Guanajuato Silver Produces Document 836,375 AgEq Ounces in This fall

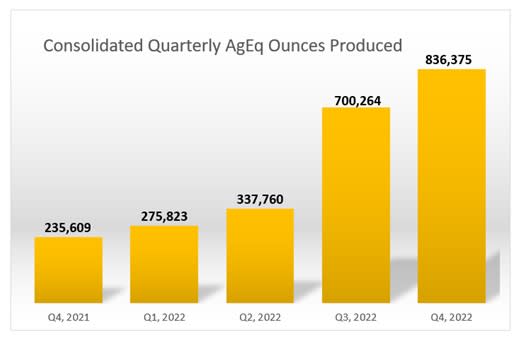

Sees 19% This fall Manufacturing Improve Over Q3

VANCOUVER, BC / ACCESSWIRE / January 26, 2023 / Guanajuato Silver Firm Ltd. (the “Firm” or “GSilver“) (TSXV:GSVR)(AQUIS:GSVR)(OTCQX:GSVRF) is happy to announce consolidated manufacturing outcomes for the three months ended December 31, 2022. Manufacturing outcomes are from the Firm’s wholly owned El Cubo Mines Complicated (“El Cubo“), Valenciana Mines Complicated (VMC), and San Ignacio Mine (“San Ignacio“) in Guanajuato, Mexico, and the Topia Mine (“Topia“) in Durango, Mexico.

This fall 2022 Manufacturing Highlights

-

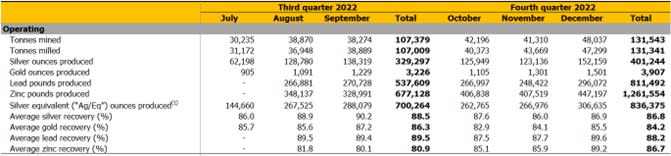

Document manufacturing in the course of the quarter of 836,375 silver-equivalent (“AgEq“) ounces derived from 401,244 ounces of silver, 3,907 ounces of gold, 811,492 kilos of lead and 1,261,554 kilos of zinc. Silver-equivalent manufacturing for all of 2022 totaled 2.15 million ounces.

-

Common silver recoveries of 86.8% proceed to surpass historic recoveries.

-

The dry stack tailings challenge at El Cubo has been initiated and superior engineering has been accomplished; the Firm is awaiting regulatory approval to start building of a dry stack facility that might enhance tailings capability at El Cubo from 2.5 years to roughly 15 years of extra tailings storage.

-

A brand new gravity circuit at El Cubo was accomplished in the course of the quarter with the target of recovering gold and silver from the Mastrantos IV historic tailings pond (See GSilver information launch dated June 22, 2022 – GSilver Discovers High-Grade Historical Tailings Material at El Cubo Assays 727 GPT AgEq Over 1.2m and 711 GPT AgEq Over 1.0m). The brand new gravity circuit is predicted to start business operations in Q1, 2023.

-

Set up of a brand new exhaust fan at El Cubo with the capability to flow into 250 cubic ft per minute has been accomplished; air flow on the mine has been considerably improved.

-

Substantial value reductions had been realized in the course of the quarter by way of the acquisition of compressors and a completely owned scoop tram fleet; additional financial savings had been realized because the Firm decreased the full variety of outdoors contractors it makes use of in its mining operations.

-

All lately acquired mining property at the moment are in manufacturing; all property acquired by way of the MMR transaction (San Ignacio, VMC and Topia) in August 2022 at the moment are absolutely operational. In direction of the tip of the quarter, the Cata mill at VMC was recommissioned and is at the moment processing mineralized materials from San Ignacio and the Los Pozos mine at VMC; the Topia mine in Durango didn’t lose a single day of manufacturing in the course of the MMR possession handover.

“We ended 2022 with report manufacturing of valuable metals from 5 mines and three processing services,” mentioned Chairman & CEO, James Anderson. “Capital investments made throughout This fall are already producing improved efficiencies and our operations workforce continues to search for alternatives to reinforce revenue margins as we try to proceed our pattern of quarterly will increase in silver manufacturing throughout all of our producing property.”

-

Silver equivalents are calculated utilizing an 89.97:1 (Ag/Au), 0.05:1 (Ag/Pb) and 0.08:1 (Ag/Zn) ratio for This fall and Q3 2022; 83.4:1 (Ag/Au) ratio for Q2 2022; and 80:1 (Ag/Au) ratio for Q1 2022.

This fall 2022 Mine Operations Proceed Development of Quarter over Quarter Manufacturing Will increase

Consolidated silver manufacturing elevated 22% to 401,244 ounces in This fall 2022 in comparison with Q3 2022; equally, consolidated gold manufacturing elevated by 21% to three,907 ounces over the identical interval. Throughout the fourth quarter, mineralized materials from San Ignacio was despatched to the El Cubo mill for processing; in 2023 the Firm expects to course of all mineralized materials from San Ignacio on the lately reactivated Cata mill at VMC. (See GSilver information launch dated January 17, 2023 – “Guanajuato Silver Restarts the Cata Mill at the Valenciana Mines Complex“)

In Durango, third-party mill feed from native operations within the neighborhood of the Topia mine added to manufacturing in the course of the quarter; this supplemental manufacturing amounted to twenty% of all tonnes processed at Topia in the course of the quarter and contributed to increased grades. There are a number of small mining operations positioned close by the Topia mine, and the Firm intends to make use of the Topia processing services because the centerpiece of a hub & spoke technique that might herald supplemental materials for processing in partnership with neighboring operations.

Consolidated silver equal manufacturing in This fall was 19% increased than the earlier quarter. This enhance displays the persevering with ramp-up of operations in any respect of GSilver’s mining property. Complete manufacturing for 2022 was 2.15 million AgEq; the Firm ended the 12 months at a business run-rate of three.5 million silver-equivalent ounces, which was roughly 8% increased than initially anticipated for 2022.

About Guanajuato Silver

GSilver is a valuable metals producer engaged in reactivating previous producing silver and gold mines in central Mexico. The Firm produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complicated, and the San Ignacio mine; all three mines are positioned inside the state of Guanajuato, which has a longtime 480-year mining historical past. Moreover, the Firm produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With 4 working mines and three processing services, Guanajuato Silver is among the quickest rising silver producers in Mexico.

Technical Data

Reynaldo Rivera, VP of Exploration of GSilver, has permitted the scientific and technical data contained on this information launch. Mr. Rivera is a member of the Australasian Institute of Mining and Metallurgy (AusIMM – Registration Quantity 220979) and a “certified individual” as outlined by Nationwide Instrument 43-101, Requirements of Disclosure for Mineral Tasks.

ON BEHALF OF THE BOARD OF DIRECTORS

“James Anderson”

Chairman and CEO

For additional data relating to Guanajuato Silver Firm Ltd., please contact:

JJ Jennex, Gerente de Comunicaciones, T: 604 723 1433

E: [email protected]

Gsilver.com

Neither the TSX Enterprise Trade nor its Regulation Providers Supplier (as that time period is outlined within the insurance policies of the TSX Enterprise Trade) accepts accountability for the adequacy or accuracy of this launch.

Ahead-Trying Statements

This information launch accommodates sure forward-looking statements and knowledge, which relate to future occasions or future efficiency together with, however not restricted to, the persevering with pattern of quarterly will increase in manufacturing and silver equal ounce recoveries in 2023; the development of a brand new dry stack tailings facility at El Cubo, the anticipated enhance and size of extra tailing storage capability ensuing therefrom and the anticipating timing for the development thereof; the flexibility of the Firm to get better gold and silver from the Mastrantos IV historic tailings pond using the newly constructed gravity circuit at El Cubo and timing for the graduation thereof; the flexibility of the Firm to proceed to supply and course of (and broaden) third celebration mineralized materials at Topia; the Firm’s capacity to keep up and enhance working efficiencies at some or all of its mining operations in 2023 and to proceed to scale back its reliance on third celebration mining contractors; the flexibility of the newly restarted Cata mill to course of the entire mineralized materials mined from San Ignacio and VMC within the volumes and grades anticipated; and the Firm’s standing as one of many quickest rising silver producers in Mexico.

Such forward-looking statements and knowledge mirror administration’s present beliefs and expectations and are primarily based on data at the moment out there to and assumptions made by the Firm; which assumptions, whereas thought of affordable by the Firm, are inherently topic to vital operational, enterprise, financial and regulatory uncertainties and contingencies. These assumptions embody: our estimates of mineralized materials at El Cubo, VMC, San Ignacio and Topia and the assumptions upon which they’re primarily based, together with geotechnical and metallurgical traits of rock conforming to sampled outcomes and metallurgical efficiency; out there tonnage of mineralized materials to be mined and processed; useful resource grades and recoveries; assumptions and low cost charges being appropriately utilized to manufacturing estimates; the flexibility of the Firm to ramp up processing of mineralized materials at Cata on the projected charges and supply ample excessive grade mineralized materials to fill such processing capability; costs for silver, gold and different metals remaining as estimated; forex change charges remaining as estimated; availability of funds for the Firm’s tasks and to fulfill present liabilities and obligations together with debt repayments; capital value estimates; decommissioning and reclamation estimates; costs for vitality inputs, labour, supplies, provides and companies (together with transportation) and inflation charges remaining as estimated; no labour-related disruptions; no unplanned delays or interruptions in scheduled building and manufacturing; all essential permits, licenses and regulatory approvals are acquired in a well timed method; and the flexibility to adjust to environmental, well being and security legal guidelines. The foregoing checklist of assumptions will not be exhaustive.

Readers are cautioned that such forward-looking statements and knowledge are neither guarantees nor ensures, and are topic to dangers and uncertainties that will trigger future outcomes, degree of exercise, manufacturing ranges, efficiency or achievements of GSilver to vary materially from these anticipated together with, however not restricted to, market situations, availability of financing, future costs of gold, silver and different metals, forex fee fluctuations, rising inflation and rates of interest, precise outcomes of manufacturing, exploration and growth actions, precise useful resource grades and recoveries of silver, gold and different metals, availability of third celebration mineralized materials for processing, unanticipated geological or structural formations and traits, geopolitical conflicts together with wars, environmental dangers, working dangers, accidents, labor points, gear or personnel delays, delays in acquiring governmental or regulatory approvals and permits, insufficient insurance coverage, and different dangers within the mining trade. There are not any assurances that GSilver will be capable of efficiently uncover and mine ample portions of excessive grade mineralized materials at El Cubo, VMC, San Ignacio and Topia for processing at its current mills to extend manufacturing, tonnage milled and recoveries charges of gold, silver, and different metals within the quantities, grades, recoveries, prices and timetable anticipated. As well as, GSilver’s resolution to course of mineralized materials from El Cubo, VMC, San Ignacio, Topia and its different mines will not be primarily based on a feasibility examine of mineral reserves demonstrating financial and technical viability and due to this fact is topic to elevated uncertainty and danger of failure, each economically and technically. Mineral assets and mineralized materials that aren’t Mineral Reserves shouldn’t have demonstrated financial viability, are thought of too speculative geologically to have the financial issues utilized to them, and could also be materially affected by environmental, allowing, authorized, title, socio-political, advertising, and different related points. There are not any assurances that the Firm’s projected manufacturing of silver, gold and different metals might be realized. As well as, there are not any assurances that the Firm will meet its manufacturing forecasts or generate the anticipated money flows from operations to fulfill its scheduled debt funds or different liabilities when due or meet monetary covenants to which the Firm is topic or to fund its exploration packages and company initiatives as deliberate. There’s additionally uncertainty concerning the continued unfold and severity of COVID-19, the continued warfare in Ukraine and rising inflation and rates of interest and the affect they’ll have on the Firm’s operations, provide chains, capacity to entry mining tasks or procure gear, provides, contractors and different personnel on a well timed foundation or in any respect and financial exercise typically. Accordingly, readers shouldn’t place undue reliance on forward-looking statements or data. All forward-looking statements and knowledge made on this information launch are certified by these cautionary statements and people in our steady disclosure filings out there on SEDAR at www.sedar.com together with the Firm’s annual data type for the 12 months ended December 31, 2021. These forward-looking statements and knowledge are made as of the date hereof and the Firm doesn’t assume any obligation to replace or revise them to mirror new occasions or circumstances save as required by regulation.

SOURCE: Guanajuato Silver Firm Ltd.

View supply model on accesswire.com:

https://www.accesswire.com/736823/Guanajuato-Silver-Produces-Record-836375-AgEq-Ounces-in-Q4