3 Soon-To-Be Dividend Kings

Dividend Aristocrats have become a favorite option for investors seeking an income stream. After all, it’s easy to understand why; these companies have upped their payouts for a minimum of 25 consecutive years, which displays their reliable nature.

While that’s impressive, there’s even a step above the Dividend Aristocrats.

Let me introduce Dividend Kings. These are the people who have demonstrated an unmatched commitment to shareholders by increasing dividend payouts for 50+ years.

Surprisingly, many stocks are preparing to join the elite club, including Archer Daniels Midland ADM and Sherwin-Williams SHW.

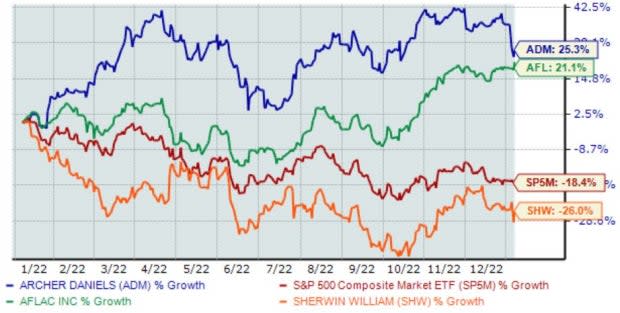

Below is a chart illustrating the performance of all three stocks over the last year, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

Archer Daniels Midland

Archer Daniels Midland, a leader in the production of food and beverages ingredients and products made from various agricultural product, is Archer Daniels Midland. ADM currently holds a Zacks Rank #2. (Buy).

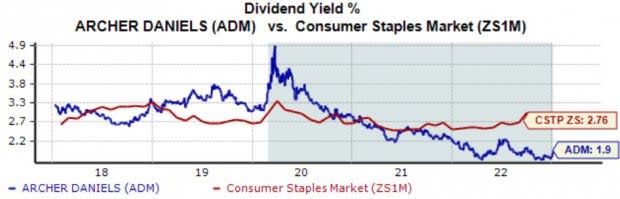

ADM’s annual dividend currently yields 1.9%, below its Zacks Consumer Staples sector average. Still, the company’s 4% five-year annualized dividend growth rate helps to pick up the slack.

Image Source: Zacks Investment Research

In addition, it’s hard to ignore ADM’s quarterly performance; the company has exceeded the Zacks Consensus EPS Estimate by double-digit percentages in four consecutive quarters.

Archer Daniels Midland’s latest report showed a 31% beat in earnings per share and revenue almost 8% higher than expectations.

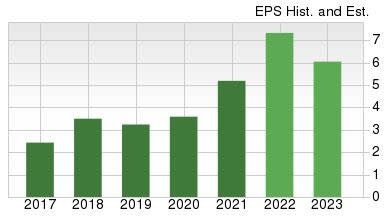

Image Source: Zacks Investment Research

The company’s current fiscal year (FY22) has a positive growth profile. Earnings are expected to rise 44% Y/Y. However, earnings are expected to slow down by 15% in FY23.

Image Source: Zacks Investment Research

Sherwin-Williams

Sherwin-Williams is a manufacturer and seller of paints, coatings, as well as other related products. As it stands now, Sherwin-Williams has a Zacks rank #2 (Buy).

SHW’s annual dividend currently yields a respectable 1.1%, just a few ticks below its Zacks Construction sector average. Impressively, the company’s payout has grown by a double-digit 20% over the last five years.

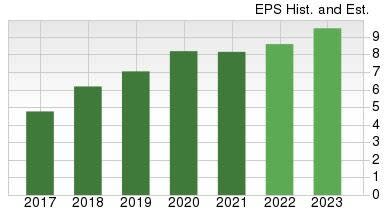

Image Source: Zacks Investment Research

With the Zacks ConsensusEPS Estimate of $8.71 in FY22, it indicates an increase of nearly 7% Y/Y. And in FY23, the company’s bottom line is forecasted to expand a further 19%.

Image Source: Zacks Investment Research

Aflac

Aflac, an American insurance company, is a major supplier of supplemental insurance in the United States. AFL currently holds a Zacks #3 (Hold) rank.

Aflac pays its shareholders through its annual dividend, which currently yields 2.2%. This is slightly lower than the Zacks Finance sector average of 2.2%.

Image Source: Zacks Investment Research

In addition, valuation multiples aren’t stretched, further reinforced by its Style Score of a “B” for Value. AFL shares are currently trading at a 13.6X forward earning multiple, slightly above its five-year median, and close to its Zacks Sector average.

Image Source: Zacks Investment Research

Bottom Line

Investors are able to enjoy consistent, reliable income through dividends. Being paid is an incredible feeling.

Many people turn to the Dividend Aristocrats when they are looking for an income stream. These companies have increased their payouts at least 25 consecutive years.

A step above the rest is the elite Dividend Kings, who have been doing this for more than 50 years and put their shareholder-friendly nature to full display.

All three stocks above – Archer Daniels Midland ADM, Sherwin-Williams SHW, and Aflac AFL – are knocking on the door of the elite club.

Get the most recent Zacks Investment Research recommendations. Download 7 Best Stocks in the Next 30 Days Today Click to get this free report

The SherwinWilliams Company (SHW) : Free Stock Analysis Report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report