Sandstorm Gold investors (TSE:SSL), have suffered a 25% loss over the past three years.

Many investors view stock picking as a way to make more money than the general market. The downside to stock picking is the possibility of buying companies that are underperforming. Unfortunately, this has been the case over the long term. Sandstorm Gold Ltd. (TSE:SSL(Shareholders): The share price has fallen 26% over the past three years, well below the market return of 31%.

It is worthwhile to assess if the company has been moving in the same direction as these poor shareholder returns, or if there are some differences between them. Let’s do this.

View our latest analysis for Sandstorm Gold

Although markets can be a powerful pricing mechanism for companies, share prices reflect investor mood and not just the underlying business performance. To see how sentiment has changed over the years, one way is to look at the interaction of a company’s stock price and its earnings per shares (EPS).

Even though the share price has fallen over the past three years, Sandstorm Gold managed to increase EPS by 56% each year during that period. One might be tempted to believe that EPS does not reflect the performance of the company during this period due to the reaction to share prices. Or, it could be that growth expectations were unrealistic in the past.

It is worth looking at other metrics as the EPS growth does not seem to be in line with the falling share prices.

The stock’s modest dividend yield of 1.1% is unlikely to influence the market view. In reality, revenue is up 17% over three years. The share price drop doesn’t seem to be based on revenue. This is an innocuous analysis, but Sandstorm Gold could be worth a closer look, as stocks sometimes fall unfairly. This could be a great opportunity.

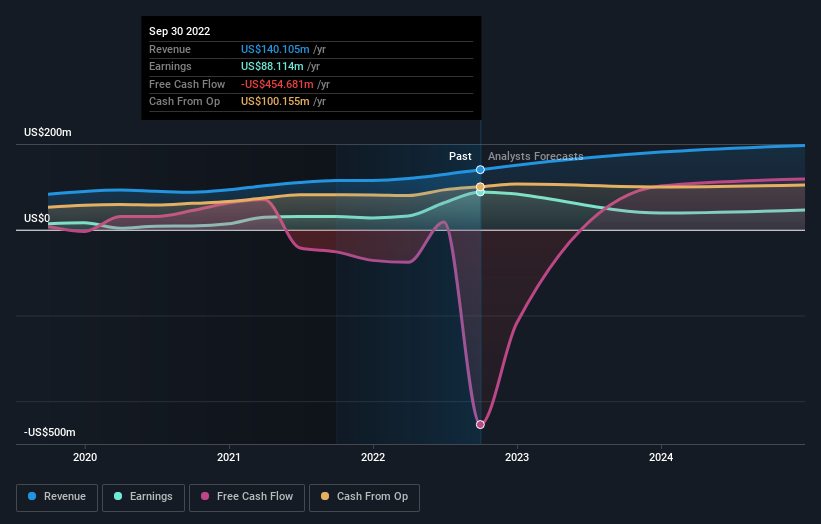

Below is an image that shows how earnings and revenues have changed over time. Click on the image to see more detail.

It is worth noting that we have seen significant insider buying over the past quarter. This we consider to be a positive. However, earnings and revenue growth trends are important to take into account. It makes sense to see what analysts believe Sandstorm Gold will achieve. earn in the future (free profit forecasts).

A Different Perspective

We regret to inform you that Sandstorm Gold shareholders have fallen 8.7% over the past year, even including dividends. It’s worse than 3.4% market decline. But it may be that the share prices have been affected by market jitters. If there is a good opportunity, it may be worth watching the fundamentals. Investors who are long-term would not be as upset since they would have earned 2% each year for five years. This could mean that the recent selloff is a chance. You might want to check the fundamental data for signs suggesting a long-term trend of growth. It is always fascinating to see how share prices perform over the long-term. However, Sandstorm Gold can be better understood if we consider other factors. You should also be aware of these factors. 3 warning signs we’ve spotted with Sandstorm Gold .

Sandstorm Gold isn’t the only stock that insiders are buying. This is a great place to start. Free list of growing companies with insider buying.

Please note: The market returns quoted in the article represent the market weighted returns of stocks that trade on CA exchanges.

Give feedback about this article Have a question about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article is by Simply Wall St. It is general in nature. Our commentary is based on historical data, analyst forecasts and other unbiased information. We do not intend to provide financial advice. It is not a recommendation not to buy or sell any stocks and does not consider your financial goals. Our goal is to provide you with long-term, focused analysis based on fundamental data. Our analysis may not take into account the most recent price-sensitive company announcements and qualitative material. Simply Wall St does not hold any position in the stocks mentioned.

Register for a paid user research session

You’ll receive a Amazon Gift card – US$30 Spend an hour helping us to create better tools for individual investors. Sign up here