Ought to You Be Including TJX Corporations (NYSE:TJX) To Your Watchlist At present?

It’s normal for a lot of buyers, particularly those that are inexperienced, to purchase shares in firms with a great story even when these firms are loss-making. Typically these tales can cloud the minds of buyers, main them to take a position with their feelings quite than on the advantage of fine firm fundamentals. Loss making firms can act like a sponge for capital – so buyers ought to be cautious that they don’t seem to be throwing good cash after unhealthy.

If this type of firm is not your model, you want firms that generate income, and even earn income, you then could be considering TJX Corporations (NYSE:TJX). Whereas revenue is not the only metric that ought to be thought-about when investing, it is value recognising companies that may persistently produce it.

View our latest analysis for TJX Companies

How Shortly Is TJX Corporations Growing Earnings Per Share?

If an organization can continue to grow earnings per share (EPS) lengthy sufficient, its share value ought to finally comply with. Which means EPS progress is taken into account an actual optimistic by most profitable long-term buyers. TJX Corporations managed to develop EPS by 4.6% per 12 months, over three years. This will not be setting the world alight, but it surely does present that EPS is on the upwards development.

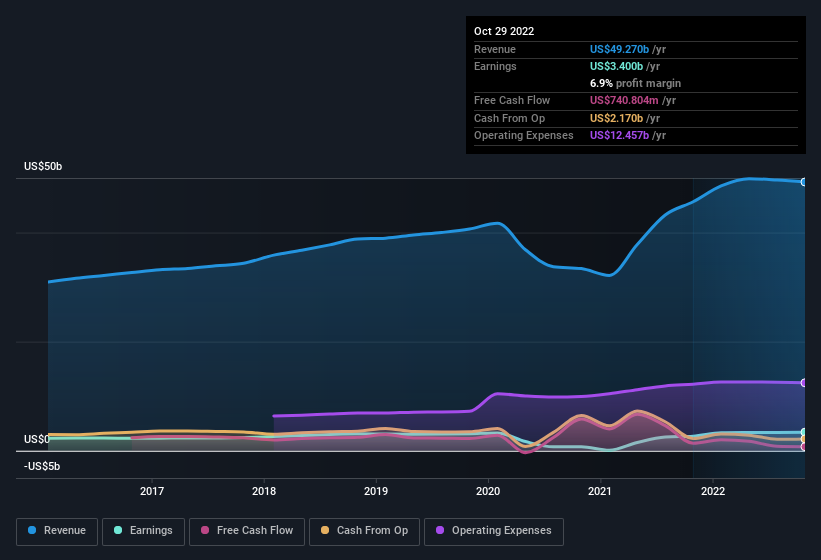

Cautious consideration of income progress and earnings earlier than curiosity and taxation (EBIT) margins can assist inform a view on the sustainability of the current revenue progress. TJX Corporations maintained secure EBIT margins during the last 12 months, all whereas rising income 8.0% to US$49b. That is an actual optimistic.

The chart under reveals how the corporate’s backside and prime traces have progressed over time. For finer element, click on on the picture.

Fortuitously, we have got entry to analyst forecasts of TJX Corporations’ future income. You are able to do your personal forecasts with out wanting, or you may take a peek at what the professionals are predicting.

Are TJX Corporations Insiders Aligned With All Shareholders?

Owing to the dimensions of TJX Corporations, we would not anticipate insiders to carry a major proportion of the corporate. However we’re reassured by the very fact they’ve invested within the firm. Notably, they’ve an enviable stake within the firm, value US$157m. Whereas that’s a variety of pores and skin within the recreation, we be aware this holding solely totals to 0.2% of the enterprise, which is a results of the corporate being so giant. This could nonetheless be a fantastic incentive for administration to maximise shareholder worth.

Is TJX Corporations Value Holding An Eye On?

One optimistic for TJX Corporations is that it’s rising EPS. That is good to see. For many who are on the lookout for a bit of greater than this, the excessive stage of insider possession enhances our enthusiasm for this progress. The mix undoubtedly favoured by buyers so contemplate retaining the corporate on a watchlist. We must always say that we have found 2 warning signs for TJX Companies (1 makes us a bit uncomfortable!) that you ought to be conscious of earlier than investing right here.

There’s at all times the potential for doing properly shopping for shares that usually are not rising earnings and don’t have insiders shopping for shares. However for many who contemplate these necessary metrics, we encourage you to take a look at firms that do have these options. You’ll be able to entry a free list of them here.

Please be aware the insider transactions mentioned on this article discuss with reportable transactions within the related jurisdiction.

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to carry you long-term targeted evaluation pushed by basic knowledge. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be a part of A Paid Person Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person buyers like your self. Sign up here