Consolidated Edison’s (NYSE:ED) traders will probably be happy with their 26% return over the past three years

By shopping for an index fund, you may roughly match the market return with ease. However should you select particular person shares with prowess, you can also make superior returns. For instance, the Consolidated Edison, Inc. (NYSE:ED) share value is up 13% within the final three years, clearly besting the market return of round 10% (not together with dividends).

Let’s check out the underlying fundamentals over the long run, and see if they have been in keeping with shareholders returns.

See our latest analysis for Consolidated Edison

Whereas the environment friendly markets speculation continues to be taught by some, it has been confirmed that markets are over-reactive dynamic methods, and traders aren’t all the time rational. One approach to look at how market sentiment has modified over time is to take a look at the interplay between an organization’s share value and its earnings per share (EPS).

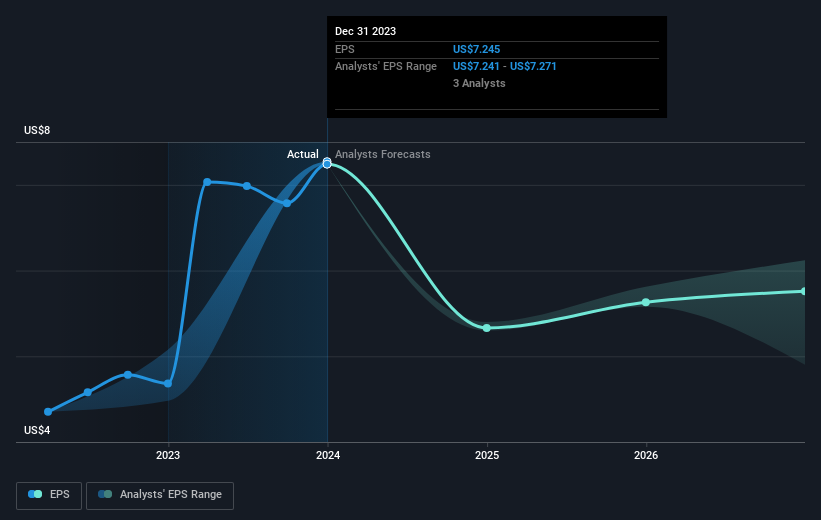

Consolidated Edison was capable of develop its EPS at 30% per yr over three years, sending the share value greater. The typical annual share value enhance of 4% is definitely decrease than the EPS development. So it appears traders have turn into extra cautious concerning the firm, over time.

The corporate’s earnings per share (over time) is depicted within the picture beneath (click on to see the precise numbers).

We think about it optimistic that insiders have made vital purchases within the final yr. Having mentioned that, most individuals think about earnings and income development tendencies to be a extra significant information to the enterprise. Dive deeper into the earnings by checking this interactive graph of Consolidated Edison’s earnings, revenue and cash flow.

What About Dividends?

It is very important think about the full shareholder return, in addition to the share value return, for any given inventory. Whereas the share value return solely displays the change within the share value, the TSR contains the worth of dividends (assuming they have been reinvested) and the advantage of any discounted capital elevating or spin-off. So for firms that pay a beneficiant dividend, the TSR is commonly loads greater than the share value return. Because it occurs, Consolidated Edison’s TSR for the final 3 years was 26%, which exceeds the share value return talked about earlier. And there is no prize for guessing that the dividend funds largely clarify the divergence!

A Totally different Perspective

Traders in Consolidated Edison had a tricky yr, with a complete lack of 5.0% (together with dividends), in opposition to a market acquire of about 25%. Even the share costs of excellent shares drop typically, however we need to see enhancements within the basic metrics of a enterprise, earlier than getting too . On the brilliant facet, long run shareholders have made cash, with a acquire of 5% per yr over half a decade. If the basic knowledge continues to point long run sustainable development, the present sell-off may very well be a possibility value contemplating. Whereas it’s effectively value contemplating the completely different impacts that market circumstances can have on the share value, there are different elements which might be much more vital. For instance, we have found 3 warning signs for Consolidated Edison (1 cannot be ignored!) that try to be conscious of earlier than investing right here.

There are many different firms which have insiders shopping for up shares. You most likely do not need to miss this free list of growing companies that insiders are buying.

Please word, the market returns quoted on this article replicate the market weighted common returns of shares that at the moment commerce on American exchanges.

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We purpose to carry you long-term targeted evaluation pushed by basic knowledge. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.