Institutional investors have a lot riding in FibroGen, Inc.’s (7NASDAQ:FGEN) ownership.

FibroGen, Inc.’s shareholders.NASDAQ:FGENThe ) can reveal which group is most powerful. Institutions have 73% of the company’s total shares. This means that the group is most likely to profit from a stock increase or lose it if it falls.

Last week institutional investors saw the biggest gains after the company’s market cap reached US$1.9b. The 1-year return on investment for institutional investors is currently at 43%. Last week’s gain would not have been unexpected.

Let’s take a closer glance to learn more about FibroGen from the different shareholders.

View our latest analysis for FibroGen

What does The Institutional Ownership Say About FibroGen

When reporting to their investors, institutions usually measure themselves against a benchmark. As a result, they tend to be more excited about a stock if it’s part of a major index. In order to be considered a growing company, we would expect that there are at least some institutions on the Register.

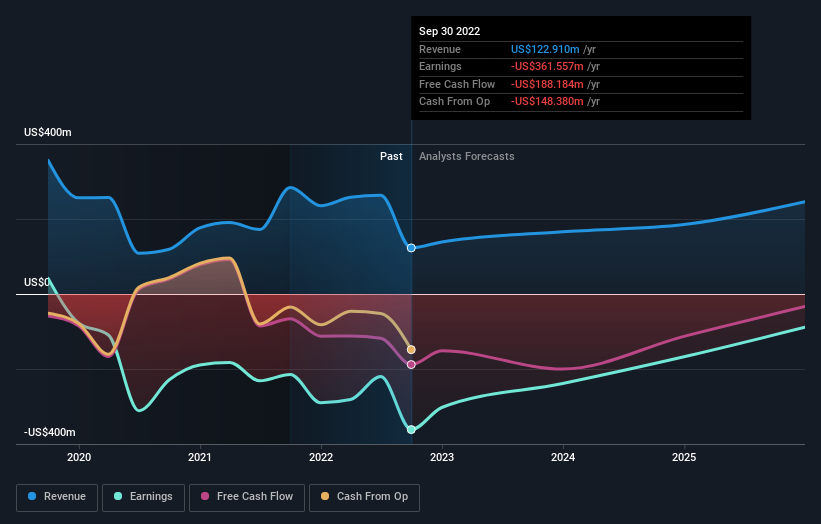

FibroGen already owns institutions on the share register. In fact, they have a significant stake in the company. Professional investors may be able to see this as a sign of credibility. However, we cannot rely solely on this fact. Institutions can make poor investments at times just as everyone else. You could see a rapid drop in share prices if several institutions change their views on a stock. Below is FibroGen’s earnings history. It is the future that matters most.

Institutional investors control more than half of the stock issued, so the board will need to be aware of their preferences. According to our data, hedge funds hold 5.1% of FibroGen. This is important to note, as hedge funds are often very active investors who might try to influence management. Many are looking for value creation (and higher shares prices) in the medium and short term. PRIMECAP Management Company is the largest shareholder of the company, holding 14%. The Vanguard Group, Inc., BlackRock, Inc., are the second- and third largest shareholders with respective 10% and 7.6% of outstanding shares.

Further inspection revealed that 7 of the top shareholders own more than half of the company’s shares. This suggests that the interests and power of the larger shareholders is balanced by those of the smaller shareholders.

A good way to assess and filter the expected performance of a stock is to research institutional ownership. You can also study analyst sentiments. It might be worthwhile to look at the forecasts of other analysts who cover the stock.

FibroGen insider ownership

Although the definition of insiders can vary from country to country, all members of the board count. Although the company management manages the business, the CEO must answer to the board of directors, even if they are members.

Insider ownership is generally something I consider a positive thing. It can make it difficult for other shareholders, however, to hold the board responsible for its decisions.

It is clear that insiders have shares in FibroGen, Inc. This is a huge company so it’s nice to see such alignment. At current prices, insiders hold shares worth US$29m. This level of insider investment is a good thing. You can check here to see if those insiders have been buying recently.

General Public Ownership

15% of the company’s stock is owned by the general public, which includes retail investors. This cannot be overlooked. If the decision is not in line with large shareholders, this size of ownership may not be enough for company policy to change.

Private equity ownership

Private equity firms have a 5.3% ownership and can play an important role in shaping corporate strategy, with a focus of value creation. Although private equity can sometimes stay for the long haul, they tend to have a shorter investment period and are not likely to invest heavily in public companies. After a time, they might decide to sell or redeploy capital.

Next steps:

It is always worthwhile to think about who holds shares in a company. To understand FibroGen better we must also consider other factors. Keep in mind that FibroGen is showing 2 warning signs in our investment analysis You should be aware of the following:

Ultimately Future is important. This is how you can get it. Free report on analyst forecasts for the company.

NB: The figures in this article were calculated using data from twelve months ago. This refers to the 12-month period that ended on the date of the financial statement. This might not be consistent to full-year figures in the annual report.

Let us know what you think about this article. Have a question about the content? Get in touch Contact us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St has a general nature. Our commentary is based only on historical data and analyst projections. This analysis does not represent a recommendation to purchase or sell any stock and it does not consider your financial goals or financial situation. Our goal is to provide you with long-term, focused analysis based on fundamental data. Please note that our analysis might not include the latest announcements from price-sensitive companies or qualitative material. Simply Wall St does not hold any position in the stocks mentioned.

Register for a paid user research session

You’ll receive a Amazon Gift Card: US$30 Give us 1 hour of your time and help us create better investing tools for individual investors like you. Sign up here