Here are the facts

Intel Zacks.com visitors have been closely following INTC (INTC) as it is one of the most important stocks. You might want to look at some of the factors that may affect the stock’s performance in the near term.

Shares of this world’s largest chipmaker have returned +11.9% over the past month versus the Zacks S&P 500 composite’s no change. Over this time, the Zacks Semiconductor-General industry, which Intel is part of, has lost 2.7%. The key question now is: Where does the stock go in the near future?

Although media reports or rumors of a significant change in a company’s business prospects often make the stock ‘trending’, and cause an immediate price drop, there are still some basic facts that ultimately determine whether to buy or hold.

Earnings Estimate Revisions

Zacks values the impact of future earnings projections on a company’s future earnings more than any other factor. Because we believe the fair market value of its stock is determined by the future value of its earnings stream.

Our analysis is based on how the sell-side analysts who cover the stock are revising earnings estimates to reflect the latest business trends. The fair value of a stock’s stock increases when its earnings estimates go up. Investors are more likely to purchase stock whose fair value exceeds its current market price. This causes the stock’s price to move upward. Empirical studies show a strong correlation between changes in earnings estimate revisions, and short-term stock prices movements.

Intel expects to report earnings of $0.20 per share in the current quarter. This is a change of -81.7% year-over-year. The Zacks Consensus estimate has changed by -7.6% over the past 30 days.

Consensus earnings estimates of $1.95 for current fiscal year indicate a year-over year change of -64.4%. This estimate has been revised by -3.5% in the last 30 days.

The consensus earnings estimate for the next fiscal year of $1.83 represents a decrease of -6.1% compared to what Intel is expected report last year. Over the last month, the estimate has varied by -3.5%.

The Zacks Rank is a proprietary stock rating tool that uses the power of earnings estimates revisions to give a clearer picture of a stock’s future price direction. This stock rating tool has a strong track record. Intel is Zacks #5 (Strong Sell) due to the large change in consensus estimate and three other factors related earnings estimates.

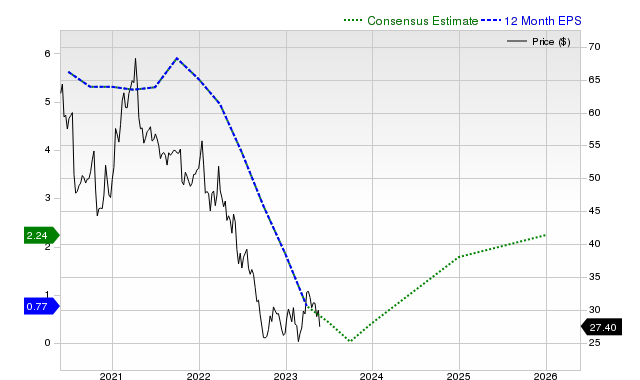

Below is a chart that shows the evolution of the forward 12-month consensus EPS estimation for the company.

12 Months of EPS

Forecast Revenue Growth

Although earnings growth is the best indicator of a company’s financial health, it doesn’t mean much if it can’t increase its revenues. It is almost impossible for a company’s earnings to grow without increasing its revenue over long periods. It is therefore crucial to know the company’s potential revenue growth.

For Intel, the consensus sales estimate for the current quarter of $14.45billion indicates a year over-year decrease of -26%. For the next fiscal year, the estimates of $63.46 and $61.11 trillion indicate changes of -18.7% to -3.7%.

Last Reported Results and Surprising History

Intel reported $15.34 billion revenue in its last quarter. This represents a change of -20.1% year-overyear. The same period saw an EPS of $0.59 compared with $1.71 one year ago.

The reported revenues are a surprise at -0.99% when compared to the Zacks Consensus estimate of $15.49 trillion. The surprise in EPS was +73.53%.

Intel has exceeded consensus EPS estimates 3 times in the past four quarters. This period saw the company surpass consensus revenue estimates by two times.

Valuation

An investment decision cannot be made without taking into account the stock’s valuation. It is crucial to assess whether the stock’s current price accurately reflects the intrinsic value and growth prospects of the company.

It is possible to determine the fairness of a stock’s current value by comparing it with its historical values, including price-to earnings (P/E), cost-to-sales(P/S), and cash flow (P/CF).

The Zacks Style Scores system uses the Zacks Value Style Score to evaluate both traditional and unorthodox valuation metrics. It organizes stocks into five groups, starting with A and ending with F. These scores help identify if a stock’s value is too high, low, or rightly valued.

This indicates that Intel is trading at an advantage over its peers. Intel has been graded B. Click here to view the values of valuation metrics that drove this grade.

Conclusion

These facts and other information from Zacks.com may help you decide if it is worth paying attention to Intel’s market buzz. However, the Zacks Rank #5 indicates that Intel may not outperform the broader market over the next few years.

Want the most recent Zacks Investment Research recommendations? Download 7 Best Stocks in the Next 30 Days Today Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report