Is Now The Time To Put Kronos Worldwide (NYSE:KRO) On Your Watchlist?

The joy of investing in an organization that may reverse its fortunes is a giant draw for some speculators, so even firms that don’t have any income, no revenue, and a document of falling quick, can handle to seek out buyers. Sadly, these excessive danger investments typically have little likelihood of ever paying off, and plenty of buyers pay a value to study their lesson. Loss-making firms are at all times racing in opposition to time to achieve monetary sustainability, so buyers in these firms could also be taking up extra danger than they need to.

If this sort of firm is not your model, you want firms that generate income, and even earn earnings, then you definately might be curious about Kronos Worldwide (NYSE:KRO). Even when this firm is pretty valued by the market, buyers would agree that producing constant earnings will proceed to supply Kronos Worldwide with the means so as to add long-term worth to shareholders.

See our latest analysis for Kronos Worldwide

How Rapidly Is Kronos Worldwide Rising Earnings Per Share?

For those who consider that markets are even vaguely environment friendly, then over the long run you’d count on an organization’s share value to comply with its earnings per share (EPS) outcomes. So it is smart that skilled buyers pay shut consideration to firm EPS when endeavor funding analysis. Kronos Worldwide managed to develop EPS by 15% per 12 months, over three years. That is an excellent fee of development, if it may be sustained.

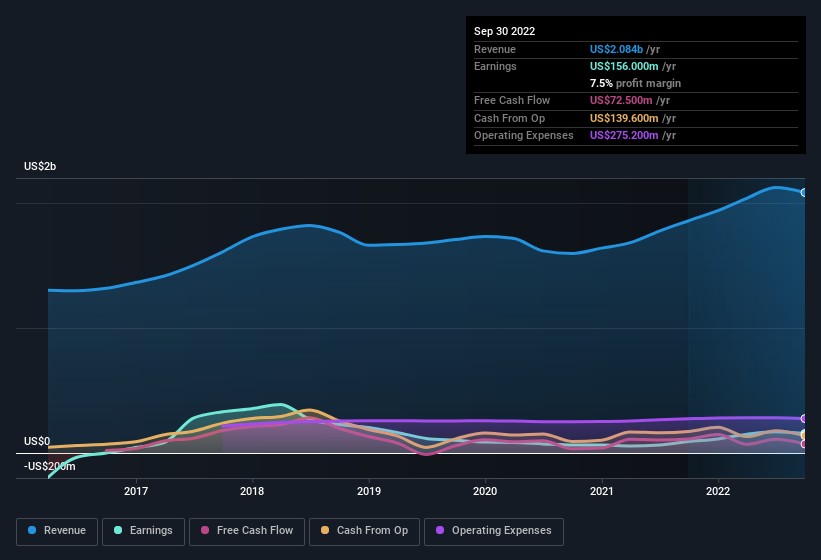

Cautious consideration of income development and earnings earlier than curiosity and taxation (EBIT) margins may also help inform a view on the sustainability of the current revenue development. Whereas we notice Kronos Worldwide achieved comparable EBIT margins to final 12 months, income grew by a stable 12% to US$2.1b. That is encouraging information for the corporate!

The chart beneath exhibits how the corporate’s backside and high traces have progressed over time. For finer element, click on on the picture.

In fact the knack is to seek out shares which have their finest days sooner or later, not up to now. You might base your opinion on previous efficiency, after all, however you may additionally need to check this interactive graph of professional analyst EPS forecasts for Kronos Worldwide.

Are Kronos Worldwide Insiders Aligned With All Shareholders?

Traders are at all times looking for a vote of confidence within the firms they maintain and insider shopping for is among the key indicators for optimism in the marketplace. This view is predicated on the likelihood that inventory purchases sign bullishness on behalf of the client. Nonetheless, insiders are generally incorrect, and we do not know the precise considering behind their acquisitions.

It is good to see that there have been no stories of any insiders promoting shares in Kronos Worldwide within the earlier 12 months. So it is positively good that firm insider Amy Samford purchased US$19k value of shares at a mean value of round US$9.71. First rate shopping for like this might be an indication for shareholders right here; administration sees the corporate as undervalued.

Does Kronos Worldwide Deserve A Spot On Your Watchlist?

One optimistic for Kronos Worldwide is that it’s rising EPS. That is good to see. Whereas some firms are struggling to develop EPS, Kronos Worldwide appears free from that morose affliction. The icing on the cake is that an insider purchased shares in the course of the 12 months; a focal point for individuals who will need to maintain a watchful eye on this inventory. Even so, bear in mind that Kronos Worldwide is showing 2 warning signs in our investment analysis , and 1 of these makes us a bit uncomfortable…

The excellent news is that Kronos Worldwide shouldn’t be the one development inventory with insider shopping for. Here is a list of them… with insider buying in the last three months!

Please notice the insider transactions mentioned on this article discuss with reportable transactions within the related jurisdiction.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We purpose to carry you long-term centered evaluation pushed by basic information. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be part of A Paid Person Analysis Session

You’ll obtain a US$30 Amazon Reward card for 1 hour of your time whereas serving to us construct higher investing instruments for the person buyers like your self. Sign up here