Ought to You Be Including Datatec (JSE:DTC) To Your Watchlist In the present day?

The joy of investing in an organization that may reverse its fortunes is a giant draw for some speculators, so even firms that haven’t any income, no revenue, and a file of falling quick, can handle to search out buyers. Generally these tales can cloud the minds of buyers, main them to take a position with their feelings reasonably than on the advantage of fine firm fundamentals. Loss-making firms are all the time racing towards time to achieve monetary sustainability, so buyers in these firms could also be taking up extra danger than they need to.

If this type of firm is not your fashion, you want firms that generate income, and even earn income, then you definately could be fascinated with Datatec (JSE:DTC). Even when this firm is pretty valued by the market, buyers would agree that producing constant income will proceed to offer Datatec with the means so as to add long-term worth to shareholders.

View our latest analysis for Datatec

Datatec’s Bettering Income

Robust earnings per share (EPS) outcomes are an indicator of an organization reaching strong income, which buyers look upon favourably and so the share worth tends to replicate nice EPS efficiency. So a rising EPS typically brings consideration to an organization within the eyes of potential buyers. It’s awe-striking that Datatec’s EPS went from US$0.045 to US$0.14 in only one yr. Whereas it is tough to maintain progress at that degree, it bodes effectively for the corporate’s outlook for the longer term.

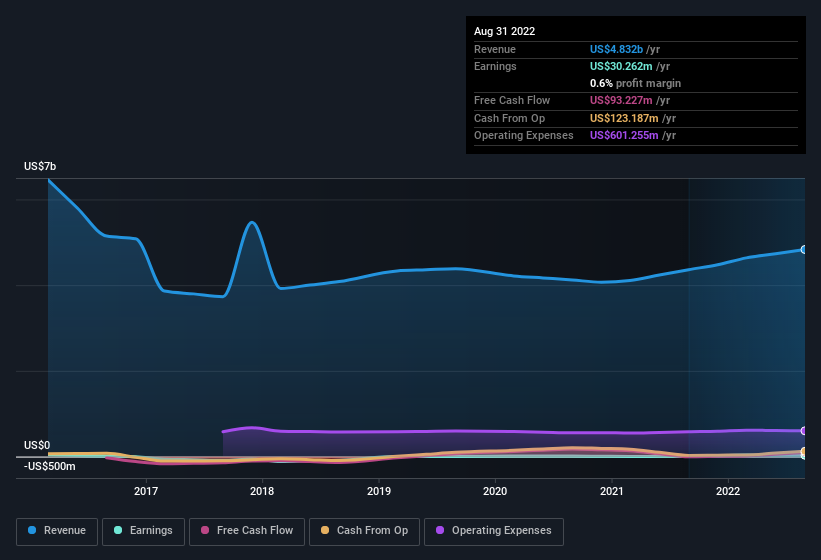

Cautious consideration of income progress and earnings earlier than curiosity and taxation (EBIT) margins can assist inform a view on the sustainability of the latest revenue progress. Datatec maintained secure EBIT margins during the last yr, all whereas rising income 11% to US$4.8b. That is an actual optimistic.

Within the chart under, you may see how the corporate has grown earnings and income, over time. For finer element, click on on the picture.

Whereas profitability drives the upside, prudent buyers all the time check the balance sheet, too.

Are Datatec Insiders Aligned With All Shareholders?

It is a necessity that firm leaders act in the perfect curiosity of shareholders and so insider funding all the time comes as a reassurance to the market. Datatec followers will discover consolation in figuring out that insiders have a big quantity of capital that aligns their greatest pursuits with the broader shareholder group. Holding US$1.2b price of inventory within the firm is not any laughing matter and insiders will probably be dedicated in delivering the perfect outcomes for shareholders. Amounting to fifteen% of the excellent shares, indicating that insiders are additionally considerably impacted by the choices they make on the behalf of the enterprise.

Does Datatec Deserve A Spot On Your Watchlist?

Datatec’s earnings per share progress have been climbing increased at an considerable price. That kind of progress is nothing wanting eye-catching, and the big funding held by insiders ought to actually brighten the view of the corporate. At occasions quick EPS progress is an indication the enterprise has reached an inflection level, so there is a potential alternative available right here. So on the floor degree, Datatec is price placing in your watchlist; in spite of everything, shareholders do effectively when the market underestimates quick rising firms. What about dangers? Each firm has them, and we have noticed 5 warning signs for Datatec you must find out about.

There’s all the time the potential for doing effectively shopping for shares that aren’t rising earnings and don’t have insiders shopping for shares. However for many who take into account these necessary metrics, we encourage you to take a look at firms that do have these options. You may entry a free list of them here.

Please be aware the insider transactions mentioned on this article discuss with reportable transactions within the related jurisdiction.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We intention to deliver you long-term targeted evaluation pushed by basic information. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be a part of A Paid Consumer Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person buyers like your self. Sign up here