Southwest Airways (NYSE:LUV) Will Be Hoping To Flip Its Returns On Capital Round

There are a couple of key traits to search for if we need to determine the subsequent multi-bagger. Ideally, a enterprise will present two traits; firstly a rising return on capital employed (ROCE) and secondly, an growing quantity of capital employed. Put merely, these kind of companies are compounding machines, which means they’re regularly reinvesting their earnings at ever-higher charges of return. Nonetheless, after briefly wanting over the numbers, we do not assume Southwest Airways (NYSE:LUV) has the makings of a multi-bagger going ahead, however let’s take a look at why that could be.

Understanding Return On Capital Employed (ROCE)

If you have not labored with ROCE earlier than, it measures the ‘return’ (pre-tax revenue) an organization generates from capital employed in its enterprise. Analysts use this formulation to calculate it for Southwest Airways:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Complete Belongings – Present Liabilities)

0.064 = US$1.6b ÷ (US$36b – US$10b) (Based mostly on the trailing twelve months to September 2022).

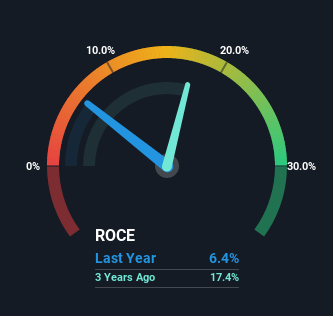

So, Southwest Airways has an ROCE of 6.4%. Although it is in step with the trade common of 6.4%, it is nonetheless a low return by itself.

See our latest analysis for Southwest Airlines

Above you may see how the present ROCE for Southwest Airways compares to its prior returns on capital, however there’s solely a lot you may inform from the previous. When you’re , you may view the analysts predictions in our free report on analyst forecasts for the company.

So How Is Southwest Airways’ ROCE Trending?

After we seemed on the ROCE pattern at Southwest Airways, we did not achieve a lot confidence. To be extra particular, ROCE has fallen from 20% over the past 5 years. Though, given each income and the quantity of property employed within the enterprise have elevated, it may counsel the corporate is investing in progress, and the additional capital has led to a short-term discount in ROCE. And if the elevated capital generates extra returns, the enterprise, and thus shareholders, will profit in the long term.

What We Can Study From Southwest Airways’ ROCE

In abstract, regardless of decrease returns within the quick time period, we’re inspired to see that Southwest Airways is reinvesting for progress and has larger gross sales in consequence. These progress traits have not led to progress returns although, for the reason that inventory has fallen 38% over the past 5 years. So we expect it might be worthwhile to look additional into this inventory given the traits look encouraging.

On a remaining word, we have discovered 1 warning sign for Southwest Airlines that we expect you ought to be conscious of.

Whereas Southwest Airways is not incomes the best return, try this free list of companies that are earning high returns on equity with solid balance sheets.

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We intention to deliver you long-term targeted evaluation pushed by elementary information. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be a part of A Paid Consumer Analysis Session

You’ll obtain a US$30 Amazon Reward card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here