When Ought to You Purchase Greatech Know-how Berhad (KLSE:GREATEC)?

Whereas Greatech Know-how Berhad (KLSE:GREATEC) won’t be probably the most broadly recognized inventory in the intervening time, it led the KLSE gainers with a comparatively massive value hike up to now couple of weeks. As a inventory with excessive protection by analysts, you possibly can assume any latest modifications within the firm’s outlook is already priced into the inventory. Nonetheless, what if the inventory remains to be a discount? At present I’ll analyse the newest knowledge on Greatech Know-how Berhad’s outlook and valuation to see if the chance nonetheless exists.

See our latest analysis for Greatech Technology Berhad

What Is Greatech Know-how Berhad Value?

Greatech Know-how Berhad is at the moment costly based mostly on my value a number of mannequin, the place I have a look at the corporate’s price-to-earnings ratio compared to the business common. On this occasion, I’ve used the price-to-earnings (PE) ratio given that there’s not sufficient info to reliably forecast the inventory’s money flows. I discover that Greatech Know-how Berhad’s ratio of 52.75x is above its peer common of 23.68x, which suggests the inventory is buying and selling at the next value in comparison with the Semiconductor business. However, is there one other alternative to purchase low sooner or later? Provided that Greatech Know-how Berhad’s share is pretty risky (i.e. its value actions are magnified relative to the remainder of the market) this might imply the value can sink decrease, giving us one other probability to purchase sooner or later. That is based mostly on its excessive beta, which is an effective indicator for share value volatility.

What sort of development will Greatech Know-how Berhad generate?

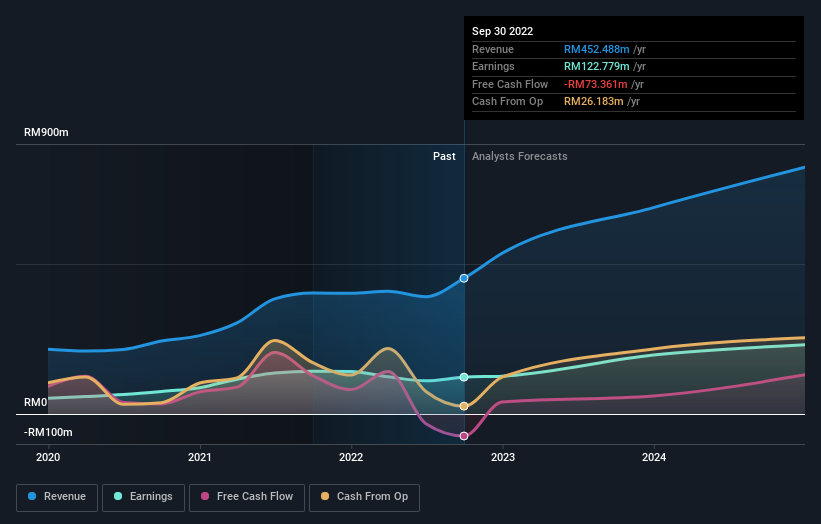

Future outlook is a vital facet while you’re looking to buy a inventory, particularly if you’re an investor in search of development in your portfolio. Though worth traders would argue that it’s the intrinsic worth relative to the value that matter probably the most, a extra compelling funding thesis could be excessive development potential at an inexpensive value. With revenue anticipated to develop by 81% over the following couple of years, the long run appears vivid for Greatech Know-how Berhad. It appears like greater money movement is on the playing cards for the inventory, which ought to feed into the next share valuation.

What This Means For You

Are you a shareholder? GREATEC’s optimistic future development seems to have been factored into the present share value, with shares buying and selling above business value multiples. At this present value, shareholders could also be asking a distinct query – ought to I promote? In the event you consider GREATEC ought to commerce under its present value, promoting excessive and shopping for it again up once more when its value falls in direction of the business PE ratio could be worthwhile. However earlier than you make this resolution, check out whether or not its fundamentals have modified.

Are you a possible investor? In the event you’ve been conserving tabs on GREATEC for a while, now might not be the very best time to enter into the inventory. The value has surpassed its business friends, which implies it’s doubtless that there isn’t any extra upside from mispricing. Nonetheless, the optimistic prospect is encouraging for GREATEC, which implies it’s value diving deeper into different components to be able to make the most of the following value drop.

Take note, relating to analysing a inventory it is value noting the dangers concerned. At Merely Wall St, we discovered 1 warning sign for Greatech Technology Berhad and we predict they deserve your consideration.

If you’re now not excited by Greatech Know-how Berhad, you need to use our free platform to see our record of over 50 other stocks with a high growth potential.

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to carry you long-term targeted evaluation pushed by basic knowledge. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be a part of A Paid Consumer Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here