Service Corporation (SCI), Gains on Expansion, Hurts by Cost Woes

Service Corporation InternationalThe focus on expansion makes ) look well-placed. Management stated that the number and quality of funeral services performed was trending ahead of expectations during its third quarter earnings conference. The production of cemetery preneeds remains strong, too.

The concern is that the Cemetery segment has seen lower revenues. The company also faces increased cost concerns. Let’s delve deeper.

Principal Concerns

For the last few quarters, revenues from cemetery segments have been decreasing year over year. The third quarter 2022 saw consolidated Cemetery revenues fall to $423.8million, from $442.1million in the previous quarter. The decline in comparable cemetery revenues was mainly attributable to lower softcore and other revenue. Due to lower atneed revenues, core revenues dropped $17.5 million. Due to the continued strength of sales average, comparable preneed cemetery sales production rose by 5%. This was partially offset by a decrease in contract velocity.

Service Corporation is facing inflationary pressure. From $338 million in the previous quarter, the gross profit for the third quarter 2022 was nearly $231 million. The total corporate administrative and general costs were $41.9million, compared with $41.5 millions in the previous year. The slight increase was mainly due to higher workers’ compensations and general liability, somewhat compensated by lower incentive compensation costs.

Operating income was $203.4 million less than the $304.3 million reported for the quarter prior to this review. These factors also had an impact on the bottom line. It declined year-over-year in the quarter under review. These trends are likely to continue. Management also expects to continue to feel pressure from the rising interest rates on its floating-rate debt. This will be evident in the fourth quarter.

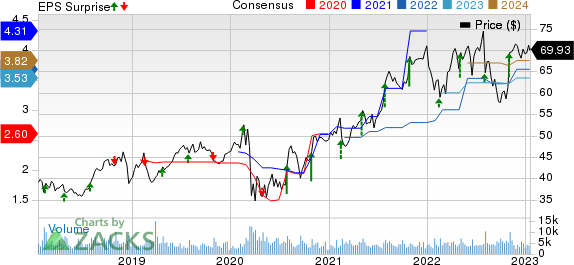

Service Corporation International Price, Consensus, and EPS Surprise

Service Corporation International price-consensus-eps-surprise-chart | Service Corporation International Quote

The Positives

Service Corporation will continue to pursue strategic buyouts of its segments as well as building new funeral homes to earn greater returns. The company spent $252.8 million on capital during the nine months ending Sep 30, 2022. This included capital improvements at existing fields, corporate system development and cemetery development.

Management expects to invest between $280 and $300 million in capital improvements at existing field locations, corporate system development, cemetery development and other expenses in the band of $280 to $3300 million by 2022.

Service Corporation completed a small $2-million acquisition in the mid Atlantic region during the second quarter of 2022. Nearly $40 million was spent on several West Coast cemetery and funeral home locations that it bought after the third quarter. Management stated on its third quarter earnings call that they remain optimistic about their acquisition pipeline. Alderwoods Group (now Keystone North America), Stewart Enterprises, and The Neptune Society are just a few of the notable past acquisitions. The company’s cemetery buyouts are intended to take advantage of the increased opportunities for catering to Baby Boomers.

A Look at Q3 & Ahead

The company posted its third quarter 2022 results. Its top and bottom lines beat Zacks Consensus estimates. Service Corporation reported adjusted earnings of 68c per share, exceeding the Zacks Consensus estimate of 51c. Total revenues of $977.7million were more than the Zacks Consensus estimate of $880 millions. Revenues declined year over the year due to a hard comparison with the year before, which was impacted in part by increased deaths from pandemics. The company saw a better than expected growth rate than the third quarter of 2019, which was pre-pandemic.

Management has raised its 2022 guidance. This is encouraging. Service Corporation now anticipates adjusted earnings (EPS), in the range $3.60 – $3.80, an increase from the previous guidance of $3.30 – $3.70. We note that the company’s earnings came in at $4.57 per share in 2021.

All said we believe that the abovementioned upsides are likely to keep Service Corporation’s growth story going. Shares of the Zacks Rank #3 (Hold) company have risen 7.7% in the past year compared with the industry’s growth of 5%.

Better Consumer Staple Stocks to Take Advantage of

Stocks with higher rankings are Inter Parfums IPAR, Philip Morris PM and e.l.f. Beauty, Inc. ELF.

Inter Parfums, a manufacturer and marketer of fragrances and related products, is currently a Zacks #1 (Strong buy). IPAR’s trailing four quarter earnings surprise was 27.8% on average. See the full report. the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Inter Parfums’ 2023 sales and earnings suggests growth of 5.8% and 5.3%, respectively, from the corresponding year-ago reported figures.

e.l.f. Beauty, which makes cosmetic and skin care products has a Zacks Rank 1. ELF’s trailing four-quarter earnings surprise was 92.8% on average.

The Zacks Consensus estimate for e.l.f. Beauty’s current fiscal-year sales and EPS suggests an increase of 24.8% and 33.3%, respectively, from the year-ago reported number.

Philip Morris, a giant in tobacco products, has a Zacks Rank 2 (Buy). PM’s trailing four-quarter earnings surprise is 9.9% on average.

Philip Morris expects a 5% EPS growth rate over the next three to five year.

Get the most recent Zacks Investment Research recommendations. Download 7 Best Stocks in the Next 30 Days Today Click to get this free report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Service Corporation International (SCI) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report