Avantor (AVTR) Q4 Earnings Surpass Estimates, Margins Up

Avantor, Inc. AVTR reported fourth quarter 2022 adjusted earnings (EPS) at 32 cents. This is 11.1% less than the previous year. The bottom line however beat the Zacks Consensus Estimate 6.7%.

We forecasted that the adjusted fourth-quarter EPS would be 29 cents.

GAAP EPS was 21 cents for the quarter, an increase of 61.5% over the previous year.

The full-year adjusted EPS was $1.41. This is flat compared with the end 2021. Full-year adjusted EPS had been projected to be $1.38.

Revenue Details

The reported quarter’s revenue was $1.79 billion, a decrease of 5.9% over the previous year. The metric beat Zacks Consensus Estimates by 0.3%.

Comparatively, the fourth-quarter revenue was $1.78 billion.

Avantor’s foreign currency translation reflected a 4.5% headwind in the reported quarter, whereas M&A had a positive impact of 0.7%, resulting in an organic sales decline of 2.1%. Avantor’s core organic growth rate was 2.7%, excluding COVID-19 headwinds.

Per management, the year-over-year uptick in the fourth quarter’s core organic sales reflected ongoing strength in Avantor’s core business. This was partly offset by inventory destocking for liquid handling and single-use tubes, a weaker year-end budget flush than anticipated, and headwinds from fewer sales days in the fourth-quarter of 2022.

Full-year revenues reached $7.51 Billion, which is 1.7% more than the 2021 period. Our estimate of $7.49 trillion is the full-year revenue.

Segmental Analysis

Avantor reports financial results in three geographic segments based on customer location — the Americas, Europe and AMEA (Asia, Middle-East and Africa).

The Americas segment’s net sales were $1.05 million, reflecting a reported decline of 3.6% year over year. However, core organic sales grew 0.1% during the quarter. Strong growth in serum, excipients and process ingredients for bioprocessing in the region was offset by destocking headwinds with liquid handling consumables (single-use tubing) and other items.

This is in line with our projected fourth-quarter segmental revenue of $1.05B, which is the same as what was reported by the company.

Europe’s net sales were $617.2 million, reflecting a reported decrease of 10.1%, whereas core organic sales increased 6.3% year over year. According to management, core organic sales increased 6.3% year over year due to strength in bioproduction.

This is compared to our projection for fourth-quarter segmental revenue of $603.4million.

AMEA arm’s net sales were $129.8 million, indicating a reported fall of 3.1% year over year. Core organic sales rose 5.7% year-over-year, driven by the sales of proprietary materials to advanced technology and applied material customers and bioproduction strength for process ingredients and excipients.

This compares with our projection for fourth-quarter segmental revenues at $123.6 million.

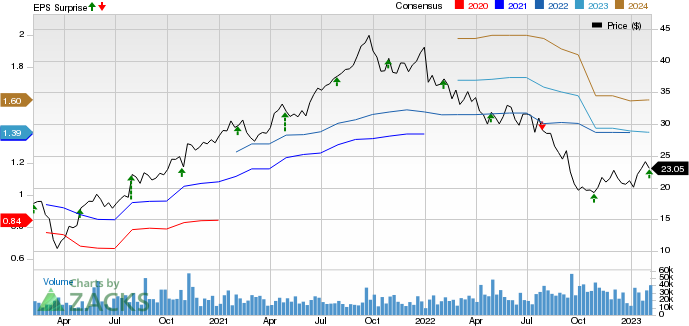

Avantor, Inc. Price, Consensus, and EPS Surprise

Avantor, Inc. price-consensus-eps-surprise-chart | Avantor, Inc. Quote

Margin Analysis

In the quarter under review, Avantor’s gross profit declined 5.1% to $614.5 million. However, the gross profit grew 29 basis point (bps) to 34%.

We expected 34.6% gross margin in the fourth quarter.

Year-over-year, selling, general and administrative costs fell 16.3% to $362.7 Million.

Operating profit totaled $251.8 million, up 17.7% from the prior-year quarter’s level. Operating margin grew 281bps to 14% in the quarter.

We projected 13.1% operating margin for fourth quarter.

Financial Position

Avantor ended full-year 2022 having cash and cash equivalents totaling $372.9 million, compared to $301.7 million at 2021’s end. At the end 2022, total debt was $6.29 trillion, compared with $7.02B at the 2021 end.

The cumulative net cash flow from operating activities was $843.6million at the end 2022, compared to $953.6 million one year ago.

Guidance

Avantor has started its financial outlook to the full-year 2023.

For the full year, the company anticipates registering growth of 0-2%. Current Zacks Consensus Estimates for the same reflect a 0.8% decline.

Avantor anticipates organic revenue growth of between 0-2% in the entire year.

The COVID-19 headwinds for the whole year are 2.5%. The core organic revenue growth projections are within 2.5-4.5%, exempting COVID-19 headwinds.

Avantor anticipates that its adjusted EPS will be within $1.35-$1.45 during the entire year. The Zacks Consensus Estimate is $1.39.

Our Take

The decline in Avantor’s adjusted EPS and the overall reported revenues in the fourth quarter of 2022 is disappointing. It is disappointing to see the declines in overall organic sales and reported revenue in each segment. Macroeconomic factors like tighter financial conditions, global supply-chain constraints and the ongoing geopolitical conflict also raised apprehensions about the company’s financial strength.

Avantor ended the fourth quarter with stronger-than-expected results. It saw a strong year-over-year increase in overall core organic sales and segmental core sales. This is quite impressive. Strength in Avantor’s end markets is encouraging. The company’s pipeline of new product launches and robust demand from its bioproduction customers for its end-to-end fluid management solution also raise optimism about the stock. The continued demand for Avantor’s Ritter and Masterflex products also looks promising. Both margins are expected to grow.

Zacks Rank and Stocks To Consider

Avantor is currently wearing a Zacks rank #4 (Sell).

Here are some stocks that have posted quarterly results and are better-ranked in the wider medical space. Cardinal Health, Inc. CAH, McKesson Corporation MCK and Hologic, Inc. HOLX.

Cardinal Health, which has a Zacks Rank #2, Buy, reported fiscal 2023 adjusted EPS (EPS) of $1.32 in the second quarter, beating the Zacks Consensus Estimate 16.8%. Revenues of $51.47billion were 2% higher than the consensus estimate. See the full article. the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cardinal Health’s long-term growth rate is 11.6%. CAH’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other two, the average being 6.4%.

McKesson was ranked #2 on Zacks. It reported an adjusted EPS of $6.90 for the third quarter fiscal 2023. This was 8.8% higher than the Zacks Consensus Estimate. Revenues of $70.49 Billion were more than the consensus estimate by 0.02%.

McKesson’s long-term growth rate is 10.4%. MCK’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other two, the average being 3.4%.

Hologic reported adjusted earnings per share of $1.07 for the first quarter of fiscal 2023. This beats the Zacks Consensus Estimate 18.9%. Revenues of $1.07 Billion surpassed the Zacks Consensus estimate by 9.5%. It currently has a Zacks Rank 1.

Hologic’s long-term expected growth rate is 15.2%. HOLX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 30.6%.

Get the most recent Zacks Investment Research recommendations. You can now download 7 Best Stocks to Watch in the Next 30 days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Avantor, Inc. (AVTR) : Free Stock Analysis Report