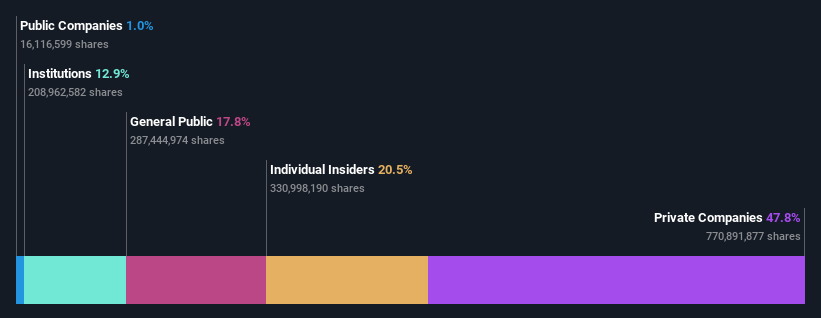

D & O Inexperienced Applied sciences Berhad’s (KLSE:D&O) high homeowners are personal corporations with 48% stake, while21% is held by insiders

To get a way of who is really in command of D & O Inexperienced Applied sciences Berhad (KLSE:D&O), it is very important perceive the possession construction of the enterprise. With 48% stake, personal corporations possess the utmost shares within the firm. Put one other means, the group faces the utmost upside potential (or draw back danger).

Particular person insiders, however, account for 21% of the corporate’s stockholders. Insiders usually personal a big chunk of youthful, smaller, corporations whereas enormous corporations are inclined to have establishments as shareholders.

Let’s delve deeper into every sort of proprietor of D & O Inexperienced Applied sciences Berhad, starting with the chart under.

View our latest analysis for D & O Green Technologies Berhad

What Does The Institutional Possession Inform Us About D & O Inexperienced Applied sciences Berhad?

Institutional traders generally examine their very own returns to the returns of a generally adopted index. So they often do think about shopping for bigger corporations which might be included within the related benchmark index.

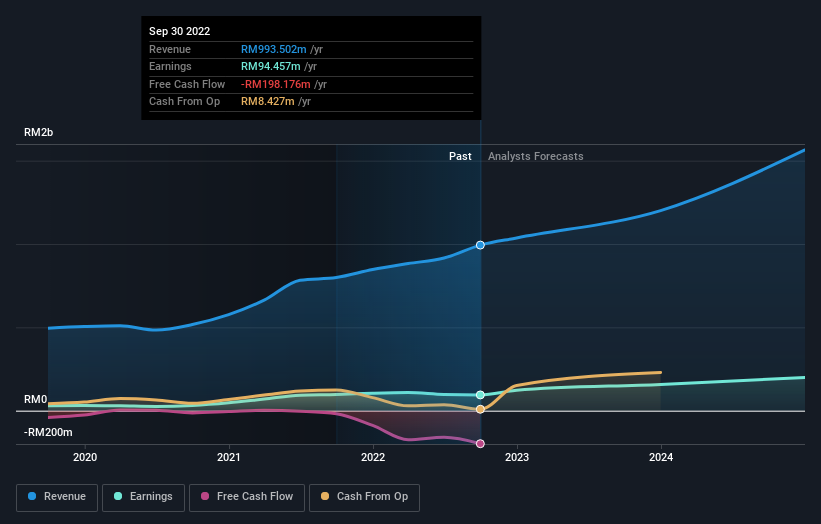

As you possibly can see, institutional traders have a good quantity of stake in D & O Inexperienced Applied sciences Berhad. This means the analysts working for these establishments have seemed on the inventory and so they prefer it. However similar to anybody else, they may very well be incorrect. If a number of establishments change their view on a inventory on the identical time, you may see the share worth drop quick. It is subsequently price D & O Inexperienced Applied sciences Berhad’s earnings historical past under. In fact, the longer term is what actually issues.

We be aware that hedge funds do not have a significant funding in D & O Inexperienced Applied sciences Berhad. Our information reveals that Golden Horizon Sources Restricted is the biggest shareholder with 11% of shares excellent. For context, the second largest shareholder holds about 10% of the shares excellent, adopted by an possession of 9.5% by the third-largest shareholder. As well as, we discovered that Kheng Tay, the CEO has 1.5% of the shares allotted to their title.

We did some extra digging and located that 6 of the highest shareholders account for roughly 53% of the register, implying that together with bigger shareholders, there are a number of smaller shareholders, thereby balancing out every others pursuits considerably.

Whereas it is smart to check institutional possession information for a corporation, it additionally is smart to check analyst sentiments to know which means the wind is blowing. There are many analysts overlaying the inventory, so it could be price seeing what they’re forecasting, too.

Insider Possession Of D & O Inexperienced Applied sciences Berhad

Whereas the exact definition of an insider may be subjective, nearly everybody considers board members to be insiders. Firm administration run the enterprise, however the CEO will reply to the board, even when she or he is a member of it.

Most think about insider possession a constructive as a result of it might point out the board is effectively aligned with different shareholders. Nevertheless, on some events an excessive amount of energy is concentrated inside this group.

Our most up-to-date information signifies that insiders personal an affordable proportion of D & O Inexperienced Applied sciences Berhad. Insiders personal RM1.5b price of shares within the RM7.5b firm. That is fairly significant. Most would say this reveals a very good diploma of alignment with shareholders, particularly in an organization of this dimension. You possibly can click here to see if those insiders have been buying or selling.

Common Public Possession

With a 18% possession, most people, largely comprising of particular person traders, have some extent of sway over D & O Inexperienced Applied sciences Berhad. Whereas this group cannot essentially name the pictures, it might definitely have an actual affect on how the corporate is run.

Non-public Firm Possession

We are able to see that Non-public Corporations personal 48%, of the shares on subject. It could be price trying deeper into this. If associated events, resembling insiders, have an curiosity in one in every of these personal corporations, that must be disclosed within the annual report. Non-public corporations might also have a strategic curiosity within the firm.

Subsequent Steps:

It is at all times price eager about the totally different teams who personal shares in an organization. However to grasp D & O Inexperienced Applied sciences Berhad higher, we have to think about many different elements. Take dangers for instance – D & O Inexperienced Applied sciences Berhad has 1 warning sign we predict try to be conscious of.

However in the end it’s the future, not the previous, that can decide how effectively the homeowners of this enterprise will do. Subsequently we predict it advisable to try this free report showing whether analysts are predicting a brighter future.

NB: Figures on this article are calculated utilizing information from the final twelve months, which seek advice from the 12-month interval ending on the final date of the month the monetary assertion is dated. This is probably not in step with full 12 months annual report figures.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to carry you long-term targeted evaluation pushed by basic information. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be part of A Paid Consumer Analysis Session

You’ll obtain a US$30 Amazon Reward card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here