Orange County Bancorp, Inc. Declares File Quarterly and Annual Earnings:

-

Web revenue for This autumn 2022 reached a quarterly document $9.1 million, a $3.6 million, or 65.0% enhance, over internet revenue of $5.5 million in This autumn 2021, due primarily to elevated curiosity revenue

-

Web revenue for fiscal 12 months 2022 reached a document $24.4 million, a $3.1 million, or 14.4% enhance, over internet revenue of $21.3 million in fiscal 12 months 2021, additionally due primarily to elevated curiosity revenue

-

Complete property elevated $144.8 million, or 6.8%, to $2.3 billion at December 31, 2022 from $2.1 billion at December 31, 2021

-

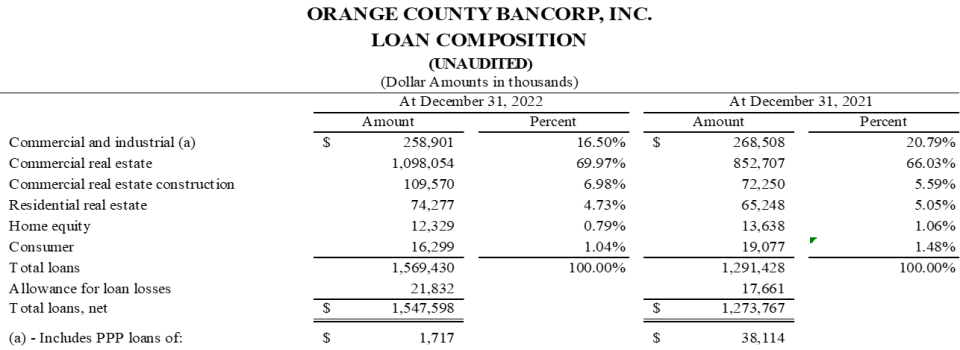

Complete loans grew $278.0 million, or 21.5%, to $1.6 billion at December 31, 2022 from $1.3 billion at December 31, 2021

-

Complete deposits have been $2.0 billion at December 31, 2022, as in comparison with $1.9 billion at December 31, 2021, a rise of $60.0 million, or 3.1%

-

Web curiosity margin for This autumn 2022 rose 102 foundation factors, or 32.9%, to 4.12% from 3.10% for This autumn 2021

-

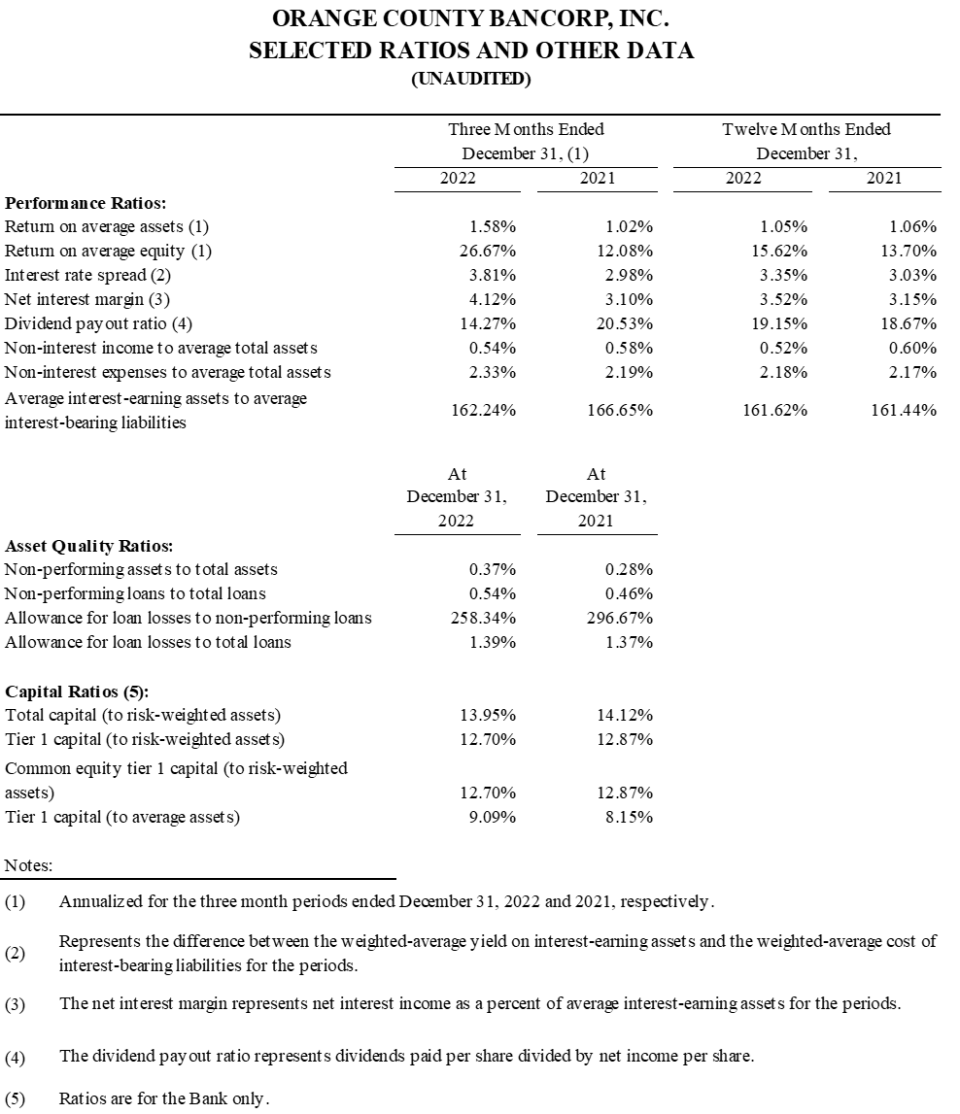

Annualized return on common property of 1.58% for the three months ended December 31, 2022 elevated 56 foundation factors, or 54.9%, versus the identical interval in 2021

-

Annualized return on common fairness of 19.41% for the three months ended December 31, 2022 elevated 733 foundation factors, or 60.7%, versus the identical interval in 2021

MIDDLETOWN, NY / ACCESSWIRE / January 25, 2023 / Orange County Bancorp, Inc. (the “Firm” – Nasdaq:OBT), mother or father firm of Orange Financial institution & Belief Firm, (the “Financial institution”) and Hudson Valley Funding Advisors, Inc. (“HVIA”), as we speak introduced internet revenue of $9.1 million, or $1.61 per fundamental and diluted share, for the three months ended December 31, 2022. This compares with internet revenue of $5.5 million, or $0.97 per fundamental and diluted share, for the three months ended December 31, 2021. The rise in internet revenue was primarily pushed by a $6.6 million enhance in internet curiosity revenue throughout the quarter ensuing from additional will increase in rates of interest and powerful mortgage progress.

Guide worth per share declined $7.95, or 24.5%, from $32.43 at December 31, 2021 to $24.48 at December 31, 2022. Tangible guide worth per share decreased $7.89, or 25.3%, from $31.18 to $23.29 at December 31, 2021 and 2022, respectively (see “Non-GAAP Monetary Measure Reconciliation” beneath for added element). These decreases mirror the influence of modifications in market worth within the available-for-sale funding portfolio, which proceed to be affected by rising rates of interest. The Financial institution maintains its complete funding portfolio inside the available-for-sale class.

“I’m happy to announce Orange Financial institution ended the 12 months with the strongest quarter in our historical past,” commented Firm President and CEO Michael Gilfeather. “We earned $9.1 million, or $1.61 per share, for the quarter, in comparison with $5.5 million, or $.97 per share, throughout the identical interval final 12 months, a 65% enhance. These earnings have been the results of rising rates of interest impacting our complete business, in addition to robust natural mortgage and deposit progress all year long. Our mortgage portfolio completed the 12 months at $1.6 billion, up 21% over 12 months finish 2021, whereas complete deposits rose 3.1% to shut out the 12 months at $2 billion.

Although smitten by mortgage progress traits we see from high quality debtors, we acknowledge native economies aren’t proof against the widespread influence of present rate of interest coverage on the Federal Reserve. It is also value noting that the Fed’s efforts to gradual financial progress additionally contain the discount of liquidity within the monetary system, negatively impacting the business’s deposit base. Whereas deposits on the Financial institution rose on a year-over-year foundation, there was some contraction within the fourth quarter deposit base. This was attributable largely to seasonal withdrawals related to municipalities which we anticipate might be changed early in 2023. Although the Fed’s efforts to additional cut back liquidity will stay a problem for the whole business, the Financial institution stays centered on its deposit gathering and assembly our targets to develop market share and help our funding plans. Based mostly on our strategic mortgage targets, the Financial institution is properly positioned to proceed originating prime quality loans additional into the 12 months and collect a bigger share of our enterprise purchasers’ funds on deposit. Whereas larger rates of interest might gradual the financial system and influence mortgage and deposit progress, they’ve additionally supplied a chance for the financial institution to extend its margins throughout 2022 and create a powerful basis for the approaching 12 months. The Financial institution’s internet curiosity margins for This autumn 2022 grew 102 foundation factors, or 32.9%, to 4.12% versus 3.10% the prior 12 months.

Wealth administration revenues for the quarter, together with our Belief and Advisory companies, have been $2.35 million, down barely from $2.51 million the identical quarter final 12 months. Belongings below administration (“AUM”) are the principal driver of price revenue for this division and topic to fluctuations in market valuation. With main bond market indices down greater than 10% and the S&P 500 fairness index down almost 20% in 2022, the fluctuation realized – from $1.3 billion at 12 months finish 2021 to $1.2 billion at 12 months finish 2022 – displays influence of those market changes and the succesful oversight of our Wealth Administration crew.

This quarter represents additional validation of our strategic positioning because the area’s premier enterprise financial institution. I could not be extra happy by our crew’s efficiency navigating the previous 12 months’s challenges, significantly the Federal Reserve’s aggressive efforts to manage inflation by rate of interest coverage and liquidity tightening measures. Whereas these actions are having their meant impact, regional financial exercise stays comparatively robust and Orange is properly positioned to handle present headwinds. We’re a high-performing enterprise financial institution in a big market with important upside alternative centered on execution of our strategic initiatives. I need to as soon as once more thank our devoted workers for his or her dedication to our purchasers. The document outcomes we skilled this quarter, and this 12 months, mirror the mixed efforts of our complete crew at Orange Financial institution.”

Fourth Quarter and Full 12 months 2022 Monetary Evaluation

Web Earnings

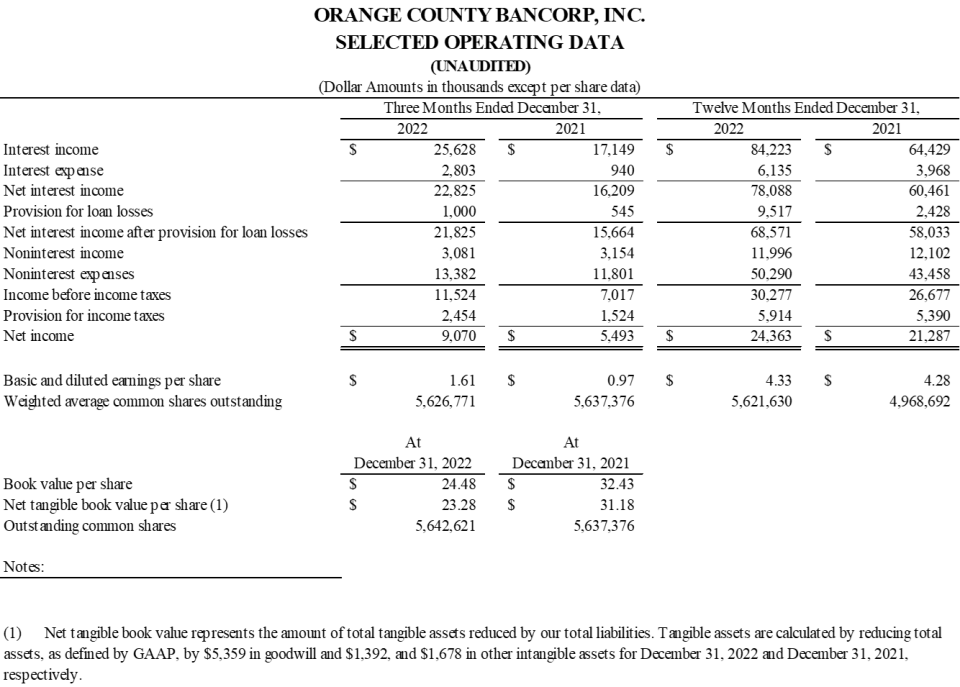

Web revenue for the fourth quarter of 2022 was a document $9.1 million, a rise of roughly $3.6 million, or 65.0%, versus internet revenue of $5.5 million for the fourth quarter of 2021. Web revenue for the twelve months ended December 31, 2022 was a document $24.4 million, as in comparison with $21.3 million for a similar interval in 2021. The rise in each intervals was pushed primarily by elevated internet curiosity revenue pushed by rate of interest will increase and powerful mortgage progress, which outpaced deposit progress throughout the 12 months.

Web Curiosity Earnings

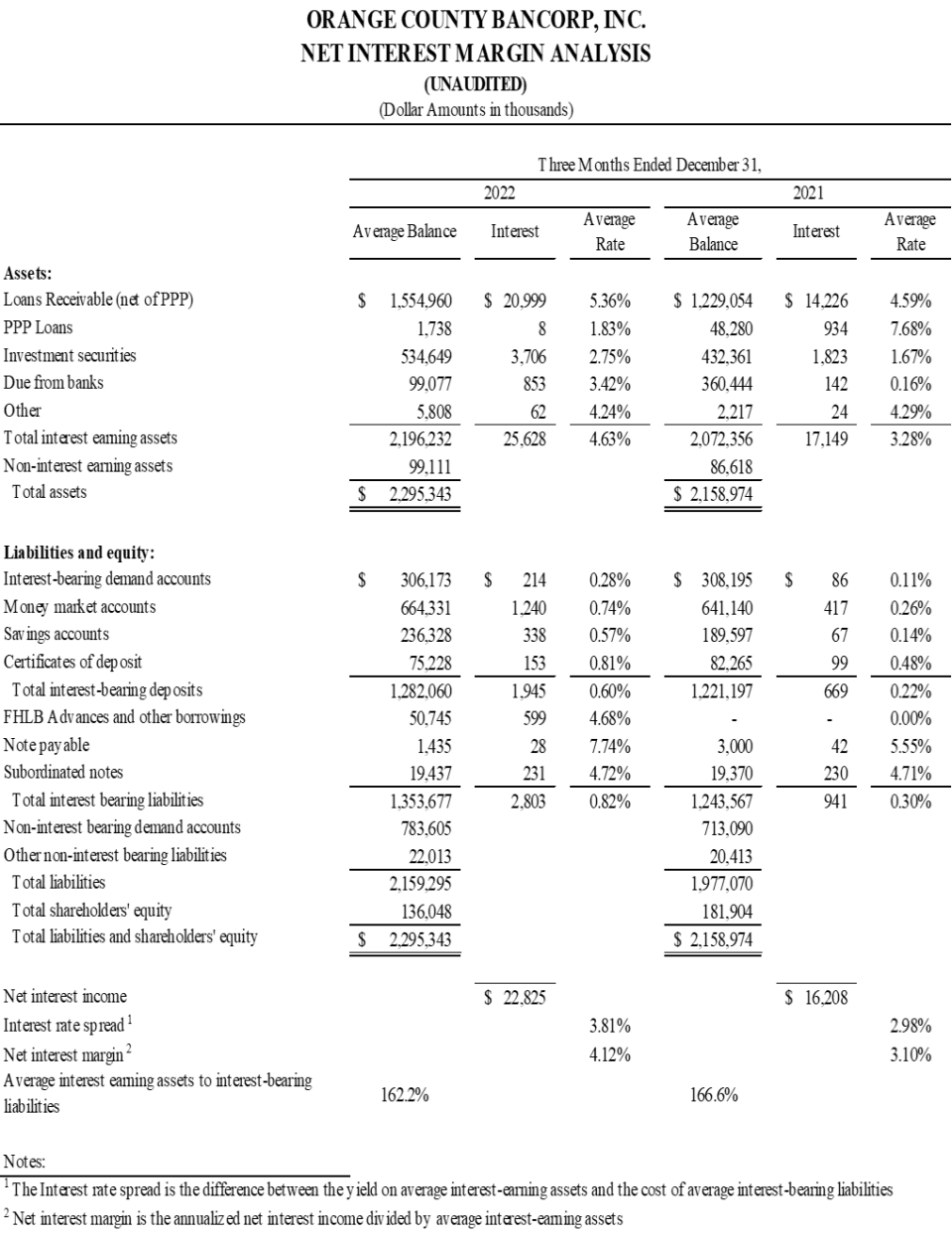

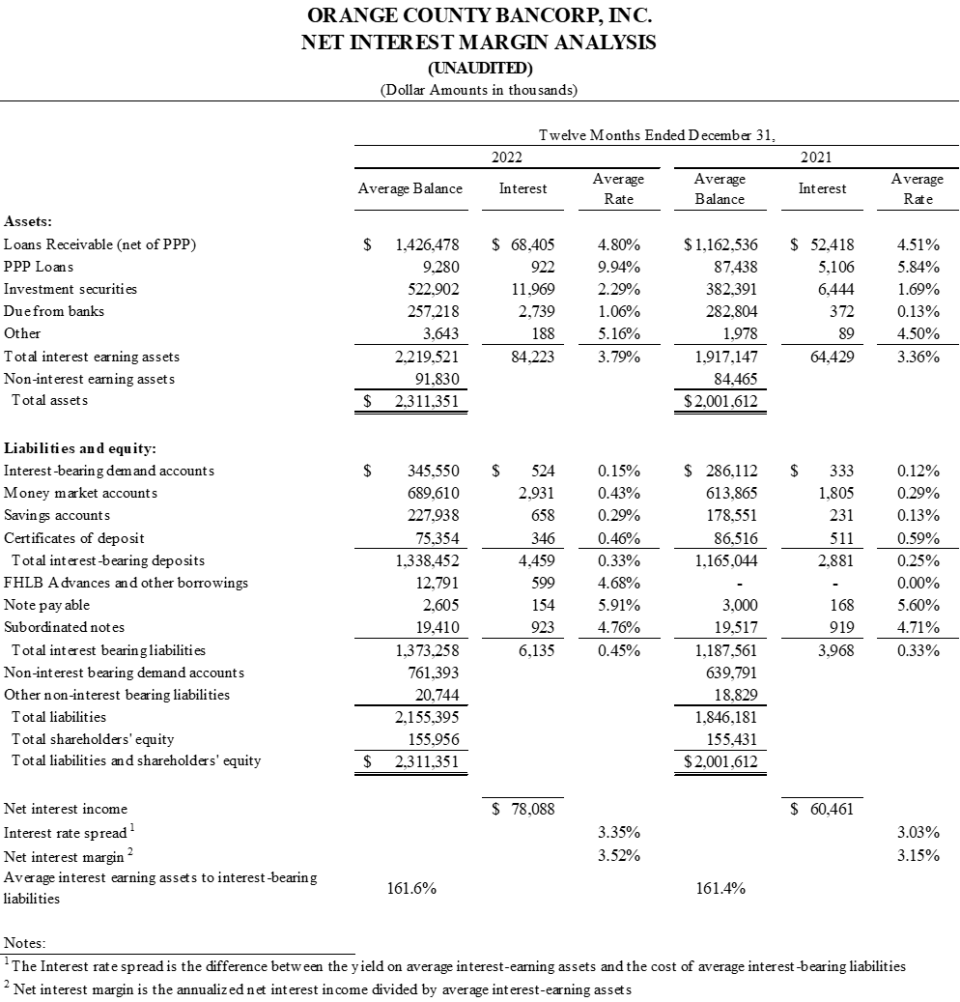

For the three months ended December 31, 2022, internet curiosity revenue elevated $6.6 million, or 40.8%, to $22.8 million, versus $16.2 million throughout the identical interval in 2021. For the twelve months ended December 31, 2022, internet curiosity revenue elevated $17.6 million, or 29.2%, over the twelve months ended December 31, 2021. These will increase embody the rising price of deposits ensuing from the rising rate of interest surroundings.

Complete curiosity revenue rose $8.5 million, or 49.4%, to $25.6 million for the three months ended December 31, 2022, in comparison with $17.2 million for the three months ended December 31, 2021. The expansion in curiosity revenue continues to be related to elevated curiosity and charges pushed by mortgage progress, in addition to an roughly 104.0% enhance in curiosity revenue related to larger ranges of funding securities. The securities-related enhance displays the deployment of extra liquidity in 2022 to seize incremental curiosity revenue within the rising charge surroundings. For the 12 months ended December 31, 2022, complete curiosity revenue rose $19.8 million, or 30.7%, to $84.2 million, as in comparison with $64.4 million for the 12 months ended December 31, 2021.

Complete curiosity expense elevated $1.9 million within the fourth quarter of 2022, to $2.8 million, as in comparison with $940 thousand within the fourth quarter of 2021. The rise displays the continuing influence of rising rates of interest on deposit merchandise throughout the quarter in addition to prices related to FHLB borrowings throughout the quarter. The management of curiosity expense has been a spotlight space for administration in 2022, as we anticipate additional will increase in short-term charges based mostly on Federal Reserve steering. In the course of the twelve months ended December 31, 2022, complete curiosity expense rose $2.2 million, or 54.6%, to $6.1 million, as in comparison with $3.9 million for the twelve months ended December 31, 2021.

Provision for Mortgage Losses

The Firm acknowledged a provision for mortgage losses of $1.0 million for the three months ended December 31, 2022, in comparison with $545 thousand for the three months ended December 31, 2021. The elevated provision primarily displays reserve will increase required by continued progress of the mortgage portfolio. The allowance for mortgage losses to complete loans was 1.39% as of December 31, 2022, a rise of two foundation factors, or 1.5%, versus 1.37% as of December 31, 2021. For the 12 months ended December 31, 2022, the supply for mortgage losses totaled $9.5 million, as in comparison with $2.4 million for the 12 months ended December 31, 2021 as a result of continued progress of the mortgage portfolio in addition to extra reserves related to charge-offs of sure syndicated loans throughout 2022. Syndicated loans represented lower than 3.5% of complete loans at December 31, 2022.

Non-Curiosity Earnings

Non-interest revenue remained comparatively secure at $3.1 million for the fourth quarter of 2022 as in comparison with $3.2 million for the fourth quarter of 2021. With assets-under-management of roughly $1.2 billion at December 31, 2022, non-interest revenue continues to be supported by the success of the Financial institution’s belief operations and HVIA asset administration actions. For the twelve months ended December 31, 2022, non-interest revenue remained stage with the twelve months ended December 31, 2021, producing roughly $12.0 million and $12.1 million, respectively.

Non-Curiosity Expense

Non-interest expense was $13.4 million for the fourth quarter of 2022, reflecting a rise of roughly $1.6 million, or 13.6%, as in comparison with $11.8 million for a similar interval in 2021. The rise in non-interest expense for the present three-month interval was attributable to continued funding in Firm progress, together with will increase in compensation and profit prices, occupancy prices, data know-how, and deposit insurance coverage. Our effectivity ratio was 51.7% for the three months ended December 31, 2022, down from 61.0% for a similar interval in 2021. For the 12 months ended December 31, 2022, our effectivity ratio was 55.8% as in comparison with 59.9% for 2021.

Earnings Tax Expense

Our provision for revenue taxes for the three months ended December 31, 2022 was $2.5 million, in comparison with $1.5 million for a similar interval in 2021. The rise for the present interval was as a result of enhance in revenue earlier than revenue taxes throughout the quarter. Our efficient tax charge for the three-month interval ended December 31, 2022 was 21.3%, as in comparison with 21.7% for a similar interval in 2021. For the twelve months ended December 31, 2022, our provision for revenue taxes was $5.9 million, as in comparison with $5.4 million for the twelve months ended December 31, 2021. Our efficient tax charge for the twelve month interval ended December 31, 2022 was 19.5%, as in comparison with 20.2% for a similar interval in 2021. The discount in efficient tax charges for the 2022 three and twelve month intervals, respectively, is due primarily to the rise in proportion of non-taxable income (tax-exempt curiosity revenue and earnings on bank-owned life insurance coverage) in contrast with complete pre-tax revenue.

Monetary Situation

Complete consolidated property elevated $144.8 million, or 6.8%, from $2.1 billion at December 31, 2021 to $2.3 billion at December 31, 2022. The rise throughout the 12 months was pushed primarily by progress in loans, deposits, and funding securities.

Complete money and due from banks decreased from $306.2 million at December 31, 2021, to $86.1 million at December 31, 2022, a lower of roughly $220.1 million, or 71.9%. The decline is because of elevated mortgage progress, in addition to administration’s deployment of extra money into investments throughout the 12 months.

Complete funding securities rose $76.0 million, or 16.3%, from $467.0 million at December 31, 2021 to $543.0 million at December 31, 2022. The rise represents the impact of purchases of funding securities, offset by a rise in unrealized losses on funding securities since December 31, 2021, in addition to paydowns and maturities throughout the interval.

Complete loans elevated $278.0 million, or 21.5%, from $1.3 billion at December 31, 2021 to roughly $1.6 billion at December 31, 2022. The rise was pushed by $245.3 million of economic actual property mortgage progress and $37.3 million of economic actual property building mortgage progress. PPP loans declined $36.4 million, to $1.7 million at December 31, 2022, from $38.1 million at December 31, 2021. A lot of the remaining PPP mortgage stability is topic to SBA mortgage forgiveness.

Complete deposits grew $60.0 million, to $2.0 billion at December 31, 2022, from $1.9 billion at December 31, 2021. This enhance was pushed by success throughout 2022 in enterprise account growth, legal professional belief deposit progress and elevated deposit ranges for native municipal accounts. At December 31, 2022, 51.1% of complete deposits have been demand deposit accounts (together with NOW accounts). FHLB advances supplemented buyer deposits to fund a portion of the mortgage progress and totaled $131.5 million at December 31, 2022. There have been no borrowings excellent at December 31, 2021.

Stockholders’ fairness skilled a lower of roughly $44.7 million, to $138.1 million at December 31, 2022, from $182.8 million at December 31, 2021. The lower was primarily attributable to $68.2 million of unrealized losses available on the market worth of funding securities acknowledged inside the Firm’s fairness as amassed different complete revenue (loss) (“AOCI”), internet of taxes, because of the rise in market rates of interest. Offsetting the AOCI fluctuation, the Financial institution acknowledged an roughly $19.7 million enhance in retained earnings throughout the twelve months ended December 31, 2022, internet of dividends paid.

At December 31, 2022, the Financial institution maintained capital ratios in extra of regulatory requirements for properly capitalized establishments. The Financial institution’s Tier 1 capital to common property ratio was 9.09%, each frequent fairness and Tier 1 capital to threat weighted property have been 12.70%, and complete capital to threat weighted property was 13.95% at December 31, 2022.

Asset High quality

At December 31, 2022, the Financial institution had complete non-performing loans of $8.5 million, or 0.54% of complete loans, which included $3.3 million of Troubled Debt Restructured Loans (“TDRs”). Complete TDRs at December 31, 2022, was $3.3 million, or 0.21% of complete loans, and skilled a lower of roughly $300 thousand in contrast with $3.6 million at December 31, 2021. Accruing loans delinquent better than 90 days skilled a rise throughout 2022 and totaled $2.3 million as of December 31, 2022, as in comparison with $1.4 million at December 31, 2021.

About Orange County Bancorp, Inc.

Orange County Bancorp, Inc. is the mother or father firm of Orange Financial institution & Belief Firm and Hudson Valley Funding Advisors, Inc. Orange Financial institution & Belief Firm is an impartial financial institution that started with the imaginative and prescient of 14 founders over 125 years in the past. It has grown by innovation and an unwavering dedication to its group and enterprise clientele to roughly $2.3 billion in complete property at December 31, 2022. Hudson Valley Funding Advisors, Inc. is a Registered Funding Advisor in Goshen, NY. It was based in 1996 and bought by the Firm in 2012.

Ahead Trying Statements

Sure statements contained herein are “ahead trying statements” inside the that means of Part 27A of the Securities Act of 1933 and Part 21E of the Securities Alternate Act of 1934. Such ahead trying statements could also be recognized by reference to a future interval or intervals, or by means of ahead trying terminology, corresponding to “might,” “will,” “consider,” “anticipate,” “estimate,” “anticipate,” “proceed,” or related phrases or variations on these phrases, or the damaging of these phrases. Ahead trying statements are topic to quite a few dangers and uncertainties, together with, however not restricted to, these associated to the true property and financial surroundings, significantly available in the market areas wherein the Firm operates, aggressive merchandise and pricing, fiscal and financial insurance policies of the U.S. Authorities, inflation, modifications in authorities rules affecting monetary establishments, together with regulatory charges and capital necessities, modifications in prevailing rates of interest, credit score threat administration, asset-liability administration, the monetary and securities markets and the supply of and prices related to sources of liquidity. Additional, given its ongoing and dynamic nature, it’s troublesome to foretell what the persevering with results of the COVID-19 pandemic may have on our enterprise and outcomes of operations. The pandemic and associated native and nationwide financial disruption might, amongst different results, proceed to end in a fabric adversarial change for the demand for our services; elevated ranges of mortgage delinquencies, drawback property and foreclosures; department disruptions, unavailability of personnel and elevated cybersecurity dangers as workers work remotely.

The Firm needs to warning readers to not place undue reliance on any such ahead trying statements, which communicate solely as of the date made. The Firm needs to advise readers that the components listed above might have an effect on the Firm’s monetary efficiency and will trigger the Firm’s precise outcomes for future intervals to vary materially from any opinions or statements expressed with respect to future intervals in any present statements. The Firm doesn’t undertake and particularly declines any obligation to publicly launch the outcomes of any revisions that could be made to any forward-looking statements to mirror occasions or circumstances after the date of such statements or to mirror the prevalence of anticipated or unanticipated occasions.

For additional data:

Robert L. Peacock

SEVP Chief Monetary Officer

[email protected]

Cellphone: (845) 341-5005

SOURCE: Orange County Bancorp, Inc.

View supply model on accesswire.com:

https://www.accesswire.com/736757/Orange-County-Bancorp-Inc-Announces-Record-Quarterly-and-Annual-Earnings