Is Brookfield Enterprise Company’s (NYSE:BBUC) ROE Of 33% Spectacular?

Whereas some traders are already effectively versed in monetary metrics (hat tip), this text is for many who want to study Return On Fairness (ROE) and why it is necessary. To maintain the lesson grounded in practicality, we’ll use ROE to higher perceive Brookfield Enterprise Company (NYSE:BBUC).

Return on Fairness or ROE is a check of how successfully an organization is rising its worth and managing traders’ cash. Merely put, it’s used to evaluate the profitability of an organization in relation to its fairness capital.

View our latest analysis for Brookfield Business

How To Calculate Return On Fairness?

The components for return on fairness is:

Return on Fairness = Web Revenue (from persevering with operations) ÷ Shareholders’ Fairness

So, based mostly on the above components, the ROE for Brookfield Enterprise is:

33% = US$1.0b ÷ US$3.2b (Primarily based on the trailing twelve months to September 2022).

The ‘return’ is the quantity earned after tax over the past twelve months. So, because of this for each $1 of its shareholder’s investments, the corporate generates a revenue of $0.33.

Does Brookfield Enterprise Have A Good ROE?

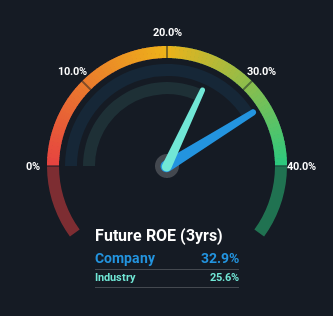

Arguably the simplest option to assess firm’s ROE is to match it with the typical in its trade. Importantly, that is removed from an ideal measure, as a result of firms differ considerably inside the identical trade classification. As is evident from the picture beneath, Brookfield Enterprise has a greater ROE than the typical (26%) within the Industrials industry.

That may be a good signal. Nevertheless, keep in mind {that a} excessive ROE doesn’t essentially point out environment friendly revenue technology. Apart from adjustments in web revenue, a excessive ROE may also be the result of excessive debt relative to fairness, which signifies threat.

How Does Debt Impression ROE?

Most firms want cash — from someplace — to develop their income. That money can come from retained earnings, issuing new shares (fairness), or debt. Within the first and second instances, the ROE will mirror this use of money for funding within the enterprise. Within the latter case, the debt used for development will enhance returns, however will not have an effect on the entire fairness. Thus using debt can enhance ROE, albeit together with additional threat within the case of stormy climate, metaphorically talking.

Combining Brookfield Enterprise’ Debt And Its 33% Return On Fairness

We predict Brookfield Enterprise makes use of a big quantity of debt to maximise its returns, because it has a considerably larger debt to fairness ratio of 4.19. So though the corporate has a powerful ROE, the corporate may not have been in a position to obtain this with out the numerous use of debt.

Conclusion

Return on fairness is helpful for evaluating the standard of various companies. In our books, the very best high quality firms have excessive return on fairness, regardless of low debt. If two firms have the identical ROE, then I might usually want the one with much less debt.

Having mentioned that, whereas ROE is a helpful indicator of enterprise high quality, you may have to take a look at a complete vary of things to find out the fitting worth to purchase a inventory. Revenue development charges, versus the expectations mirrored within the worth of the inventory, are a very essential to think about. Examine the previous revenue development by Brookfield Enterprise by this visualization of past earnings, revenue and cash flow.

After all, you may discover a implausible funding by wanting elsewhere. So take a peek at this free list of interesting companies.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to carry you long-term centered evaluation pushed by basic knowledge. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be a part of A Paid Consumer Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here