Insiders at Conagra Brands, Inc. (NYSE.CAG) increased their holdings last year by 496%

Insiders were net buyers Conagra Brands, Inc. (NYSE:CAG The stock was purchased by () stock in the past year. This means that insiders purchased more stock than they actually sold.

We believe that insider transactions are not essential for long-term investing. However, it is sensible to keep an eye on what insiders have been doing.

See our latest analysis for Conagra Brands

Conagra Brands: The last 12 Months of Insider Transactions

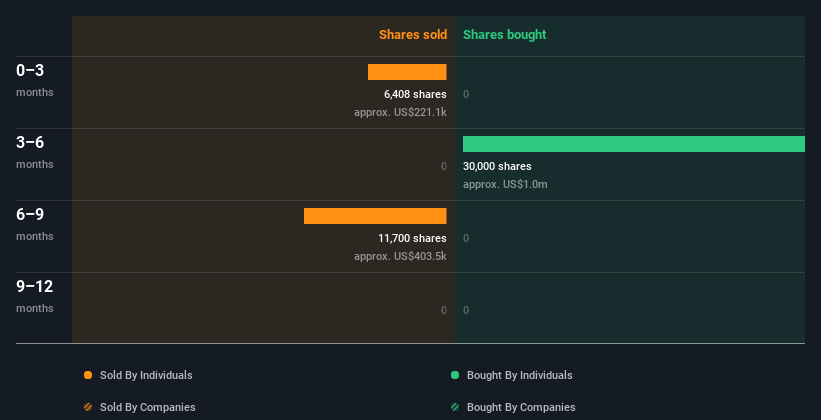

Emanuel Chirico, Independent Director, made the largest insider purchase over the past 12 months. The transaction involved US$1.0m in shares, at a cost of US$34.06 per share. Although the purchase price was significantly lower than the current price of US$38.83, we believe insider buying is still a positive. This transaction does not reveal much about current stock prices but it does indicate that insiders believe the stock is less valuable at lower prices.

Below is a chart that shows insider transactions by individuals and companies over the past year. You can click on the graph below to view the details of each insider transactions!

Many other companies have insiders who buy shares. You most likely do. Not You don’t want to miss it No cost list of growing companies that insiders are buying.

Conagra Brands Insiders are Selling the Stock

Conagra Brands saw significant insider sales over the past three months. Carey Bartell, the Executive Vice President, sold shares worth US$221k in this period. We didn’t make any purchases. We are cautious about this, but it is not the only thing.

Insider Ownership

Investors love to see how much company stock is owned by insiders. Insider ownership is usually higher than outsider ownership. This means that insiders are more likely to be motivated to build the company over the long-term. Conagra Brands insiders hold shares worth US$85m. This represents 0.5% of company shares. Although this is not a great level of insider ownership it is enough to show some alignment between management, smaller shareholders, and the company.

So what do the Conagra Brands Insider Transactions indicate?

Insiders haven’t purchased Conagra Brands stock over the past three months. However, there was some selling. They seem keener when you compare the past twelve months. Insiders own shares. We are not bothered by the recent selling. While it is helpful to see what insiders do in regards to buying or selling, it can also be helpful to learn the risks faced by a company. Simply Wall St has discovered that Conagra Brands is at risk. 5 warning signs (1 is significant!) These are the most important things to pay attention before you move on with your analysis.

Naturally It is possible to find a great investment opportunity by looking elsewhere. Take a look at these pictures No cost list of interesting companies.

Insiders, for the purposes of this article are individuals who report transactions to the relevant regulatory agency. We account for transactions in open markets and private dispositions at the moment but not derivative transactions.

Give feedback about this article Are you concerned about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article is by Simply Wall St. It is general in nature. Our commentary is based on historical data, analyst forecasts and other unbiased information. We do not intend to provide financial advice. This analysis does not represent a recommendation to purchase or sell any stock and it does not consider your financial goals or financial situation. We strive to deliver long-term, detailed analysis that is based on fundamental data. Our analysis may not take into account the most recent price-sensitive company announcements and qualitative material. Simply Wall St holds no position in any of the stocks mentioned.

Register for a paid user research session

You’ll receive a Amazon Gift Card: US$30 Spend an hour helping us to create better tools for individual investors. Sign up here