Oracle Corporation (NYSE.ORCL), insiders increased their holding by 27% earlier this years

Insiders were net purchasers of Oracle Corporation (NYSE:ORCL Stock during the last year. Insiders also bought more stock than what they sold.

Although we wouldn’t suggest that investors base their decisions on the actions of directors, logic dictates that you should be aware of whether insiders are selling or buying shares.

View our latest analysis for Oracle

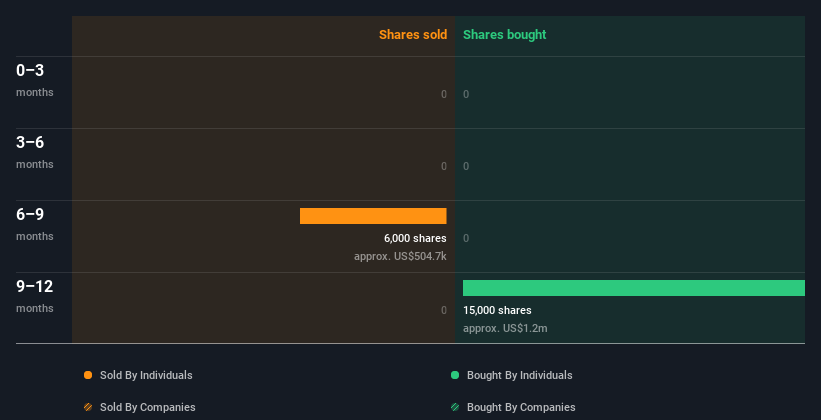

Oracle’s Insider Transactions for the 12 Months Since January

Charles Moorman, Independent Director, made the largest insider purchase within the past 12 months. The transaction involved US$1.3 million worth of shares, at a cost of US$84.57 per share. It is clear that an insider wanted the shares, even at a lower price than the current share prices (which are US$80.50 each). Their view may have changed over time, but this shows that they still believe in the company’s future. We pay close attention to what insiders pay for shares. We generally feel more positive about stocks when insiders have bought shares at higher prices than current prices. This indicates that they consider the stock to be a good investment, even if it is expensive. Charles Moorman was only one of the insiders to have bought shares over the past twelve months.

Below is a chart that shows the insider transactions made by individuals and companies over the past year. You can click the graph below to find out who, what, when and for how much.

Oracle isn’t the only stock-insider who is buying. Take a look at this. No cost list of growing companies with insider buying.

Oracle Insider Ownership

You can also look at the shares that the shareholders own to gauge the alignment of the leaders and the other shareholders. High insider ownership can make company leaders more attentive to shareholder interests. It is great to see that Oracle insiders hold 43% of the company’s value, which amounts to approximately US$93b. This type of substantial ownership by insiders can increase the chances that the company is managed in the interests of all shareholders.

What does this data tell us about Oracle Insiders?

In the past three months, there haven’t been any transactions involving insiders. This doesn’t necessarily mean that much. Positively, the transactions of the last year are encouraging. Oracle insiders have good feelings about the company’s prospects judging by their transactions and high insider ownership. This is why insider transactions are useful in helping us to build a thesis on the stock. However, it’s important to understand the risks facing this company. This is what we found. 2 warning signs for Oracle We recommend that you take a look at it.

Take note! Oracle may not be the most desirable stock to invest in. Have a look at these No cost list of interesting companies with high ROE and low debt.

This article will define insiders as individuals who report their transactions the appropriate regulatory body. We account for both open market transactions as well as private dispositions. However, we do not include derivative transactions.

Give feedback about this article Are you concerned about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article is by Simply Wall St. It is general in nature. Our commentary is based on historical data, analyst forecasts and other unbiased information. We do not intend to provide financial advice. It is not a recommendation not to buy or sell any stocks and it doesn’t take into account your financial situation or objectives. Our goal is to provide you with long-term, focused analysis based on fundamental data. Our analysis may not take into account the most recent price-sensitive company announcements and qualitative material. Simply Wall St holds no position in any of the stocks mentioned.

Register for a paid user research session

You’ll receive a Amazon Gift card – US$30 Give us 1 hour of your time and help us create better investing tools for individual investors like you. Sign up here