm. This may be adverse in some circumstances.

It appears insiders personal a major proportion of THG Plc. Insiders personal UK£123m value of shares within the UK£682m firm. We might say this exhibits alignment with shareholders, however it’s value noting that the corporate remains to be fairly small; some insiders might have based the enterprise. You possibly can click here to see if those insiders have been buying or selling.

Normal Public Possession

Most people, who’re normally particular person buyers, maintain a 12% stake in THG. This dimension of possession, whereas appreciable, will not be sufficient to alter firm coverage if the choice just isn’t in sync with different massive shareholders.

Non-public Fairness Possession

With an possession of 21%, non-public fairness corporations are ready to play a job in shaping company technique with a concentrate on worth creation. Some buyers is likely to be inspired by this, since non-public fairness are generally capable of encourage methods that assist the market see the worth within the firm. Alternatively, these holders is likely to be exiting the funding after taking it public.

Non-public Firm Possession

Evidently Non-public Firms personal 5.4%, of the THG inventory. It is onerous to attract any conclusions from this truth alone, so its value wanting into who owns these non-public corporations. Generally insiders or different associated events have an curiosity in shares in a public firm by way of a separate non-public firm.

Subsequent Steps:

Whereas it’s properly value contemplating the totally different teams that personal an organization, there are different elements which can be much more essential. Take dangers for instance – THG has 4 warning signs (and 1 which is concerning) we predict you must find out about.

In the end the long run is most essential. You possibly can entry this free report on analyst forecasts for the company.

NB: Figures on this article are calculated utilizing information from the final twelve months, which discuss with the 12-month interval ending on the final date of the month the monetary assertion is dated. This will not be in step with full 12 months annual report figures.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We purpose to carry you long-term centered evaluation pushed by basic information. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be part of A Paid Consumer Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person buyers like your self. Sign up here