Investors Are Faced With Slowing Returns On Capital At Lands’ End (NASDAQ.LE)

What are the key trends to look for in a stock? A business should show two trends. Return on capital employed (ROCE); and secondly an increasing The amount The amount of capital used. This is basically a sign that a company has profitable initiatives it can continue reinvesting in. It is a characteristic that makes a compounding device. However, after investigating Lands’ End (NASDAQ:LE), we don’t think it’s current trends fit the mold of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

If you are unsure, ROCE (Return on Capital Invested in a Company) is a method to determine how much pretax income (in percentage terms), a company earns from capital it has invested in its business. This formula is used to calculate Lands’ End.

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

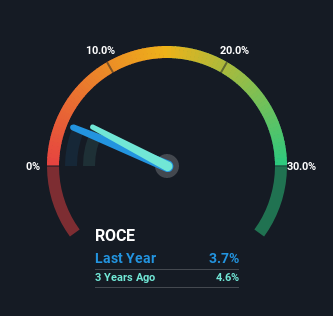

0.037 = US$32m ÷ (US$1.2b – US$360m) Based on the trailing twelve month period up to October 2022.

Thus, Lands’ End has a ROCE of 3.7%. It’s not a good return on investment and is lower than the 12% industry average.

See our latest analysis for Lands’ End

Below you can see Lands’ End’s current ROCE compared to its previous returns on capital. However, you can only tell so much from the past. You can see the predictions of our analysts if you are interested. No cost report on analyst forecasts for the company.

What the Trend of ROCE Can Teach Us

Since Lands End’s capital utilization and returns have been constant for the past five year, there has not been much to report. This is a common occurrence when you look at a stable and mature business that has stopped reinvesting its earnings. It likely has passed this phase of the business cycle. With this in mind, we don’t believe Lands’ End will become a multibagger unless there is an improvement in investment.

The Key Takeaway

Lands’ End has continued to earn the same returns with the same capital for the past five years. The stock has lost 57% over the past five years so it doesn’t seem like the market is optimistic about these trends improving anytime soon. The inherent trends aren’t typical for multi-baggers so if you want to be multi-baggers we believe you may have more success elsewhere.

We also spotted another thing 2 warning signs facing Lands’ End These are some of the things you might be interested in.

For those who are interested in investing solid companies, This is a great article. No cost list of companies with solid balance sheets and high returns on equity.

Let us know what you think about this article. Have a question about the content? Get in touch Contact us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St has a general nature. Our commentary is based on historical data, analyst forecasts and other unbiased information. We do not intend to provide financial advice. This analysis does not represent a recommendation to purchase or sell any stock and it does not consider your financial goals or financial situation. Our aim is to give you long-term, detailed analysis that is based on fundamental data. Our analysis may not take into account the most recent price-sensitive company announcements and qualitative material. Simply Wall St does not hold any position in the stocks mentioned.

Register for a paid user research session

You’ll receive a Amazon Gift Card – US$30 Give us 1 hour of your time and help us create better investing tools for individual investors like you. Sign up here