Seyna provides declare administration product for insurance coverage brokers

French startup Seyna is slowly constructing an all-in-one platform for insurance coverage brokers in order that they will create, promote and handle insurance coverage merchandise from scratch. And the corporate is launching a brand new product referred to as Seyna Claims. Because the title suggests, Seyna Claims empowers insurance coverage brokers in order that they will deal with claims themselves.

Seyna is an insurtech startup that has obtained an insurance coverage license from the French regulator (ACPR). The corporate has created a core insurance coverage system, which implies that it could actually shortly generate insurance coverage insurance policies with completely different clauses in order that brokers can discover the suitable steadiness between protection and value. The startup has increase €47 million since its inception.

Some corporations working with Seyna embrace Dalma, a pet insurance coverage startup, or Garantme, an unpaid lease insurance coverage firm. Seyna purchasers can construct a subscription funnel with real-time quotes, generate contracts and invoices on the fly, and extra.

Along with Seyna’s personal steadiness sheet, the corporate additionally companions with large reinsurance corporations like Swiss Re, Scor or Munich Re. Some corporations even have an present relationship with insurance coverage corporations in order that they solely use Seyna’s tech platform.

Whereas brokers can now do loads of issues, they usually must depend on a third-party declare administration corporations. These corporations choose up the cellphone, verify whether or not an incident is roofed by the coverage and analyze paperwork. Additionally they take a minimize on insurance coverage premiums.

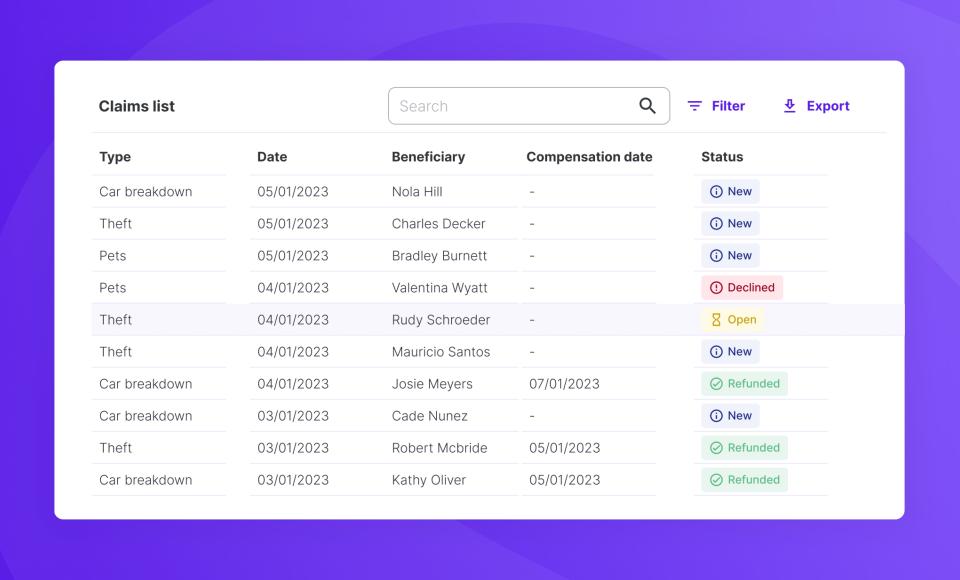

With Seyna Claims, many insurance coverage brokers will be capable of deal with these pesky duties straight. It’s a software-as-a-service product with a white-label interface that ought to value lower than working with a declare administration companion.

Not like different dealer platforms, resembling Courtigo and Sydia, Seyna isn’t simply an administrative instrument. It integrates with the remainder of the Seyna insurance coverage platform. For instance, declare information can straight enrich the accounting tab that reveals how your insurance coverage merchandise are doing.

Sooner or later, the startup hopes it could actually allow third-party integrations in Seyna Claims to reinforce the product’s potential. As an illustration, Seyna might supply integrations with Shift Technology for fraud detection, Stripe or MangoPay for payouts with built-in KYC options, and many others.

Insurance coverage corporations may also select to make use of Seyna Claims independently from the remainder of the Seyna platform. The startup desires to construct a modular platform in order that the insurance coverage business can choose and select some Seyna merchandise in the event that they assume they are often related to enhance their operations. Primarily, Seyna is making an attempt to modernize the insurance coverage tech stack.

Picture Credit: Seyna