Talkspace (NASDAQ/TALK) to Spend Its Cash Wisely

Investors are attracted to non-profitable companies. This is why we can easily understand why. Biotech and mining exploration companies lose money over years before they find success with new treatments or discoveries. History is full of rare successes. But those that fail are often overlooked.

This risk is so significant that we decided to take a look at it. Talkspace (NASDAQ:TALKIt is important that shareholders are concerned about the cash burn. This report will examine the company’s annual negative cash flow. We will now refer to it as the “cash burned”. Let’s examine the cash of the company in relation to its cash loss.

View our latest analysis for Talkspace

What happens if Talkspace runs out of money?

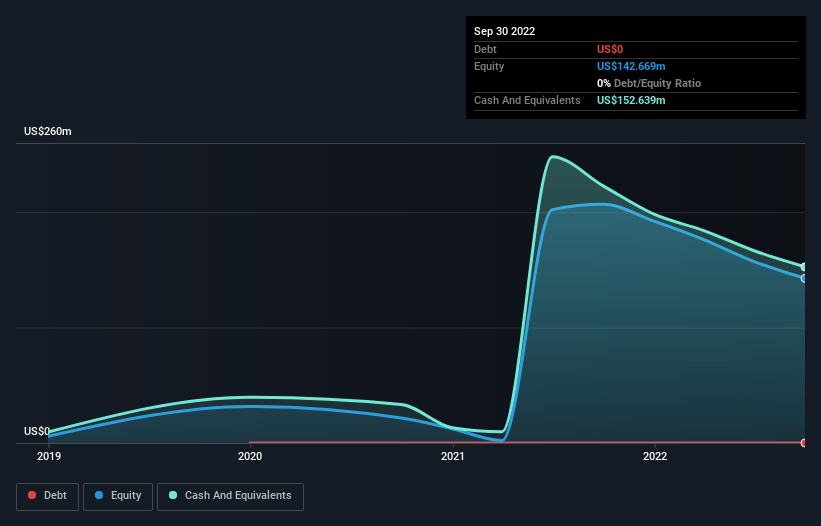

Calculating a company’s cash runway involves dividing its cash hoard with its cash burn. Talkspace had US$153 million in cash and no debt as of September 2022. Importantly, Talkspace’s cash burn in the last twelve months was US$72m. The company had 2.1 year cash runway as of September 2022. Analysts forecast that Talkspace (at a level of free cash flow) will be profitable in 4 years. This means that if Talkspace doesn’t reduce its cash burn quickly it might look to raise additional cash. The image below shows how the company’s cash balance has changed over time.

How is Talkspace growing?

It’s not surprising at first that Talkspace has seen its cash burn increase by 40% year-on-year. A 7.5% revenue growth is encouraging. These two factors are why we don’t find the growth profile particularly exciting. The future is what is most important. While it is worth looking at the past, it is still worthwhile to do so. It is therefore very sensible to have a look at the future. our analyst forecasts for the company.

How easy can Talkspace raise cash?

Talkspace appears to be developing its business well. However, we would still like to see how easy it could raise money to speed up growth. A listed company can either issue shares or take on debt to raise cash. Publicly listed companies have the advantage of being able to sell shares to investors to fund growth and raise cash. We can see how much cash a company burns relative to its market capitalisation to get an idea of how many shareholders would be affected if it needed to raise additional cash.

Talkspace is valued at US$117m, and it has burned through US$72m in the last year. This is 61% of the company’s market value. We consider Talkspace a high-risk stock due to its large cash burn relative to the company’s market value. There is also the possibility of severe dilution.

Talkspace’s Cash Burn a Worry?

We are not happy with the ratio of cash burn to market capital, but we must mention that Talkspace’s cash runway seemed very promising. Analysts are predicting that the company will break even. This is a positive. Based on the factors mentioned in this article, we believe Talkspace’s cash burn to be a risk. It is important that readers have a good understanding of the risks associated with investing in stocks. 3 warning signs for Talkspace These are the things potential shareholders need to consider before investing in a stock.

Naturally You might be able to find a great investment elsewhere. Have a look at this Free list of companies insiders are buying, this list of stocks growth stocks (according to analyst forecasts)

Let us know what you think about this article. Are you concerned about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St has a general nature. Our commentary is based on historical data, analyst forecasts and other unbiased information. We do not intend to provide financial advice. This analysis does not represent a recommendation to purchase or sell any stock and it does not consider your financial goals or financial situation. We strive to deliver long-term, focused analysis that is based on fundamental data. Please note that our analysis might not include the latest announcements from price-sensitive companies or qualitative material. Simply Wall St holds no position in any of the stocks mentioned.

Participate in a Paid User Research Session

You’ll receive a Amazon Gift card – US$30 Give us 1 hour of your time and help us create better investing tools for individual investors like you. Sign up here