Euronext Amsterdam Growth Companies With High Insider Ownership And Earnings Growth Up To 105%

Amid fluctuating global economic conditions, the Euronext Amsterdam market has showcased resilience, with particular interest in growth companies that boast high insider ownership—a sign often interpreted as confidence by those who know the company best. In today’s investment landscape, such attributes may be particularly appealing given broader market uncertainties and mixed economic signals.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

|

Name |

Insider Ownership |

Earnings Growth |

|

BenevolentAI (ENXTAM:BAI) |

27.8% |

62.8% |

|

Envipco Holding (ENXTAM:ENVI) |

15.1% |

67.8% |

|

Ebusco Holding (ENXTAM:EBUS) |

31.4% |

115.2% |

|

MotorK (ENXTAM:MTRK) |

35.9% |

105.8% |

|

Basic-Fit (ENXTAM:BFIT) |

12% |

66.1% |

|

PostNL (ENXTAM:PNL) |

30.8% |

24.7% |

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. specializes in designing, developing, manufacturing, and selling or leasing reverse vending machines for recycling used beverage containers, primarily serving markets in the Netherlands, North America, and Europe, with a market capitalization of approximately €337.49 million.

Operations: The company generates its revenue by designing, developing, manufacturing, and selling or leasing reverse vending machines for recycling used beverage containers across the Netherlands, North America, and Europe.

Insider Ownership: 15.1%

Earnings Growth Forecast: 67.8% p.a.

Envipco Holding N.V. has demonstrated a notable turnaround, becoming profitable with a net income of €0.147 million in Q1 2024 after a loss the previous year. The company’s revenue surged to €27.44 million from €10.41 million, reflecting robust growth. Despite recent share dilution and high volatility in its stock price, Envipco is trading significantly below its estimated fair value and forecasts suggest earnings will grow by 67.8% annually, outpacing the Dutch market’s 16.2%.

Simply Wall St Growth Rating: ★★★★★☆

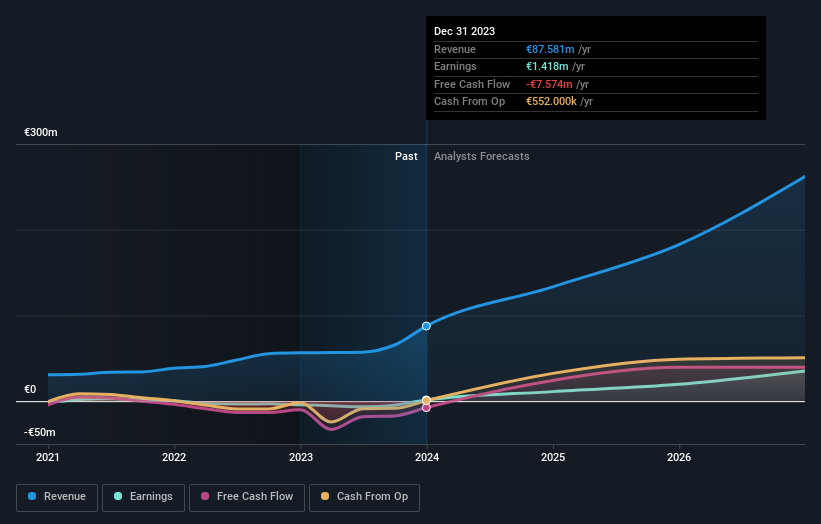

Overview: MotorK plc operates as a provider of software-as-a-service (SaaS) solutions tailored for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market capitalization of approximately €272.94 million.

Operations: The company generates its revenue primarily through its software and programming segment, which brought in €42.94 million.

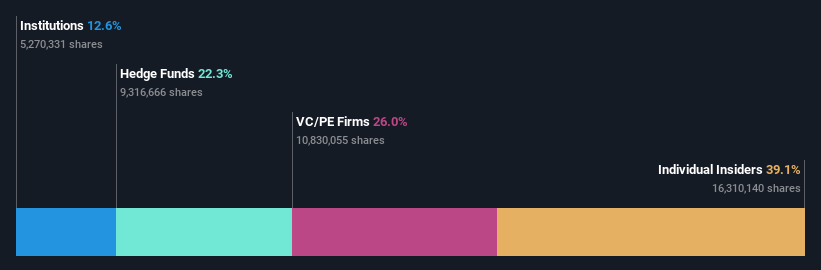

Insider Ownership: 35.9%

Earnings Growth Forecast: 105.8% p.a.

MotorK plc, despite expectations of unprofitability over the next three years and recent shareholder dilution, is positioned for substantial growth with earnings forecasted to increase by 105.85% annually. Revenue growth is also promising, projected at 24% per year, outstripping the Dutch market’s 9.5%. Recent leadership changes include Helen Protopapas joining as a director following Mauro Pretolani’s resignation. However, there has been no significant insider trading activity in the past three months.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. offers postal and logistics services across the Netherlands, other parts of Europe, and internationally, with a market capitalization of approximately €0.65 billion.

Operations: The company’s revenue is primarily generated from its Packages and Mail in The Netherlands segments, contributing €2.25 billion and €1.35 billion respectively.

Insider Ownership: 30.8%

Earnings Growth Forecast: 24.7% p.a.

PostNL, amidst a challenging landscape with a recent net loss of €20 million and declining sales from €780 million to €763 million, maintains high insider ownership but faces hurdles. The company’s share price has been highly volatile over the past three months. Despite this, PostNL’s earnings are expected to grow by 24.7% annually, outpacing the Dutch market forecast of 16.2%. However, its revenue growth lags behind at 3.4% per year compared to the market’s 9.5%. Additionally, PostNL carries a high debt level and has an unstable dividend track record, raising concerns about financial sustainability despite trading at half its estimated fair value.

Seize The Opportunity

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTAM:ENVI ENXTAM:MTRK and ENXTAM:PNL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]