Wall Street Analysts View Tecnoglass, (TGLS), as a Buy: Should you Invest?

Investors often look to analyst recommendations when deciding whether to purchase, sell, hold, or trade a stock. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock’s price, but are they really important?

Before we get into the details about how to use brokerage recommendations to your advantage and their reliability, let’s look at what these Wall Street heavyweights think. Tecnoglass (TGLS).

Tecnoglass currently holds a median brokerage recommendation (ABR), at 1.00. This is based on actual recommendations (Buy or Hold, Sell, etc.). The average brokerage recommendation (ABR) for Tecnoglass is currently 1.00. This is based on the actual recommendations (Buy, Hold, Sell, etc.). A strong buy is indicated by an ABR of 1.

Three of the three recommendations that are derived the current ABR are Strong Buys, which represent 100% of all recommendations.

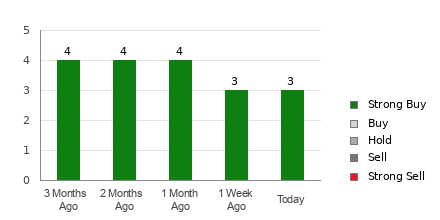

Brokerage Recommendation Trends for TGLS

Check price target & stock forecast for Tecnoglass here>>>

Although the ABR recommends buying Tecnoglass based on this information, it is not a good idea to make an investment decision based solely on this information. Multiple studies have shown that brokerage recommendations are not effective in helping investors choose stocks with the highest potential price appreciation.

You might be wondering why. A brokerage firm’s vested interest in a stock that they cover can often result in strong positive biases by their analysts when rating it. Our research has shown that brokerage firms assign five “Strong Buys” to every recommendation of a stock.

Also, their interests don’t always align with retail investors and they rarely predict the direction of stock prices. You can make the most of this information by validating your research or using an indicator that has proved to be extremely successful in forecasting a stock’s price movements.

Our proprietary stock rating tool Zacks Rank has a strong track record. This classifies stocks into five groups ranging from Zacks Rank #1 to Zacks Rank 5. It also provides a reliable indicator about a stock’s near-term performance. Validating the Zacks Rank using ABR could help you make a profit on your investment decision.

Zacks Rank and ABR should not be confused

Both Zacks Rank (ABR) and Zacks Rank (ABR) are shown in a range from 1-5. However, they are two different measures.

The ABR is calculated solely on the basis of broker recommendations. It is usually displayed in decimals (e.g. 1.28). Zacks Rank on the other hand is a quantitative model to maximize the potential of earnings estimate revisions. It is shown in whole numbers from 1 through 5.

The reality is that brokerage firms employ analysts who are too optimistic in their predictions. They give investors favorable ratings because of the vested interests of their employers, which can lead to misguided investors.

Earnings estimate revisions, on the other hand are the heart of the Zacks Rank. Empirical research has shown a strong correlation between earnings estimate revision trends and stock price movements in the near future.

Additionally, Zacks Rank grades will be applied proportionately for all stocks for whom brokerage analysts provide current year earnings estimates. This tool keeps a balance between its five ranks.

When it comes to freshness, there is a crucial difference between Zacks Rank and the ABR. The ABR may not always be current if you take a look at it. Nevertheless, the ABR is updated frequently by brokerage analysts to reflect changes in business trends. Their actions are reflected in Zacks Rank immediately. This makes it timely for predicting future stock price.

Should You Invest In TGLS?

The Zacks Consensus Estimate has increased by 3.3% to $3.17 in terms of revisions to earnings estimates for Tecnoglass.

The stock could rise because of the growing optimism among analysts about the company’s earnings prospects. This is evident by the strong agreement between them in revising EPS estimates up.

The Zacks Rank #1 (Strong buy) has been given to Tecnoglass due to the size of the change in the consensus estimate and three other factors that are related to earnings estimates. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Tecnoglass could be a good investment guide.

Want the latest Zacks Investment Research recommendations? You can now download 7 Best Stocks to Watch in the Next 30 days. Click to get this free report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report