Bullish insiders bet CA$14m on Parkit Enterprise Inc. (CVE:PKT)

Many insiders have increased their holdings significantly in the last year. Parkit Enterprise Inc. (CVE:PKT). This is encouraging, as it suggests that insiders are more optimistic regarding the company’s future prospects.

We would not consider insider trading to be as important as long-term investment.

See our latest analysis for Parkit Enterprise

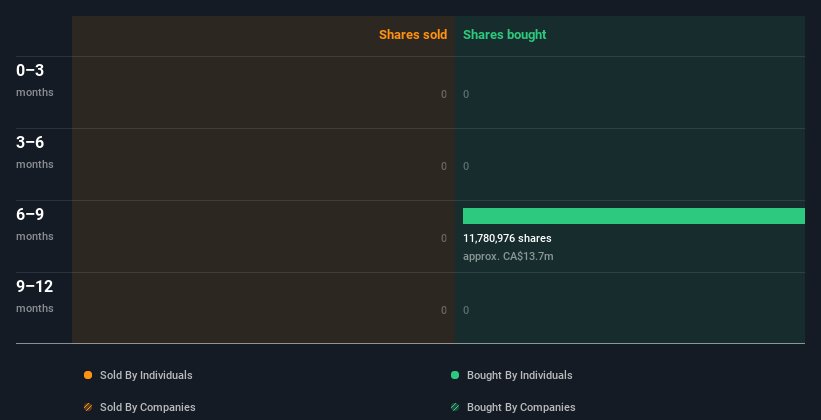

Parkit Enterprise: The last 12 months of insider transactions

The largest single purchase made by an insider in the past twelve months was when Chairman Steven Scott purchased shares worth CA$7.0m at a cost of CA$1.19 each share. An insider would have wanted to purchase shares at a price higher than the current share price of CA$1.06. Although their views may have changed since they purchased the shares, it does indicate that they are confident in the company’s future. We believe that the price that an insider pays to purchase shares is important. It is more encouraging for insiders to pay above the current price because it indicates that they see value even at higher levels.

Parkit Enterprise insiders might have purchased shares over the past year but didn’t actually sell any. The chart below displays insider transactions, both by companies and individuals, over the past one year. Click on the chart to see all transactions including share price, individual transaction and date.

There are many other companies with insiders that buy up shares. You most likely do. Not You don’t want to miss it Free list of growing companies that insiders are buying.

Parkit Enterprise boasts high insider ownership

To help me see how closely insiders are aligned with them, I look at the number of shares they own in a company. The likelihood that insiders will be motivated to build the company over the long-term is higher if they have more insider ownership. Parkit Enterprise insiders have 9.8% of the company. This is worth around CA$24m. This is strong, but not exceptional insider ownership. However, it is enough to show some alignment between management shareholders and smaller shareholders.

What do the Parkit Enterprise Insider Transactions indicate?

We are not bothered by the fact that there haven’t been any Parkit Enterprise insider transactions in recent months. Positively, transactions from the last year are encouraging. Parkit Enterprise is owned by insiders. Their transactions shouldn’t be a concern. You should certainly take a look here FREE report showing analyst forecasts for Parkit Enterprise.

Take note! Parkit Enterprise is not the best stock to purchase. Take a look at this. Free list of interesting companies with high ROE and low debt.

This article will define insiders as individuals who report their transactions the appropriate regulatory body. We currently account only for transactions in open markets and private dispositions.

Give feedback about this article Are you concerned about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article is by Simply Wall St. It is general in nature. Our commentary is based on historical data, analyst forecasts and other unbiased information. We do not intend to provide financial advice. It is not a recommendation not to buy or sell any stocks and it doesn’t take into account your financial situation or objectives. Our goal is to provide you with long-term, focused analysis based on fundamental data. Please note that our analysis might not include the latest announcements from price-sensitive companies or qualitative material. Simply Wall St holds no position in any of the stocks mentioned.

Participate in a Paid User Research Session

You’ll receive a Amazon Gift Card – US$30 Spend an hour helping us to create better tools for individual investors. Sign up here