Viavi (VIAV) Revenues Decline Y/Y, Q2 Earnings Beat Estimates

Viavi Options Inc. VIAV reported comparatively sturdy second-quarter fiscal 2023 outcomes, with the underside and the highest line beating the respective Zacks Consensus Estimate. Nonetheless, it reported year-over-year decrease revenues owing to demand softness pushed by weak end-market situations and a difficult macroeconomic setting.

Web Revenue

On a GAAP foundation, internet earnings within the quarter was $8.4 million or 4 cents per share in comparison with $34.6 million or 14 cents per share within the year-ago quarter. Prime-line contraction on a year-over-year foundation and better earnings taxes induced the decline in earnings.

Non-GAAP internet earnings was $31.5 million or 14 cents per share in contrast with $59.3 million or 24 cents per share within the prior-year quarter. The underside line surpassed the Zacks Consensus Estimate by 3 cents.

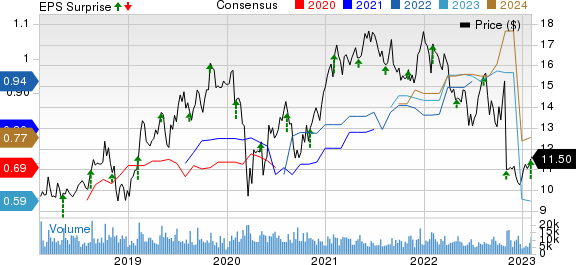

Viavi Options Inc. Worth, Consensus and EPS Shock

Viavi Options Inc. price-consensus-eps-surprise-chart | Viavi Options Inc. Quote

Revenues

Quarterly complete revenues declined 9.6% yr over yr to $284.5 million from $314.8 million within the prior yr. The decline is primarily as a result of persistence of demand softness and headwinds in service supplier spending within the Community Service Enablement section. Nonetheless, the highest line surpassed administration’s steerage and outperformed the consensus estimate of $270 million. Nonetheless,

Lowered spending by service suppliers in CapEx and OpEx hampered the income progress for Community and Service Enablement (NSE) section. Revenues from Community Enablement (NE) have been down 16.2% from the year-ago quarter to $179.7 million, pushed by weaker demand for fiber and wi-fi lab merchandise, partially offset by sturdy demand for wi-fi subject devices. The corporate additionally witnessed a optimistic momentum for the lately acquired Jackson Labs resilient PNT product. Service Enablement (SE) revenues declined by 8.1% to $27.4 million, led by inferior product combine. Firm’s information middle merchandise skilled low demand pushed by weak point in enterprise market.

Optical Safety and Efficiency Merchandise (OSP) revenues witnessed a progress of 9.6% yr over yr to $77.4 million as a result of greater demand for each anti-counterfeiting and 3D sensing merchandise within the December quarter.

The revenues from America (37.4% of complete revenues throughout second-quarter fiscal 2023) stood at $106.3 million, down from $125.7 million. The revenues from Asia-Pacific (36.9%) stood at $105.1 million, up from $91 million. The revenues from EMEA (25.7%) stood at $73.1, down from $98.1 million.

Different Particulars

Throughout the quarter, the non-GAAP gross margin stood at 61.1%, down 210 bps from the year-ago quarter’s ranges. Non-GAAP working margin was 16.2%, down 710 bps from the year-ago quarter.

The working margin for the NSE section stands at 8.9%. In Community Enablement non-GAAP gross margin was 64.1%, down by 30bps as a result of demand rigidity induced by low spending from service suppliers. Non-GAAP gross margin for Service Enablement (SE) was 66.8% and it witnessed a contraction of 500bps yr over yr, pushed by smooth product combine and a decline in quantity.

Money Circulate & Liquidity

Throughout the December quarter, Viavi generated $46.2 million of money from working actions, a big enhance from $22.2 million within the year-ago interval. As of Dec 31, 2022, the corporate had $484.1 million in money and money equivalents with $617.2 million of long-term debt.

Outlook

Within the fiscal third quarter, administration expects prospects to proceed reducing their CapEx and OpEx as a result of weak end-market situations. Regardless of the demand rigidity, the corporate expects a near-term restoration with the stabilization of service supplier spending. Administration anticipates a requirement restoration for cable subject devices as soon as main cable operators start upgrading networks throughout 2023. Viavi expects SE revenues to be steady for the rest of fiscal 2023. Within the OSP section, the corporate is sensing weaker efficiency primarily as a result of weaker demand for anti-counterfeiting product demand within the subsequent quarter. It additionally expects that the marketplace for the corporate’s 3D sensing merchandise is more likely to decline within the second half of fiscal 2023. Viavi is engaged on a restructuring plan to regulate to altering market situations.

For the third quarter, the corporate approximates revenues of $266 million (+/- $10 million). Viavi expects non-GAAP working revenue margins of round 13.6% and non-GAAP earnings are estimated within the band of 10-12 cents per share. For the Community and Service Enablement section, revenues are estimated at $197 million (+/- 8 million) with a non-GAAP working margin of seven.2-8.2%. Income for Optical Safety and Efficiency Merchandise (OSP) section is approximated at $69(+/- $2 million). It anticipates the non-GAAP tax bills between 23% and 25%. Based mostly on present inventory worth ranges, the estimated share depend is roughly 226 million shares.

Zacks Rank & Different Shares to Think about

Viavi at present has a Zacks Rank #3 (Maintain). You possibly can see the whole checklist of as we speak’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2, delivered an earnings shock of 12.7%, on common, within the trailing 4 quarters. Earnings estimates for ANET stand at $4.38 per share.

Arista offers cloud networking options for information facilities and cloud computing environments. The corporate gives 10/25/40/50/100 Gigabit Ethernet switches and routers optimized for next-generation information middle networks.

Jabil Inc. JBL, sporting a Zacks Rank #1, delivered an earnings shock of 8.7%, on common, within the trailing 4 quarters. Earnings estimates for JBL for the present yr have remained unchanged previously 30 days at $8.37 per share.

Jabil is without doubt one of the largest international suppliers of digital manufacturing companies. The corporate gives electronics design, manufacturing, product administration and after-market companies to prospects catering to aerospace, automotive, computing, shopper, protection, industrial, instrumentation, medical, networking, peripherals, storage and telecommunications industries.

Motorola Options, Inc. MSI, carrying a Zacks Rank #2 (Purchase), delivered an earnings shock of 6.6%, on common, within the trailing 4 quarters. Earnings estimates for MSI for the present yr have remained unchanged previously 60 days at $10.20 per share.

Motorola is a number one communications gear producer with sturdy market positions in barcode scanning, wi-fi infrastructure gear, and authorities communications.

Need the newest suggestions from Zacks Funding Analysis? In the present day, you possibly can obtain 7 Finest Shares for the Subsequent 30 Days. Click to get this free report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Viavi Solutions Inc. (VIAV) : Free Stock Analysis Report