What is the current state of the housing market in your state?

You might be thinking about selling, buying, or both. investing in real estateDon’t believe everything you read about the “housing industry.” The housing market actually consists of 50 different housing markets. If your intention is to move, you need to first understand the current situation in your area and how it has changed over the past two decades.

Also: 25 Sneaky Car Dealership Tricks To Avoid at All Costs

Next: 3 Things You Must Do When Your Savings Reach $50,000

GOBankingRates analyzed Zillow data to show the housing market in each state, from the time of the pandemic until today. The average single-family residence home value for each state will be shown in dollars and percent changes. However, the study also examines how each state’s housing market has changed over the past one, six, and one year periods. For each state, any noteworthy revelations are also discussed.

Keep reading to learn how the pandemic steered home values in your state.

Alabama

-

October 2020 home value $160,644

-

October 2022 home price: $214,110

-

2-Year Change $53,466

-

2-Year (%): 33.28%

Alabama was the first state to witness the rapidly rising housing prices that defined 2022’s housing market.

Home values increased by $9,000 between April & September and then again between October & November

September and October

Take our poll: How Long Do You Think It Will Take You To Pay Off Your Credit Card Debt?

Alaska

-

February 2020: $307,566

-

February 2022 Home Value: $351,345

-

2-Year Change $43,779

-

2-Year (%): 14.23%

Alaska has seen its home values decline more than any other US state in the last two-years.

Percentages

Arizona

-

February 2020: $300,366

-

February 2022 Home Value: $437,565

-

2-Year Change $137,199

-

2-Year (%): 45.68%

Arizona sellers have enjoyed a record-breaking couple of years, with an almost 50% increase in sales.

Over the past two years, home values have increased by 5%.

Arkansas

-

February 2020: $141,465

-

February 2022 Home Value: $187,512

-

2-Year Change $46,047

-

2-Year (%): 32.55%

Arkansas home values increased 15.05% between October 2020 and October 2021. The increase was even more dramatic in Arkansas.

In the 2 year period 2020-2022, 32.55%

California

-

February 2020: $601,078

-

February 2022 Home Value: $782,440

-

2-Year Change $181,362

-

2-Year (%): 30.17%

California’s 30.17% spike in home values is a surprise, even though they saw a rise of more than one third in their home values within two years.

Nevertheless, it was not among the highest percent growths in the country. The state’s $180,000+

The second-highest jump in dollar value was Hawaii. The other 48 states did not break

The $200,000 mark.

Colorado

-

February 2020: $436,255

-

February 2022 Home Value: $590,347

-

2-Year Change $154,092

-

2-Year (%): 35.32%

Only eight states have seen a dollar increase in home values exceeding $150,000.

Colorado has outperformed most states in terms housing inflation for most of the period.

pandemic.

Connecticut

-

February 2020: $292,071

-

February 2022 Home Value: $383,163

-

2-Year Change $91,092

-

2-Year (%): 31.19%

Especially in the last six months, appreciation has been very mild in Connecticut. Over the past six months

Only 5.08% of home values increased between April 2022 – October 2022. However, this is only a 5.08% increase in home values over the past two years.

Appreciation has surpassed 30%

Delaware

-

February 2020: $277,377

-

February 2022 Home Value: $361,145

-

2-Year Change $83,768

-

2-Year (%): 30.20%

Delaware saw only slight price increases, just like Connecticut.

Pandemics became more common as the months went by. The six months that elapsed between April 2022 & October 2022 were the most difficult.

2022: Prices rose just 4.28%

Florida

-

February 2020: $274,990

-

February 2022 Home Value: $425,541

-

2-Year Change $150,551

-

2-Year (%): 54.75%

The Florida market was hot in 2021. The Sunshine State is still hot, and prices are high.

Between October 2022-2022, the greatest percentage change was 55%.

Over two years in the country.

Georgia

-

February 2020: $222,395

-

February 2022 Home Value: $325,977

-

2-Year Change $103,582

-

2-Year (%): 46.58%

Georgia is located just above Florida alphabetically as well as geographically.

appreciation value. Prices rose by 47% in 2022, one of highest rates in the nation. In

In the six months from April 2022 to October 2022, there was a 5.63% increase.

Hawaii

-

February 2020: $754,859

-

February 2022 Home Value: $1,046,647

-

2-Year Change $291,788

-

2-Year (%): 38.65%

Hawaii has spent the past two years in a separate class in terms of dollars. The state recorded the

The country saw the largest increases across all categories and at every time point.

The pandemic is in its entirety. It is, however, in line with other states at the percentage level.

Idaho

-

February 2020: $326,244

-

February 2022 Home Value: $468,568

-

2-Year Change $142,324

-

2-Year (%): 43.63%

While no state can match Hawaii’s insane price rises in dollars, there are still some states that can.

Idaho’s housing market has seen a significant percentage increase in the last two years.

Illinois

-

February 2020: $215,021

-

February 2022 Home Value: $245,405

-

2-Year Change $55,868

-

2-Year (%): 25.98%

The Illinois housing market was quite cool from 2020-2021 year-over, but it has started to improve.

In 2022, it will rebound. Its 1-month percentage growth, from September to Oct 2022 was

It was tiny, 0.2%, but the 6-month percentage rise to 3.82% and its one-year change were significant.

It was 10.38%. It’s now at 30% after two years.

Indiana

-

February 2020: $171,509

-

February 2022 Home Value: $228,155

-

2-Year Change $56,646

-

2-Year (%): 33.03%

Indiana was an average state during the pandemic. Because housing prices were relatively low,

Low to begin, dollar-amount growths were quite mild. It started to rise again in 2022.

From 0.52% in its monthly percentage change to more than 30% two years later

Iowa

-

February 2020: $165,499

-

February 2022 Home Value: $202,669

-

2-Year Change $37,170

-

2-Year (%): 22.46%

Between 2020 and 2021, the Iowa housing market was quite cool. The housing market was relatively cool in Iowa between 2020 and 2021.

Although the market is slowly recovering, it is showing signs of improvement. Although it has only experienced a 0.53% growth,

The percentage of increase between September & October has been more than 22% for the past two years.

Kansas

-

February 2020: $170,770

-

February 2022 Home Value: $216,854

-

2-Year Change $46,084

-

2-Year (%): 26.99%

Like Iowa, Kansas’s prices began relatively low in Kansas. However, Kansas has a higher starting price.

It jumped nearly 27%

Kentucky

-

February 2020: $160,409

-

February 2022 Home Value: $207,068

-

2-Year Change $46,659

-

2-Year (%): 29.09%

Kentucky saw very similar price and percentage changes to Kansas.

The pandemic was seen in every state of residents. The pandemic was not as severe in 2022.

The overall dollar amount and percent change were higher.

Louisiana

-

February 2020: $179,377

-

February 2022 Home Value: $218,683

-

2-Year Change $39,306

-

2-Year (%): 21.91%

Louisiana’s home prices rose by only 10.57% between Oct 2021 and Oct 2022.

This makes it one of the states that the housing market is growing more slowly.

Maine

-

February 2020: $265,435

-

February 2022 Home Value: $368,386

-

2-Year Change $102,951

-

2-Year (%): 38.79%

Maine is in the middle of home value growth. This is nearly 40% more than

There are many, but they are not the most expensive. The average home in the state was worth more than $102,000.

In the two-year period since October 2020.

Maryland

-

February 2020: $338,847

-

February 2022 Home Value: $416,893

-

2-Year Change $78,046

-

2-Year (%): 23.03%

Maryland saw a 0.24% increase in home values between September and Oct.

It is one of the most exciting markets in the country. It has grown by more than 80% in the last two years.

23%.

Massachusetts

-

February 2020: $464,598

-

February 2022 Home Value: $600,805

-

2-Year Change $136,207

-

2-Year (%): 29.32%

With the pandemic price rises in Japan of almost one-third, housing prices were particularly high.

Massachusetts for almost the entire last two years. However, today things are cooling down —

In fact, prices fell by 0.1% between September and October.

Michigan

-

February 2020: $181,970

-

February 2022 Home Value: $234,822

-

2-Year Change $52,852

-

2-Year (%): 29.04%

While prices rose in Michigan during the pandemic, they did not rise nearly as fast as in other states.

states. The price of oil rose only 0.26% between September and October 2022.

There is a cooler market than most other places in the country.

Minnesota

-

February 2020: $276,216

-

February 2022 Home Value: $338,866

-

2-Year Change $62,650

-

2-Year (%): 22.68%

Minnesota was not hit by housing inflation, although it has risen to almost 23%.

The value of homes in the past two decades. The home value rose by 8% between September and October 2022.

Just 0.2%

Mississippi

-

February 2020: $134,820

-

February 2022 Home Value: $171,183

-

2-Year Change $36,363

-

2-Year (%): 26.97%

In the early days after the pandemic, Mississippi was the only state with the second-lowest home value.

Today, however it isn’t recovering quickly and has a percentage growth of only 0.3%

Between September and Oktober, it has grown almost 27% over the past two year.

Missouri

-

February 2020: $181,469

-

February 2022 Home Value: $237,572

-

2-Year Change $56,103

-

2-Year (%): 30.92%

Missouri’s state was almost entirely in the middle for the past two years.

today.

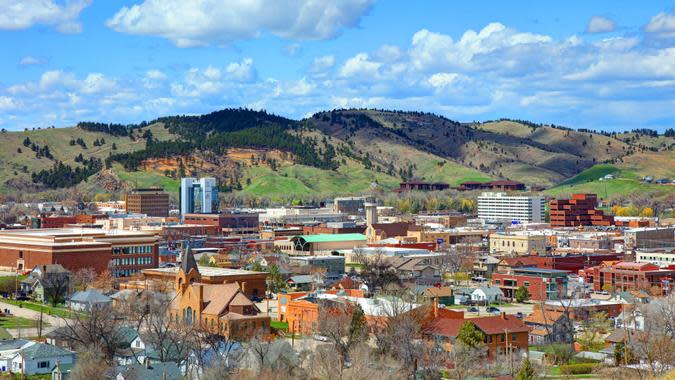

Montana

-

February 2020: $309,222

-

February 2022 Home Value: $465,328

-

2-Year Change $156,106

-

2-Year (%): 50.48%

Montana’s growth rate was very high in the early days after the pandemic. It is still on a good track.

An upward trend with a more than 50% increase in two years.

Nebraska

-

February 2020: $198,563

-

February 2022 Home Value: $250,424

-

2-Year Change $51,861

-

2-Year (%): 26.12%

Nebraska experienced a 99% percent increase in the pandemic’s duration, which was around the middle of the epidemic.

pack. It has seen a 0.68% increase in October and September.

Nevada

-

February 2020: $329,440

-

February 2022 Home Value: $462,422

-

2-Year Change $132,982

-

2-Year (%): 40.37%

Nevada buyers experienced a particularly difficult 2021. Things have started to improve in 2022. In fact,

Home values fell by -1.57%

New Hampshire

-

February 2020: $327,766

-

February 2022 Home Value: $457,688

-

2-Year Change $129,922

-

2-Year (%): 39.64%

New Hampshire saw a rare six-figure rise in home prices.

The pandemic’s early years saw some slowing down between 2020 and 2022.

$130,000.

New Jersey

-

February 2020: $368,867

-

February 2022 Home Value: $484,982

-

2-Year Change $116,115

-

2-Year (%): 31.48%

The pandemic has brought down the New Jersey housing market. Between September and

October saw prices rise by just 0.19%, one the lowest rates in America.

New Mexico

-

February 2020: $221,814

-

February 2022 Home Value: $302,159

-

2-Year Change $80,345

-

2-Year (%): 36.22%

During the pandemic, New Mexico’s prices rose more than one-third.

However, the pace of change is not as rapid today. The home value increased by approximately 5% between September and Oct.

Moderate 0.47%

New York

-

February 2020: $294,495

-

February 2022 Home Value: $380,572

-

2-Year Change $86,077

-

2-Year (%): 29.23%

New York’s home values are on the rise. It is a steady, but not dramatic, increase.

30%. It showed a 0.31 percent increase between September and October.

North Carolina

-

February 2020: $225,623

-

February 2022 Home Value: $331,320

-

2-Year Change $105,697

-

2-Year (%): 46.85%

Depending on whether your goal is to buy or sell, the housing market can be either horrible or great.

This is a great thing, as home values have risen almost 50% in the last two years. The prices rose

Between October 2021-2022, the rate was 19.61% and more than 6.3% in the final month.

Six months ending October 2022

North Dakota

-

February 2020: $247,308

-

February 2022 Home Value: $291,464

-

2-Year Change $44,156

-

2-Year (%): 17.85%

The growth rate in North Dakota over the last two decades has been slow. Although prices are on the rise, they are not rising at all.

The rate in other states is below 20%.

Ohio

-

February 2020: $168,186

-

February 2022 Home Value: $219,125

-

2-Year Change $50,939

-

2-Year (%): 30.29%

Home appreciation between September & October of 0.40% — which is moderate — the

Ohio’s housing market is not cooling nor expanding, and it is still holding steady.

Oklahoma

-

February 2020: $247,308

-

February 2022 Home Value: $291,464

-

2-Year Change $44,156

-

2-Year (%): 17.85%

Oklahoma has maintained a moderate rate of growth over the last two years. It has grown only 17.85% over the past two years.

For the next two years, 15.17% for 2021 and 2022 and 5.60% for the six months prior to that,

October, 2022.

Oregon

-

February 2020: $398,729

-

February 2022 Home Value: $519,777

-

2-Year Change $121,048

-

2-Year (%): 30.36%

Oregon has not experienced a cooling in its housing market over the past two decades. Home

The value of the property saw an increase in value of over $121,000. This could be changing, however; the month between

In September and October, there was a home value decline of -0.17%.

Pennsylvania

-

February 2020: $216,001

-

February 2022 Home Value: $271,778

-

2-Year Change $55,777

-

2-Year (%): 25.82%

Pennsylvania could be a buyer’s paradise soon. However, home values haven’t fallen dramatically.

A 26% increase in prices for homes is not going to cause an uptick in other states.

high.

Rhode Island

-

February 2020: $330,767

-

February 2022 Home Value: $446,183

-

2-Year Change $115,416

-

2-Year (%): 34.89%

With home values increasing by nearly 35%, Rhode Island’s housing market is strong.

Good news for sellers and owners who intend to stay, but perhaps not so good for buyers.

Its growth rate from September to Oct 2022 was 0.32%. This suggests that this value is high.

Increase may be here to stay

South Carolina

-

February 2020: $210,592

-

February 2022 Home Value: $301,828

-

2-Year Change $91,236

-

2-Year (%): 43.32%

South Carolina also saw a strong increase in home values over the past two year, with an average of over

43% increase. That value rose by 7.23% between April and Oct 2022.

As well.

South Dakota

-

February 2020: $230,669

-

February 2022 Home Value: $307,859

-

2-Year Change $77,190

-

2-Year (%): 33.46%

South Dakota’s market is almost twice as hot as its brother state North Dakota. With an

Over 33% market growth in the last two years.

Tennessee

-

February 2020: $210,711

-

February 2022 Home Value: $308,368

-

2-Year Change $97,657

-

2-Year (%): 46.35%

Tennessee is currently one of the most coveted markets in the nation. It is also known for its.

It saw an almost 47% value increase over the past 2 years, from April 2022 to October 2022.

Increase of 6.51%

Texas

-

February 2020: $226,720

-

February 2022 Home Value: $317,342

-

2-Year Change $90,622

-

2-Year (%): 39.97%

Texas’s housing market has maintained a moderate rate of value growth in recent years.

Past two years, nearly 40% growth. Its growth was smaller in the months between.

Slowing might be indicated by September and October at 0.16%

Utah

-

February 2020: $396,892

-

February 2022 Home Value: $568,418

-

2-Year Change $171,526

-

2-Year (%): 43.22%

Only California or Hawaii can compare to the $171 526 price hike that the typical home has experienced.

Utah saw a dramatic increase in home prices over the past 2 years. Only a few other states can boast higher levels.

Utah’s home values rose by 43.22% in percent

Vermont

-

February 2020: $276,362

-

February 2022 Home Value: $380,074

-

2-Year Change $103,712

-

2-Year (%): 37.53%

Vermont’s two-year growth rate has been respectable, but it is not at the top or at the bottom of the pack.

The bottom. Vermont will have its lowest point in September-2022.

The highest rate of growth in the U.S. was 1.05%.

Virginia

-

February 2020: $310,482

-

February 2022 Home Value: $390,554

-

2-Year Change $80,072

-

2-Year (%): 25.79%

Virginia’s increase in home value has been modest, less than other states over the past two years.

years. The month has seen a significant increase in home values of over $80,000 in the past 2 years.

Values have increased only 0.3% between September and October 2022.

Washington

-

February 2020: $454,580

-

February 2022 Home Value: $623,467

-

2-Year Change $168,887

-

2-Year (%): 37.15%

Washington was the home of the most affordable American home values both before and after the Revolution.

Two years after the pandemic, it has recovered. Homeownership has increased by more than 37%

Values have changed by nearly $170,000 in the last two years. It could be changing.

However, homes have lost their value between September 2022 and October 2022, down by 0.3%

West Virginia

-

February 2020: $117,494

-

February 2022 Home Value: $144,532

-

2-Year Change $27,038

-

2-Year (%): 23.01%

West Virginia has maintained low to moderate home values over the past two year, to the

tune of 23%, which is approximately a $27,000 increase. But signs could be pointing towards rising value, to

A tune of 0.57% for the top 20% states with rising value in the month September to October

October 20, 222.

Wisconsin

-

February 2020: $214,196

-

February 2022 Home Value: $273,153

-

2-Year Change $58,957

-

2-Year (%): 27.52%

Although 27% is not bad, housing inflation was relatively low throughout the Wisconsin pandemic.

You shouldn’t sneeze at. Recently, prices increased by 0.54 percent between September 2022 & October 2022.

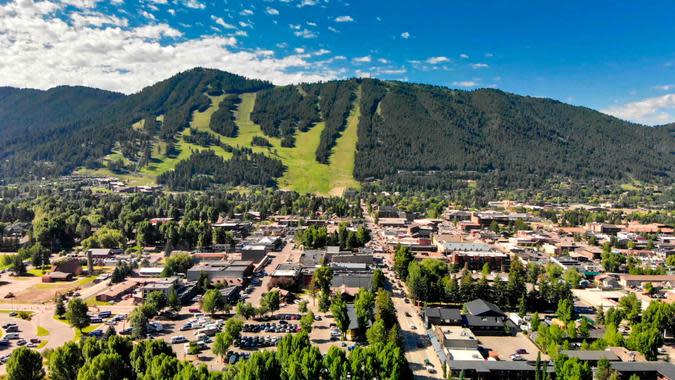

Wyoming

-

February 2020: $274,831

-

February 2022 Home Value: $341,135

-

2-Year Change $66,304

-

2-Year (%): 24.13%

Wyoming has been able to hang out with many states at the lower end of home price increases. It is currently at 25%. However, it has experienced an increase of 0.3% between September 2022 and October 2022.

More Information from GOBankingRates

Methodology: GOBankingRates used Zillow’s October 2020 Single-Family Residence, (SFR) home values data to find out the current state in the housing market in your particular state. GOBankingRates first found the following for each state: (1) October 2020 SFR Home Value; (2) October 2021 FFR Home Value; (3) April 2022 FFR Home Value; (4) September 2022 and (5) October 2022 FFR Home Value. GOBankingRates then found the following figures for each state: (6) a two-year change in SFR house value (Oct. 2020 – Oct. 2022); (3) an increase in SFR home values (April 2022 – April 2022); (4) an increase in SFR home values (September 2022 – October 2022); (5) an increase in SFR home worth; (6) a one-year change in SFR house value (Oct. 21 — Oct. 2022); (8) six months (Apr. 2022-2022: Change in SFR value. All data were collected and are current as of November 17, 2022.

This article first appeared on GOBankingRates.com: What Is the Current State of the Housing Market in Your State?