Unimech Group Berhad’s (KLSE:UNIMECH) traders shall be happy with their favorable 90% return during the last 5 years

Usually talking the intention of lively inventory selecting is to search out corporations that present returns which are superior to the market common. And the reality is, you can also make vital features in the event you purchase good high quality companies on the proper value. To wit, the Unimech Group Berhad share value has climbed 60% in 5 years, simply topping the market decline of 18% (ignoring dividends). However, the more moderen features have not been so spectacular, with shareholders gaining simply 26% , together with dividends .

With that in thoughts, it is value seeing if the corporate’s underlying fundamentals have been the motive force of long run efficiency, or if there are some discrepancies.

View our latest analysis for Unimech Group Berhad

To cite Buffett, ‘Ships will sail world wide however the Flat Earth Society will flourish. There’ll proceed to be huge discrepancies between value and worth within the market…’ One solution to look at how market sentiment has modified over time is to take a look at the interplay between an organization’s share value and its earnings per share (EPS).

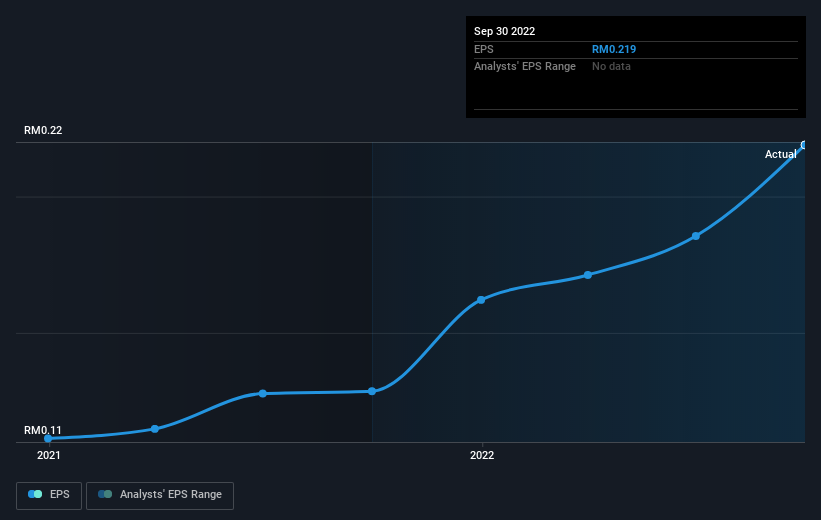

Throughout 5 years of share value progress, Unimech Group Berhad achieved compound earnings per share (EPS) progress of 26% per yr. This EPS progress is greater than the ten% common annual enhance within the share value. Subsequently, it appears the market has change into comparatively pessimistic concerning the firm. This cautious sentiment is mirrored in its (pretty low) P/E ratio of seven.68.

The corporate’s earnings per share (over time) is depicted within the picture under (click on to see the precise numbers).

This free interactive report on Unimech Group Berhad’s earnings, revenue and cash flow is a superb place to begin, if you wish to examine the inventory additional.

What About Dividends?

When funding returns, it is very important contemplate the distinction between whole shareholder return (TSR) and share value return. The TSR is a return calculation that accounts for the worth of money dividends (assuming that any dividend obtained was reinvested) and the calculated worth of any discounted capital raisings and spin-offs. It is truthful to say that the TSR offers a extra full image for shares that pay a dividend. Because it occurs, Unimech Group Berhad’s TSR for the final 5 years was 90%, which exceeds the share value return talked about earlier. And there is no prize for guessing that the dividend funds largely clarify the divergence!

A Completely different Perspective

It is good to see that Unimech Group Berhad shareholders have obtained a complete shareholder return of 26% during the last yr. And that does embrace the dividend. That acquire is best than the annual TSR over 5 years, which is 14%. Subsequently it looks as if sentiment across the firm has been optimistic recently. In the very best case state of affairs, this may increasingly trace at some actual enterprise momentum, implying that now might be a good time to delve deeper. Whereas it’s effectively value contemplating the completely different impacts that market situations can have on the share value, there are different elements which are much more vital. Even so, remember that Unimech Group Berhad is showing 2 warning signs in our investment analysis , you need to find out about…

However observe: Unimech Group Berhad might not be the very best inventory to purchase. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please observe, the market returns quoted on this article mirror the market weighted common returns of shares that at the moment commerce on MY exchanges.

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We intention to deliver you long-term centered evaluation pushed by elementary knowledge. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be part of A Paid Person Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here