Artesian Resources NASDAQ:ARTN.A – Is it Time to Put them on your Watchlist?

Investors are often attracted to the idea of investing in companies that can turn their fortunes around. Even those with no revenue, no profits, or a poor track record can attract investors. Investors can be influenced by these stories, and invest based on their emotions instead of the merits of a good company. Investors need to be careful that they are not throwing money after bad.

If you’re not interested in high-risk, high-reward companies, perhaps you would be more attracted to profitable, growing businesses, such as Artesian Resources (NASDAQ:ARTN.A). Profit is not the only metric to consider when investing. However, businesses that consistently generate it are worth recognizing.

Check out our latest analysis for Artesian Resources

Artesian Resources Earnings per Share are Growing

If a company’s earnings per share (EPS), can continue to increase for long enough, the share price will follow. Most long-term successful investors consider EPS growth to be a positive. Artesian Resources grew its EPS 5.6% annually over a three-year period. This is not a huge deal, but it shows a positive trend in EPS.

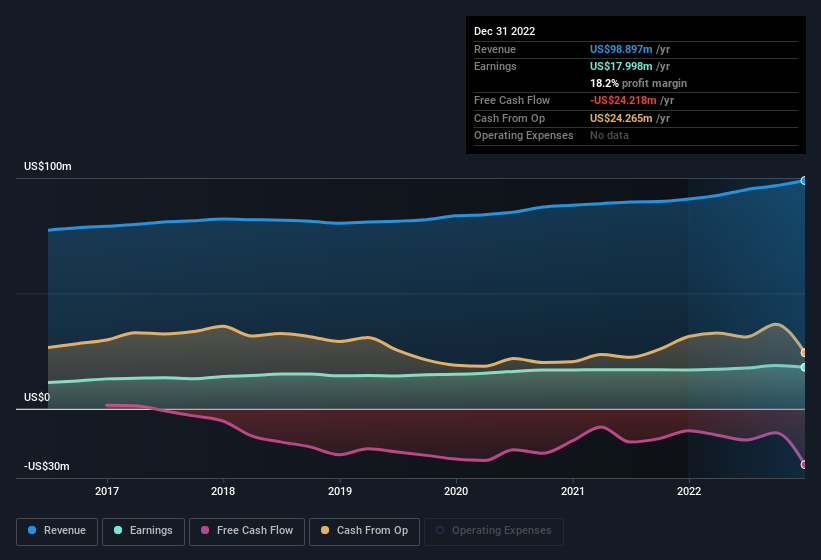

It’s important to note that top-line revenue growth can be a good indicator of sustainable growth. When combined with a strong earnings before interest and taxes (EBIT) ratio, this is an excellent way for companies to keep their competitive advantage on the market. Artesian Resources has maintained stable EBIT over the last 12 months, while its revenue increased by 8.8%. That’s progress.

The chart below shows changes in the bottom line and top line of the company over time. Click the image to see a finer version.

Profitability is the key to success, but prudent investors will always look for ways to maximize their returns. check the balance sheet, too.

Are Artesian Resources insiders aligned with all shareholders?

Insiders owning shares should provide investors with a sense that their interests are aligned. Artesian Resources’ followers can take comfort knowing that the company’s insiders own a large amount of capital, aligning their interests with those of other shareholders. Insiders have a large stake in the company, valued at US$57m. They are motivated to make it successful. The insiders’ shares are worth 10% of the total outstanding shares. They have significant influence on the business through their decisions.

Insiders investing in the company is a good thing, but are the remuneration rates reasonable? This quick analysis of CEO compensation would suggest that they are. The median total compensation of CEOs at companies with similar market capitalization to Artesian Resources (between US$200m and US$800m) is approximately US$2.6m.

Artesian Resources’ CEO received a total of US$1.0m for the year that ended December 2022. This is clearly below the average. At first glance, this arrangement appears generous to shareholders. It also indicates a modest culture of remuneration. The CEO’s remuneration is not the most important factor for investors. However, when pay is modest it can support a greater alignment between the CEOs and shareholders. It can also be seen as a sign of good corporate governance.

Does Artesian Resources Deserve A Spot On Your Watchlist?

Artesian Resources’ growing profit is a positive sign. Artesian Resources is a real winner when it comes to EPS, but there’s more. A reasonable person might think that Artesian Resources is a stock to watch, given the significant level of insiders and reasonable CEO compensation. Remember that there are still risks. We’ve identified some of the risks. 2 warning signs for Artesian Resources (1 is significant) What you need to know

You can always make money by buying stocks. It is not Growing earnings do not Insiders can buy shares. For those who look at these metrics, we recommend that you check out companies with insiders. The following are some of the ways to improve your own ability to speak. You can access these features. You can access a free list of them here.

Note that the insider transaction discussed in this article is a reportable transaction in the jurisdiction concerned.

You have any feedback to make on this article. Are you concerned about the content of this article? Get in touch Contact us today. Alternatively, email editorial-team (at) simplywallst.com.

This article is a general one. Our articles do not provide financial advice. They are based solely on historical data, analyst forecasts and a method that is unbiased. This is not a recommendation on whether to buy or sale any stocks. Nor does it take into account your goals, or your financial status. Our goal is to provide you with a long-term analysis based on fundamental data. Please note that our analysis does not include the most recent qualitative or price-sensitive material from companies. Simply Wall St does not hold any of the stocks mentioned.

Join a Paid User Research Session

You’ll receive a Amazon Gift Card US$30 Please give us an hour to build better investment tools for you and other individual investors. Sign up here