Coats Group plc stock was purchased by insiders (LON:COA), which is great news.

It is not usually a big deal when a single insider buys stock. But, multiple insiders can purchase stock, such as in Coats Group plc’s (LON:COAFor shareholders, this is good news.

While we believe that shareholders shouldn’t follow insider transactions, it is foolish to ignore these transactions entirely.

See our latest analysis for Coats Group

Coats Group Transactions in the Last Year

In the last twelve months, the biggest single purchase by an insider was when Independent Chairman of the Board David Gosnell bought UK£100k worth of shares at a price of UK£0.63 per share. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of UK£0.74. Although it suggests that insiders think the stock is undervalued at lower prices than they believe, we don’t know much about their current opinions on prices.

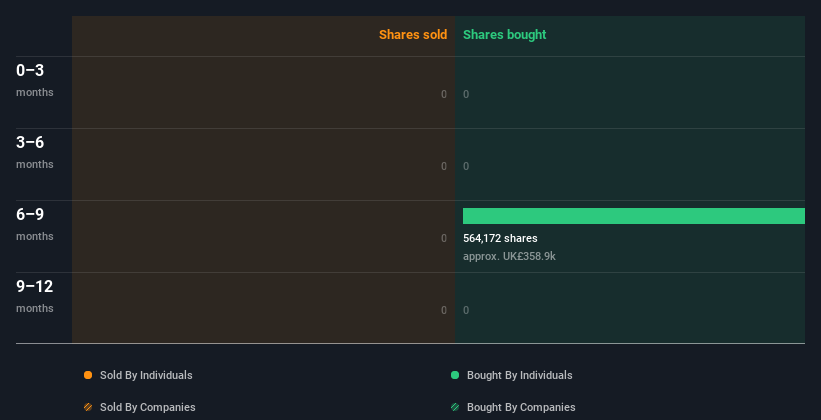

Coats Group insiders purchased shares over the past year but they didn’t actually sell. Below you can see a visual representation showing insider transactions between companies and individuals in the last 12 month. Click on the chart to see the details of each transaction, including the date, share price and individual.

Insiders may also be buying Coats Group. For those who love to search Win investments This Free list of growing companies with recent insider purchasing, could be just the ticket.

Coats Group Has High Insider Ownership

To see how aligned insiders are to me, I love to look at how many shares an insider owns in a company. Insider ownership is usually higher than outsider ownership. This makes it more likely that they will be incentivised for long-term growth of the company. Insiders own 0.4% of Coats Group shares, worth about UK£5.3m, according to our data. Although this level of ownership may not be impressive, it is certainly more than nothing.

What do the Coats Group Insider Transactions indicate?

Insider transactions have not occurred in the past three months, but that doesn’t necessarily mean anything. Our analysis of transactions from the last year was encouraging. We’d love to see individual holdings larger. But, we don’t see any reason to believe that Coats Group insiders would doubt the company. While insider transactions may help us to build a thesis on the stock, it’s worth understanding the risks facing this company. This is an example of what we’ve seen. 2 warning signs for Coats Group You should be aware.

Take note! Coats Group might not be the best stock for you to buy. Have a look at these Free list of interesting companies with high ROE and low debt.

This article will define insiders as individuals who report transactions and make them available to the appropriate regulatory body. At the moment, we account for open-market transactions and private dispositions. But not derivative transactions.

Give feedback about this article Have a question about the content? Get in touch Contact us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article is by Simply Wall St. It is general in nature. Our commentary is based on historical data, analyst forecasts and other unbiased information. We do not intend to provide financial advice. This analysis does not represent a recommendation to purchase or sell any stock and it does not consider your objectives or financial situation. Our goal is to provide you with long-term, focused analysis based on fundamental data. Please note that our analysis might not include the latest announcements from price-sensitive companies or qualitative material. Simply Wall St holds no position in any of the stocks mentioned.

Register for a paid user research session

You’ll receive a Amazon Gift Card – US$30 Give us 1 hour of your time and help us create better investing tools for individual investors like you. Sign up here