Pinterest, Inc. (NYSE.PINS), insiders have reason to brag after they saw a US$884k investment in addition to their US$5.0m.

Last week Pinterest, Inc. (NYSE:PINSInsiders who purchased shares during the past 12 months were handsomely rewarded. The company’s market value increased by US$1.3b as a result of the shares rising 8.1%. Their original stock purchase of US$5.0m is now worth US$5.9m.

Although insider transactions may not be the most important aspect of long-term investing, logic dictates that you need to pay attention to whether insiders buy or sell shares.

Check out our latest analysis for Pinterest

Pinterest Insider Transactions in the Last Year

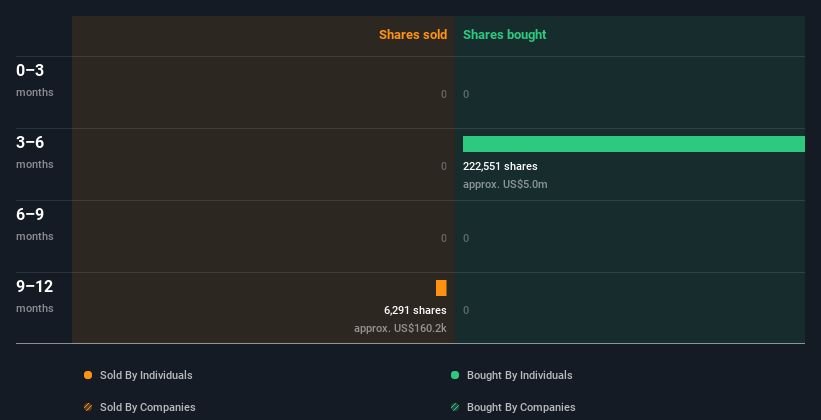

In the last twelve months, the biggest single purchase by an insider was when CEO & Director William Ready bought US$5.0m worth of shares at a price of US$22.47 per share. Although we like to see buying, this purchase was well below the current price at US$26.44. This buy does not tell us how insiders feel about current share prices because they were bought at a lower price.

Below is a chart that shows insider transactions by individuals and companies over the past year. You can click the graph below to find out who, what, when and how much each seller sold.

There are always many stocks insiders are buying. You can check out this list or each stock individually if you prefer. Free list of companies. (Hint: insiders have been buying them).

Pinterest Insider Ownership

Common shareholders should check how many shares are owned by company insiders. If insiders hold a significant amount of shares, it is a good sign. About US$2.2b worth shares are owned by Pinterest insiders (12% of the company). This type of insider ownership would please most shareholders, as it indicates that management incentives align with other shareholders.

What do The Pinterest Insider Transactions Indicate?

Insider transactions have not occurred in the past three months, but that doesn’t necessarily mean anything. Our analysis of transactions from the past year is encouraging. The company’s future looks bright, according to the insiders. Although we enjoy keeping up to date with insider transactions and the ownership of shares, we always consider the potential risks before investing in a stock. We found Simply Wall St to be a great place to find 3 warning signs for Pinterest Before you buy shares, pay attention to these issues.

You can’t miss this opportunity to visit another company, one that may have superior financials. Free list of interesting companies, that have HIGH return on equity and low debt.

Insiders, for the purposes of this article are individuals who report transactions to the relevant regulatory agency. We account for both open market transactions as well as private dispositions. However, we do not include derivative transactions.

Give feedback about this article Are you concerned about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St has a general nature. Our commentary is based on historical data, analyst forecasts and other unbiased information. We do not intend to provide financial advice. This analysis does not represent a recommendation to purchase or sell any stock and it does not consider your financial goals or financial situation. Our goal is to provide you with long-term, focused analysis based on fundamental data. Our analysis may not take into account the most recent price-sensitive company announcements and qualitative material. Simply Wall St does not hold any position in the stocks mentioned.

Participate in a Paid User Research Session

You’ll receive a Amazon Gift Card: US$30 Give us 1 hour of your time and help us create better investing tools for individual investors like you. Sign up here