Here is Why We Suppose Sims (ASX:SGM) Would possibly Deserve Your Consideration Right now

The joy of investing in an organization that may reverse its fortunes is an enormous draw for some speculators, so even corporations that don’t have any income, no revenue, and a report of falling brief, can handle to seek out traders. However the actuality is that when an organization loses cash every year, for lengthy sufficient, its traders will often take their share of these losses. Loss making corporations can act like a sponge for capital – so traders needs to be cautious that they are not throwing good cash after dangerous.

In distinction to all that, many traders want to deal with corporations like Sims (ASX:SGM), which has not solely revenues, but in addition earnings. Even when this firm is pretty valued by the market, traders would agree that producing constant earnings will proceed to offer Sims with the means so as to add long-term worth to shareholders.

See our latest analysis for Sims

How Quick Is Sims Rising Its Earnings Per Share?

Sims has undergone a large progress in earnings per share during the last three years. A lot in order that this three 12 months progress fee would not be a good evaluation of the corporate’s future. Consequently, we’ll zoom in on progress during the last 12 months, as a substitute. Impressively, Sims’ EPS catapulted from AU$1.14 to AU$3.19, during the last 12 months. Yr on 12 months progress of 179% is actually a sight to behold. The very best case state of affairs? That the enterprise has hit a real inflection level.

Prime-line progress is a good indicator that progress is sustainable, and mixed with a excessive earnings earlier than curiosity and taxation (EBIT) margin, it is a good way for a corporation to take care of a aggressive benefit out there. The music to the ears of Sims shareholders is that EBIT margins have grown from 1.9% to 4.2% within the final 12 months and revenues are on an upwards development as effectively. Ticking these two containers is an effective signal of progress, in our guide.

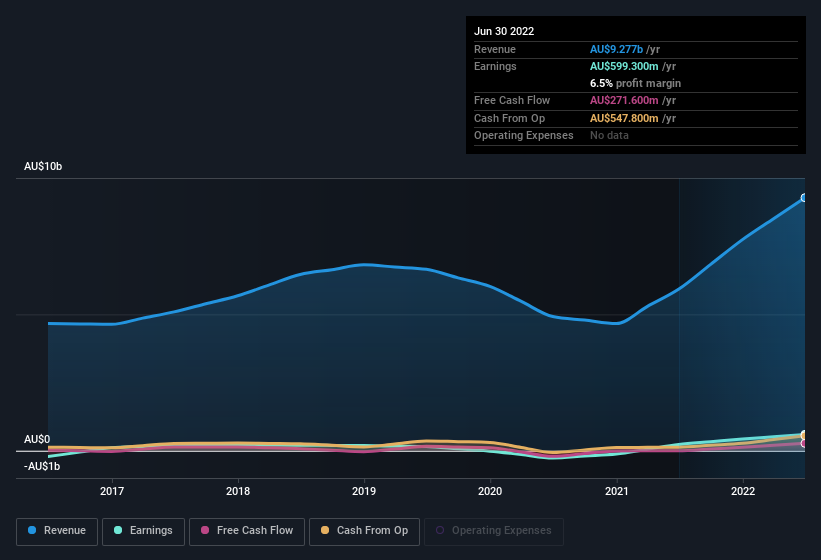

You may check out the corporate’s income and earnings progress development, within the chart under. Click on on the chart to see the precise numbers.

The trick, as an investor, is to seek out corporations which are going to carry out effectively sooner or later, not simply prior to now. Whereas crystal balls do not exist, you’ll be able to test our visualization of consensus analyst forecasts for Sims’ future EPS 100% free.

Are Sims Insiders Aligned With All Shareholders?

It is stated that there is no smoke with out fireplace. For traders, insider shopping for is commonly the smoke that signifies which shares might set the market alight. This view is predicated on the chance that inventory purchases sign bullishness on behalf of the customer. In fact, we will by no means make sure what insiders are pondering, we will solely decide their actions.

We observe that Sims insiders spent AU$106k on inventory, during the last 12 months; in distinction, we did not see any promoting. It is a good search for the corporate because it paints an optimistic image for the longer term.

The excellent news, alongside the insider shopping for, for Sims bulls is that insiders (collectively) have a significant funding within the inventory. With a whopping AU$113m price of shares as a gaggle, insiders have lots driving on the corporate’s success. This may point out that the targets of shareholders and administration are one and the identical.

Is Sims Value Maintaining An Eye On?

Sims’ earnings per share progress have been climbing increased at an considerable fee. Simply as heartening; insiders each personal and are shopping for extra inventory. These elements appear to point the corporate’s potential and that it has reached an inflection level. We would counsel Sims belongs close to the highest of your watchlist. What about dangers? Each firm has them, and we have noticed 2 warning signs for Sims (of which 1 makes us a bit uncomfortable!) it is best to find out about.

There are many different corporations which have insiders shopping for up shares. So in case you just like the sound of Sims, you may in all probability love this free list of growing companies that insiders are buying.

Please observe the insider transactions mentioned on this article seek advice from reportable transactions within the related jurisdiction.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We intention to deliver you long-term targeted evaluation pushed by basic information. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be a part of A Paid Person Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here