Vertex (VRTX) to Report This autumn Earnings: What’s within the Playing cards?

Vertex Prescribed drugs Integrated VRTX will report fourth-quarter 2022 outcomes on Feb 7, after the market closes. Within the final reported quarter, VRTX delivered a optimistic earnings shock of 8.67%.

This massive-cap biotech’s efficiency has been fairly spectacular, with its earnings beating estimates in three of the trailing 4 quarters however lacking the mark in a single. VRTX has a trailing four-quarter earnings shock of three.16%, on common.

Vertex Prescribed drugs Integrated Value and EPS Shock

Vertex Prescribed drugs Integrated price-eps-surprise |

Vertex Prescribed drugs Integrated Quote

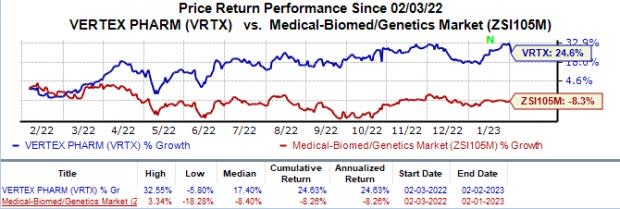

Previously 12 months, shares of Vertex have risen 24.6% towards the trade’s 8.3% decline.

Picture Supply: Zacks Funding Analysis

Let’s see how issues are shaping up for the quarter to be reported.

Components to Think about

Vertex’s income progress in fourth-quarter 2022 is more likely to have been pushed by a fast uptake of its blockbuster cystic fibrosis (CF) medication Trikafta/Kaftrio (Trikafta’s model identify in Europe). The Zacks Consensus Estimate and our mannequin estimates for Trikafta gross sales are pegged at $2.04 billion and $1.99 billion, respectively.

Gross sales for Trikafta within the to-be-reported quarter are more likely to have been pushed bystrong uptakes in worldwide markets and elevated drug adoption in the US amongst pediatric sufferers (6-11 years of age). Greater gross sales of Trikafta are more likely to have triggered gross sales erosion of Vertex’s different CF medicine and current mixtures, specifically Kalydeco, Orkambi and Symdeko/Symkevi.

Traders can even anticipate an replace on Vertex’s non-CF pipeline through the fourth-quarter convention name.

As a part of its collaboration with CRISPR Therapeutics CRSP, Vertex developed exa-cel (previously CTX001), an investigational ex-vivo CRISPR gene-edited remedy for 2 indications, specifically sickle cell illness (SCD) and transfusion-dependent beta thalassemia (TDT).Vertex expects exa-cel to be its subsequent industrial launch.

Throughout fourth-quarter 2022, Vertex and companion CRISPR Therapeutics initiated a rolling biologics license software (BLA) submission with the FDA for exa-cel in each SCD and TDT indications. Each CRISPR Therapeutics and Vertex intend to finish this rolling submission in first-quarter 2023.

This October, the FDA accepted the corporate’s investigational new drug (IND) software searching for to provoke a medical examine on a brand new candidate, VX-634, concentrating on alpha-1 antitrypsin deficiency (AATD). A medical examine will begin later this 12 months.

Final December, the FDA additionally accepted one other one of many firm’s IND applicationsseeking to start out medical research on VX-522, an investigational mRNA-based remedy for cystic fibrosis (CF) indication. With this remedy, administration intends to focus on a affected person populationwho nonetheless can not profit from its 4 marketed CF medicines. The remedy is being developed in collaboration with Moderna. This examine is anticipated to start in early-2023.

Aside from the above therapies, Vertex is quickly advancing its mid- to late-stage pipeline candidates in further illnesses like acute ache, APOL1-mediated kidney illnesses (AMKD) and cell remedy for kind I diabetes. The corporate signed a collaboration take care of Entrada Therapeutics in December 2022 to find and develop intracellular Endosomal Escape Automobile (EEV) therapeutics for myotonic dystrophy kind 1 (DM1).

Earnings Whispers

Our confirmed mannequin doesn’t predict an earnings beat for Vertex this time round. The mix of a optimistic Earnings ESP and a Zacks Rank #1 (Robust Purchase), 2 (Purchase) or 3 (Maintain) will increase the chances of an earnings beat. Sadly, that’s not the case right here, as you will note under. You possibly can uncover the very best shares to purchase or promote earlier than they’re reported with our Earnings ESP Filter.

Earnings ESP: Vertex has an Earnings ESP of -3.00% because the Most Correct Estimate of $3.42 per share is decrease than the Zacks Consensus Estimate of $3.53.

Zacks Rank: Vertex has a Zacks Rank #3, presently.

Shares to Think about

Listed here are just a few shares price contemplating from the general healthcare house, as our mannequin reveals that these have the fitting mixture of components to beat on earnings this reporting cycle.

Arcus Biosciences RCUS has an Earnings ESP of +29.01% and a Zacks Rank #1. You possibly can the whole record of in the present day’s Zacks #1 Rank shares right here.

Arcus Biosciences’ inventory has declined 27.7% prior to now 12 months. Arcus Biosciences beat earnings estimates in three of the final 4 quarters whereas lacking the mark on one event. Arcus Biosciences has delivered an earnings shock of 56.74%, on common.

Syndax Prescribed drugs SNDX has an Earnings ESP of +10.66% and a Zacks Rank #1.

Syndax Prescribed drugs’ inventory has surged 87.7% prior to now 12 months. Syndax Prescribed drugs beat estimates in three of the final 4 quarters whereas assembly the mark on one event. Syndax Prescribed drugs has delivered an earnings shock of 95.39%, on common.

Keep on prime of upcoming earnings bulletins with the Zacks Earnings Calendar.

Need the most recent suggestions from Zacks Funding Analysis? Right this moment, you’ll be able to obtain 7 Finest Shares for the Subsequent 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Syndax Pharmaceuticals, Inc. (SNDX) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Arcus Biosciences, Inc. (RCUS) : Free Stock Analysis Report