AmerisourceBergen (NYSE) shareholders have enjoyed a 24% CAGR in the last three year.

An index fund is a simple way to reap the benefits of the stock market. If you can buy quality businesses at reasonable prices, your portfolio return could be greater than the average market return. Have a look at AmerisourceBergen Corporation (NYSE:ABCOver the past three years, it has increased 81%. This is well above the market return of 17% (not counting dividends). Recent returns are not as impressive, however, as the stock returned just 24% last year, including dividends.

Let’s look at the underlying fundamentals for the longer-term and see if they have been consistent with shareholder returns.

Check out our latest analysis for AmerisourceBergen

Buffett once said that ships will sail the world, but the Flat Earth Society would thrive. It will be difficult to find the right price for a company in the marketplace …’ A simple but imperfect way to see how perceptions have changed is to compare earnings per share (EPS), and share price movements.

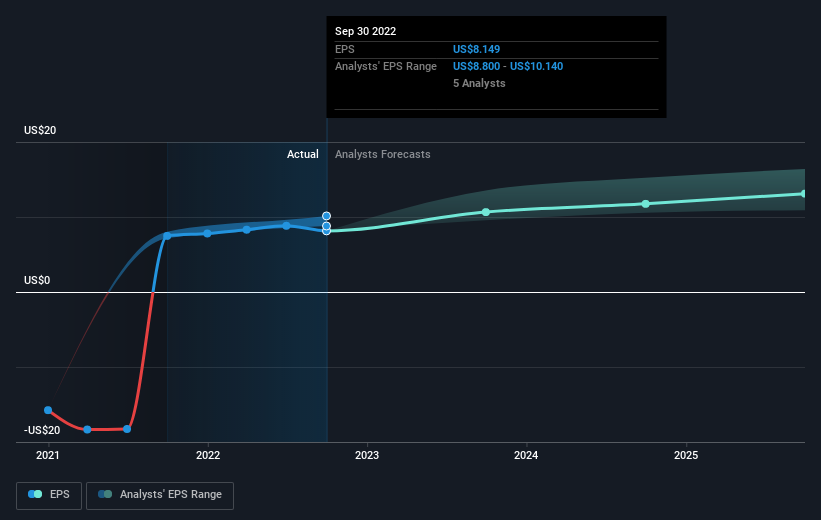

AmerisourceBergen managed to increase its EPS by 27% annually over three years, which pushed the share price higher. This EPS growth is more than the 22% annual average increase in the share prices. It seems that investors have become more cautious over the company in recent years.

Below is an image that shows how EPS has changed over time. Click on the image to see more detail.

Check out this interactive graph that AmerisourceBergen has created to help you understand AmerisourceBergens key metrics. earnings, revenue and cash flow.

What about Dividends

It is important to calculate the total shareholder and share price returns for each stock. TSR is a return calculation that includes cash dividends (assuming any dividend received was reinvested), and any discounted capital raises or spin-offs. TSR provides a more comprehensive picture of dividend stocks than the share price return. The TSR for AmerisourceBergen over the past 3 years was 89%. This is higher than the share price returns mentioned above. Therefore, the dividends received by the company have boosted the Total Shareholder return

A Different Perspective

It’s great to see AmerisourceBergen rewarding shareholders with a 24% total shareholder return over the past 12 months. That includes the dividend. This is a better return than the annualized return at 12% over the past half decade. This suggests that the company is doing well in recent times. The share price momentum is strong so it’s worth looking at the stock to make sure you don’t miss an opportunity. It is worth taking into consideration the various market conditions that can impact the share price. However, there are more important factors. Here’s an example: 2 warning signs for AmerisourceBergen You should be aware.

Take note! AmerisourceBergen is not the best stock to invest in. Have a look at these Free list of interesting companies with past earnings growth (and further growth forecast).

Please note that the market returns in this article are the market weighted average returns for stocks currently trading on US exchanges.

Let us know what you think about this article. Have a question about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St has a general nature. Our commentary is based on historical data, analyst forecasts and other unbiased information. We do not intend to provide financial advice. It is not a recommendation not to buy or sell any stocks and does not take into account your objectives or financial situation. Our aim is to give you long-term focused analysis that is based on fundamental data. Please note that our analysis might not include the most recent announcements from price-sensitive companies or qualitative material. Simply Wall St does not hold any position in the stocks mentioned.

Register for a paid user research session

You’ll receive a Amazon Gift card – US$30 Give us 1 hour of your time and help us create better investing tools for individual investors like you. Sign up here