US financial development stronger than anticipated

The US economic system did higher than anticipated on the finish of final yr, regardless of greater borrowing prices and rising value of residing dragging on development.

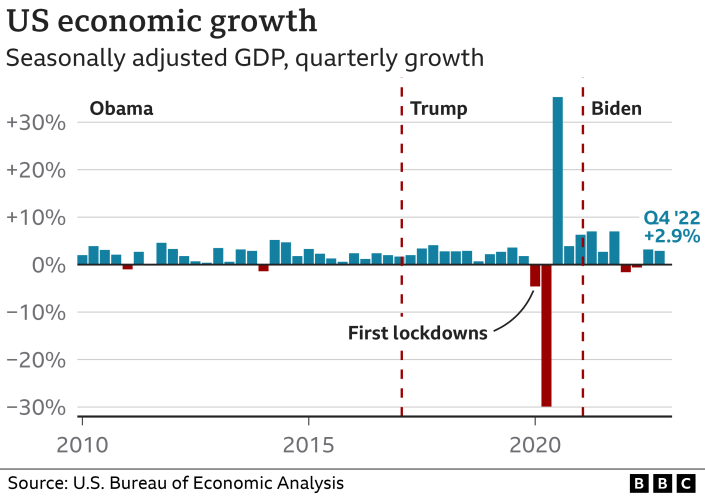

The economic system grew at an annualised fee of two.9% within the final three months of 2022, official figures present.

That was down from 3.2% within the earlier quarter, as dwelling gross sales and building tumbled.

Some analysts are nervous that the US economic system is headed for recession, though the roles market has held up.

The unemployment fee is hovering round historic lows, however different components of the economic system have been weakening.

In December, usually a giant month for shopper spending, retail gross sales dropped 1.1% from a month earlier.

Manufacturing has additionally suffered, whereas the inventory market dropped sharply final yr.

Thursday’s report confirmed housing funding – which is delicate to rates of interest – falling at an annual fee of practically 27% within the three months to December, pushed by declines within the building of recent houses.

However shopper spending, the principle driver of the US economic system, continued at a strong, albeit slowing, tempo.

For the total yr, the economic system grew by 2.1%. That was down from final yr, when the economic system roared again to life after the pandemic, increasing by 5.9% – the quickest fee since 1984.

That surge helped spark a fast rise in costs, pushing the US central financial institution to intervene to attempt to stabilise prices.

Final yr, the Federal Reserve hiked rates of interest from close to zero to greater than 4% – the best fee in 15 years.

By lifting borrowing prices, the financial institution is encouraging customers to save lots of extra and spend much less, hoping this can ease the pressures pushing up costs. Nevertheless it dangers triggering a extreme slowdown, which may depart hundreds of thousands of individuals out of labor.

Studies of job cuts have been rising. Manufacturing agency 3M, chemical compounds firm Dow, and tech corporations IBM and SAP had been among the many large corporations to announce main redundancies this week. However others, corresponding to restaurant chain Chipotle, are including employees.

Fed officers have stated they continue to be hopeful the economic system can regulate with out large job losses, permitting their rate-hiking marketing campaign to finish in a so-called “smooth touchdown” as a substitute.

“For nearly a yr, the Federal Reserve has been attempting to attain a smooth touchdown by elevating short-term rates of interest just-enough to deliver down inflation with out inflicting a recession. It is clear the economic system stays comparatively robust within the face of the Fed’s efforts, suggesting they’re succeeding,” stated Richard Flynn, managing director at Charles Schwab UK.

“Nevertheless, buyers could concern that as we speak’s figures are considerably deceiving as different current information has pointed in direction of a recession.”