Is Selective Insurance coverage Group, Inc.’s (NASDAQ:SIGI) Current Inventory Efficiency Influenced By Its Fundamentals In Any Manner?

Selective Insurance coverage Group’s (NASDAQ:SIGI) inventory is up by a substantial 9.8% over the previous month. Provided that inventory costs are normally aligned with an organization’s monetary efficiency within the long-term, we determined to review its monetary indicators extra intently to see if that they had a hand to play within the latest value transfer. Notably, we will likely be listening to Selective Insurance Group’s ROE immediately.

Return on fairness or ROE is a key measure used to evaluate how effectively an organization’s administration is using the corporate’s capital. Put one other method, it reveals the corporate’s success at turning shareholder investments into income.

View our latest analysis for Selective Insurance Group

How To Calculate Return On Fairness?

The components for return on fairness is:

Return on Fairness = Web Revenue (from persevering with operations) ÷ Shareholders’ Fairness

So, based mostly on the above components, the ROE for Selective Insurance coverage Group is:

8.9% = US$225m ÷ US$2.5b (Based mostly on the trailing twelve months to December 2022).

The ‘return’ is the quantity earned after tax during the last twelve months. One option to conceptualize that is that for every $1 of shareholders’ capital it has, the corporate made $0.09 in revenue.

What Has ROE Bought To Do With Earnings Progress?

So far, we now have realized that ROE measures how effectively an organization is producing its income. We now want to judge how a lot revenue the corporate reinvests or “retains” for future development which then provides us an concept concerning the development potential of the corporate. Assuming the whole lot else stays unchanged, the upper the ROE and revenue retention, the upper the expansion price of an organization in comparison with firms that do not essentially bear these traits.

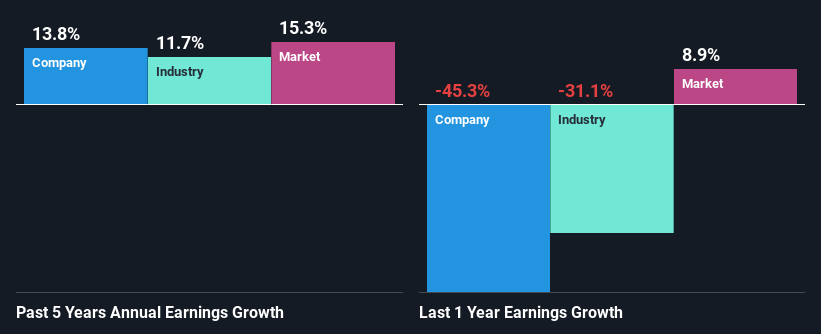

A Facet By Facet comparability of Selective Insurance coverage Group’s Earnings Progress And eight.9% ROE

While you first have a look at it, Selective Insurance coverage Group’s ROE would not look that engaging. But, a more in-depth research reveals that the corporate’s ROE is just like the business common of 11%. Even so, Selective Insurance coverage Group has proven a reasonably respectable development in its internet earnings which grew at a price of 14%. Contemplating the reasonably low ROE, it’s fairly potential that there may be another facets which are positively influencing the corporate’s earnings development. Resembling – excessive earnings retention or an environment friendly administration in place.

We then carried out a comparability between Selective Insurance coverage Group’s internet earnings development with the business, which revealed that the corporate’s development is just like the common business development of 12% in the identical interval.

Earnings development is a vital metric to think about when valuing a inventory. What buyers want to find out subsequent is that if the anticipated earnings development, or the dearth of it, is already constructed into the share value. This then helps them decide if the inventory is positioned for a vibrant or bleak future. Has the market priced sooner or later outlook for SIGI? Yow will discover out in our latest intrinsic value infographic research report.

Is Selective Insurance coverage Group Utilizing Its Retained Earnings Successfully?

Selective Insurance coverage Group’s three-year median payout ratio to shareholders is 23% (implying that it retains 77% of its earnings), which is on the decrease aspect, so it looks like the administration is reinvesting income closely to develop its enterprise.

Moreover, Selective Insurance coverage Group has paid dividends over a interval of no less than ten years which signifies that the corporate is fairly severe about sharing its income with shareholders. Present analyst estimates recommend that the corporate’s future payout ratio is anticipated to drop to 18% over the following three years. Because of this, the anticipated drop in Selective Insurance coverage Group’s payout ratio explains the anticipated rise within the firm’s future ROE to 16%, over the identical interval.

Abstract

Total, we really feel that Selective Insurance coverage Group actually does have some constructive components to think about. Regardless of its low price of return, the truth that the corporate reinvests a really excessive portion of its income into its enterprise, little question contributed to its excessive earnings development. With that stated, the most recent business analyst forecasts reveal that the corporate’s earnings are anticipated to speed up. To know extra concerning the newest analysts predictions for the corporate, try this visualization of analyst forecasts for the company.

Have suggestions on this text? Involved concerning the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to deliver you long-term targeted evaluation pushed by basic knowledge. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be part of A Paid Consumer Analysis Session

You’ll obtain a US$30 Amazon Reward card for 1 hour of your time whereas serving to us construct higher investing instruments for the person buyers like your self. Sign up here