Douglas Kirwin Is The Non-Government Director of Southern Gold Restricted (ASX:SAU) And They Simply Picked Up 900% Extra Shares

Even when it is not an enormous buy, we expect it was good to see that Douglas Kirwin, the Non-Government Director of Southern Gold Restricted (ASX:SAU) lately shelled out AU$69k to purchase inventory, at AU$0.023 per share. Despite the fact that that is not a large purchase, it did improve their holding by 900%, which is arguably signal.

View our latest analysis for Southern Gold

Southern Gold Insider Transactions Over The Final 12 months

During the last yr, we are able to see that the most important insider buy was by insider Paul Shadbolt for AU$496k price of shares, at about AU$0.12 per share. That implies that an insider was pleased to purchase shares at above the present worth of AU$0.027. It’s extremely potential they remorse the acquisition, however it’s extra doubtless they’re bullish in regards to the firm. To us, it is essential to contemplate the worth insiders pay for shares. It’s typically extra encouraging in the event that they paid above the present worth, because it suggests they noticed worth, even at greater ranges. Notably Paul Shadbolt was additionally the most important vendor.

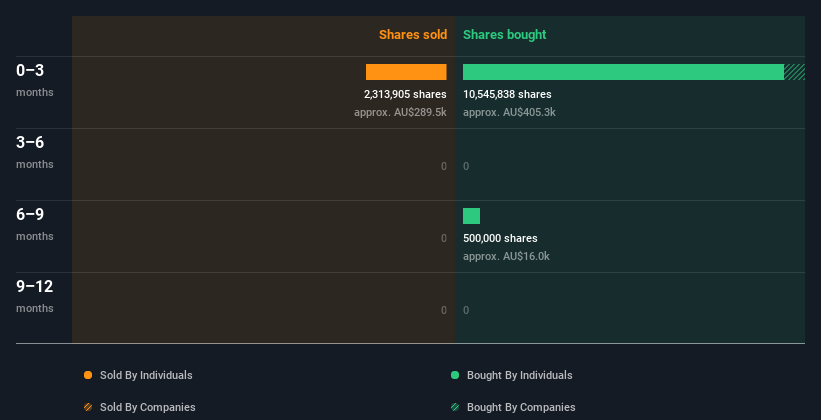

Within the final twelve months insiders bought 9.75m shares for AU$632k. However they bought 2.31m shares for AU$290k. In whole, Southern Gold insiders purchased greater than they bought over the past yr. Their common worth was about AU$0.065. That is good to see because it implies that insiders would possibly see worth round present costs. You’ll be able to see the insider transactions (by corporations and people) over the past yr depicted within the chart under. By clicking on the graph under, you’ll be able to see the exact particulars of every insider transaction!

Southern Gold just isn’t the one inventory insiders are shopping for. So take a peek at this free list of growing companies with insider buying.

Insider Possession Of Southern Gold

I like to have a look at what number of shares insiders personal in an organization, to assist inform my view of how aligned they’re with insiders. Often, the upper the insider possession, the extra doubtless it’s that insiders shall be incentivised to construct the corporate for the long run. From our knowledge, it appears that evidently Southern Gold insiders personal 12% of the corporate, price about AU$982k. However they could have an oblique curiosity by means of a company construction that we’ve not picked up on. While higher than nothing, we’re not overly impressed by these holdings.

What May The Insider Transactions At Southern Gold Inform Us?

The current insider purchases are heartening. And the long term insider transactions additionally give us confidence. However then again, the corporate made a loss over the last yr, which makes us slightly cautious. We will surely desire see greater ranges of insider possession however evaluation of the insider transactions means that Southern Gold insiders predict a shiny future. So these insider transactions may also help us construct a thesis in regards to the inventory, however it’s additionally worthwhile understanding the dangers going through this firm. Remember that Southern Gold is showing 5 warning signs in our investment analysis, and three of these are important…

After all, you would possibly discover a improbable funding by trying elsewhere. So take a peek at this free list of interesting companies.

For the needs of this text, insiders are these people who report their transactions to the related regulatory physique. We at the moment account for open market transactions and personal tendencies, however not spinoff transactions.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We intention to convey you long-term targeted evaluation pushed by elementary knowledge. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be part of A Paid Person Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here