Is this Oilfield Services Company priced right?

Schlumberger SLB The largest oilfield services company worldwide, with operations in 120 countries and all major geographies.

SLB operates as an energy technology company through four distinct divisions: Well construction; Digital; Reservoir Performance; and Production Systems. Schlumberger covers many aspects of energy extraction, including data management and software, well stimulation, reservoir management and well stimulation.

The recent strength in oil prices along with Schlumberger’s broad technical expertise has encouraged a recent boon to the business.

SLB is also committed to ESG policy, and moving their business towards zero emissions. SLB is the first company in the energy services industry to set a scope 3 emission ambition. This is the highest level of reduction required by the EPA. SLB’s diverse offerings and this will likely give them a lot of runway for future growth.

There may be some short-term risks. To reduce their financial risk, many upstream companies in the energy sector have reduced capital expenditure and prioritized returning capital for shareholders. A lack of heavy investment may weigh on Schlumberger’s earnings going forward.

Schlumberger reports earnings Friday, January 20, before the market opens

Earnings Expectations

Strong earnings and sales growth are expected from Schlumberger. Sales for Q4 are expected increase 26% to $7.7 Billion, and FY 2022 sales will rise 22% to $28 Billion.

Earnings growth in Q4 is expected at 68% to $0.69/share, and FY 2022 earnings are projected to increase 68% or $2.15/share.

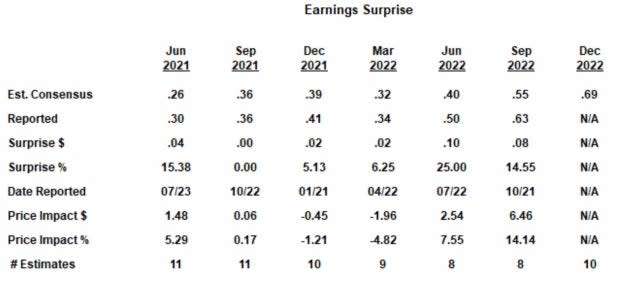

SLB has a strong track record regarding earnings. SLB reports almost always in line with expectations, beatings, and there has been only one missing instance since 2012. It was $-0.01.

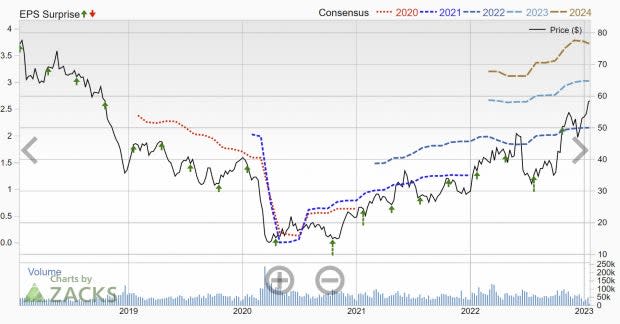

A more recent development is earnings volatility. The chart below shows that SLB has made big moves since the Q2 report. After the Q2 report, the stock rose 7.5%, while it was up 14.5% following Q3. These moves were also supported by some significant beats.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Valuation

Schlumberger shares have increased 74% in the past six months, and 140% in the last two years. This is more than the sector’s performance during these periods. SLB has enjoyed a very positive post-Covid economy.

Schlumberger stock has performed so well that it appears like the stock is now fully priced. The upside could be limited.

Current valuations are comparable to its historical averages. It is significantly higher than its sector median of 10 years. The current forward P/E for one year is also just below the 10-year median. SLB currently has a Zacks rank #3 (Hold), indicating that there is no positive trend in earnings growth.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conclusion

Schlumberger is an excellent business, with great long-term prospects. The company has seen exceptional returns in the last two years. Schlumberger has been able to share some of its earnings through higher dividends due to this success. FCF will now be divided by Schlumberger to be distributed as dividends, with a yield of 1.2%.

Schlumberger and the Energy sector should find this earnings report very interesting.

Want the most recent Zacks Investment Research recommendations? Download 7 Best Stocks in the Next 30 Days Today Click to get this free report