Why Shares in This Aerospace Provider Soared in March

Shares in premium specialty alloy firm Carpenter Know-how (NYSE: CRS) rose 10.5% in March, in keeping with information offered by S&P Global Market Intelligence. The transfer got here in an upbeat month for aerospace-focused shares, pushed by GE Aerospace‘s (NYSE: GE) upbeat presentation on March 7.

Carpenter Know-how’s development prospects

The corporate classifies itself because the “main international producer of merchandise, components, and elements made from specialty supplies, alloys, and titanium.” It generates round half of its gross sales from the aerospace market. Its different two vital finish markets are industrial & client (19%) and medical (14%).

As such, aerospace is its major finish market and the figuring out issue influencing its earnings. Its alloys and merchandise are used extensively within the aerospace trade, together with engines, fasteners, and structural and avionics elements.

One attention-grabbing facet of Carpenter’s options is that they’re discovered within the authentic tools market (OEM) and the upkeep, restore, and operations (MRO) markets. That is a major plus within the present atmosphere as a result of, for instance, if Boeing continues to battle to ramp up airplane manufacturing, the OEM market might be damage.

Nevertheless, if airways are pressured to function older planes for longer on account of Boeing’s failure to satisfy supply necessities, the demand for MRO providers is more likely to improve.

A development trade

The excellent news is that the most important plane engine producer on this planet, GE Aerospace, not too long ago gave an upbeat evaluation of each OEM and MRO markets. GE Aerospace expects engine deliveries to develop by 20% to 25% in 2024 in comparison with a 38% improve in 2023.

In the meantime, GE Aerospace sees its providers income reaching a low double-digit compound annual development fee from 2023 to 2028.

All of it speaks to a optimistic atmosphere for Carpenter, whether or not on the OEM or MRO facet, as a result of its options serve each finish markets, and I believe it is an excellent stock to buy.

Carpenter’s margin growth

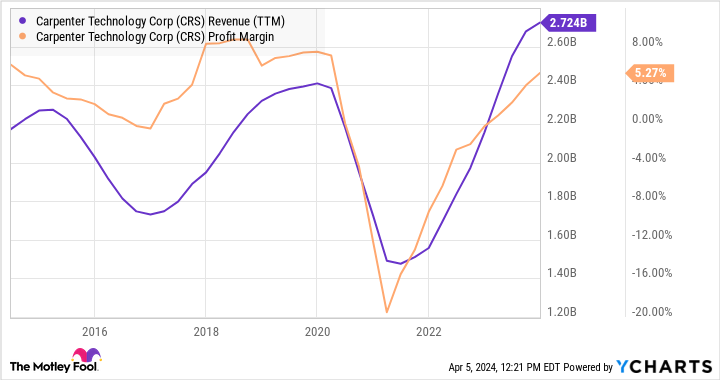

An upbeat trade evaluation is especially excellent news for Carpenter as a result of its comparatively excessive fastened prices imply its revenue margin is extremely leveraged. In plain English, its revenue margin goes up considerably with a rise in income.

As you may see under, its working revenue margin sank as income fell as a result of lockdowns, nevertheless it’s coming again strongly now.

Administration believes its working earnings will develop from $133 million in 2023 to a spread of $310 million to $330 million in 2024, after which $460 million to $500 million in 2027. Hitting these targets would imply the inventory is materially undervalued on 20 instances 2024 earnings.

Must you make investments $1,000 in Carpenter Know-how proper now?

Before you purchase inventory in Carpenter Know-how, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Carpenter Know-how wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $526,345!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 4, 2024

Lee Samaha has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

Why Shares in This Aerospace Supplier Soared in March was initially printed by The Motley Idiot