Why NMI Holdings (NMIH) May Beat Earnings Estimates Once more

Have you ever been looking for a inventory that is perhaps well-positioned to keep up its earnings-beat streak in its upcoming report? It’s price contemplating NMI Holdings (NMIH), which belongs to the Zacks Insurance coverage – Property and Casualty business.

When wanting on the final two stories, this mortgage insurance coverage firm has recorded a powerful streak of surpassing earnings estimates. The corporate has topped estimates by 10.72%, on common, within the final two quarters.

For the final reported quarter, NMI Holdings got here out with earnings of $0.90 per share versus the Zacks Consensus Estimate of $0.82 per share, representing a shock of 9.76%. For the earlier quarter, the corporate was anticipated to publish earnings of $0.77 per share and it really produced earnings of $0.86 per share, delivering a shock of 11.69%.

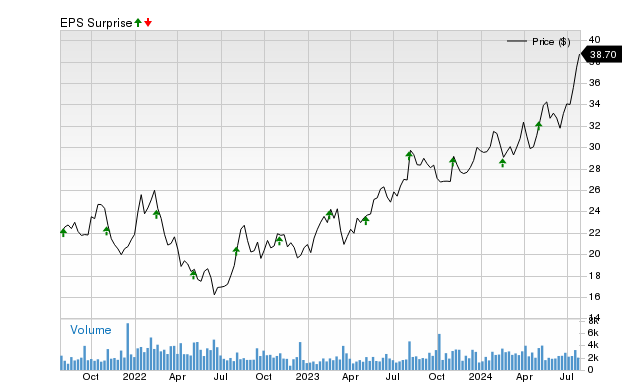

Worth and EPS Shock

Thanks partially to this historical past, there was a good change in earnings estimates for NMI Holdings recently. In truth, the Zacks Earnings ESP (Anticipated Shock Prediction) for the inventory is constructive, which is a superb indicator of an earnings beat, notably when mixed with its stable Zacks Rank.

Our analysis reveals that shares with the mixture of a constructive Earnings ESP and a Zacks Rank #3 (Maintain) or higher produce a constructive shock almost 70% of the time. In different phrases, when you have 10 shares with this mixture, the variety of shares that beat the consensus estimate may very well be as excessive as seven.

The Zacks Earnings ESP compares the Most Correct Estimate to the Zacks Consensus Estimate for the quarter; the Most Correct Estimate is a model of the Zacks Consensus whose definition is said to alter. The concept right here is that analysts revising their estimates proper earlier than an earnings launch have the newest info, which may probably be extra correct than what they and others contributing to the consensus had predicted earlier.

NMI Holdings has an Earnings ESP of +2.33% for the time being, suggesting that analysts have grown bullish on its near-term earnings potential. Whenever you mix this constructive Earnings ESP with the inventory’s Zacks Rank #3 (Maintain), it reveals that one other beat is probably across the nook. The corporate’s subsequent earnings report is anticipated to be launched on February 14, 2023.

With the Earnings ESP metric, it is necessary to notice {that a} damaging worth reduces its predictive energy; nonetheless, a damaging Earnings ESP doesn’t point out an earnings miss.

Many corporations find yourself beating the consensus EPS estimate, however that is probably not the only real foundation for his or her shares transferring greater. Alternatively, some shares could maintain their floor even when they find yourself lacking the consensus estimate.

Due to this, it is actually necessary to examine an organization’s Earnings ESP forward of its quarterly launch to extend the percentages of success. Be sure to make the most of our Earnings ESP Filter to uncover one of the best shares to purchase or promote earlier than they’ve reported.

Need the newest suggestions from Zacks Funding Analysis? Right now, you’ll be able to obtain 7 Finest Shares for the Subsequent 30 Days. Click to get this free report

NMI Holdings Inc (NMIH) : Free Stock Analysis Report