Huntington Ingalls Industries, Inc., NYSE :HII, is heavily dominated with 88% ownership

Huntington Ingalls Industries, Inc.NYSE:HIIYou should be aware which shareholder groups are the most powerful. The 88% share of institutions that own the company is the largest. In other words, the group has the greatest upside potential (or downside)

Institutional owners are able to access a large pool of liquidity and resources, which means that their decisions regarding investing can be influenced by individual investors. It is often desirable to have a large amount of institutional money invested into a company.

Let’s take a closer glance to learn more about Huntington Ingalls Industries from the different shareholders.

View our latest analysis for Huntington Ingalls Industries

What does the Institutional Ownership tell us about Huntington Ingalls Industries

Many institutions compare their performance to an index that approximates local markets. They pay more attention to companies included in major indices.

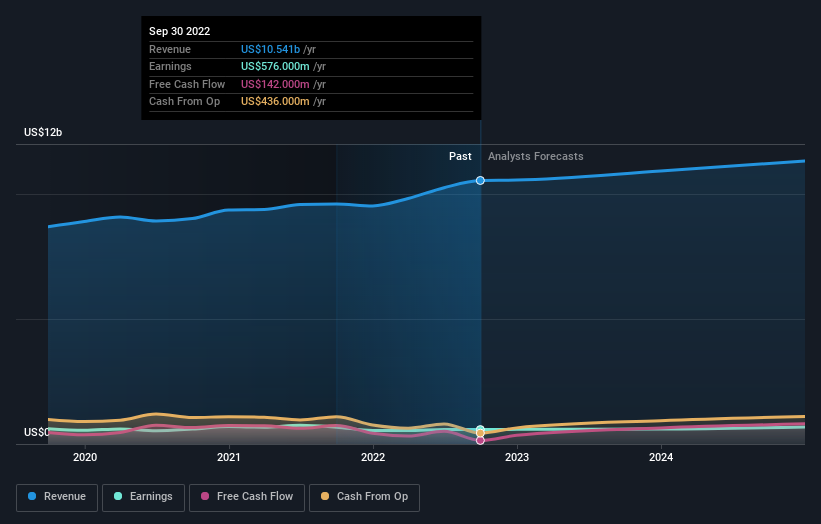

Huntington Ingalls Industries already maintains institutions on the stock registry. They actually own a substantial stake in the company. Analysts working for these institutions will have seen the stock and found it appealing. They could, however, be mistaken. There is always the possibility of multiple institutions holding a stock. Multiple parties could try to sell stock quickly if a trade goes wrong. A company with a poor track record of growth is more at risk. Here are Huntington Ingalls Industries historical earnings and revenues. However, there are many more details.

Institutional investors control more than half of the issued stock. The board will need to consider their preferences. Huntington Ingalls Industries is not a popular place for hedge funds. The Vanguard Group, Inc. is the largest shareholder of Huntington Ingalls Industries, owning 12%. BlackRock, Inc., with 9.3% of common stock, is second, while State Street Global Advisors, Inc. owns 7.3%.

Further research revealed that 11 of the top shareholders own 51% of the company. This suggests that there is no single shareholder with significant control over the company.

It is possible to filter and gauge the stock’s potential performance by researching institutional ownership. You can also study analyst sentiments. There are many analysts who cover the stock so it is possible to look into forecast growth.

Insider Ownership Of Huntington Ingalls Industries

Although the definition of insiders can vary between countries, all members of a board of directors are considered to be insiders. The board should be accountable to the company management and represent the shareholders’ interests. Sometimes, top-ranking managers serve on the board.

Many consider insider ownership to be a positive as it indicates that the board is well aligned and supportive of other shareholders. Sometimes, however, too much power can be concentrated within the group.

Insiders have shares in Huntington Ingalls Industries, Inc., which would interest shareholders. According to current prices, insiders hold shares worth US$176m. Many would agree that this is a sign of a strong alignment between shareholders, directors and officers. However, it is worth looking at. if those insiders have been selling.

General Public Ownership

10% of the company’s stock is owned by the public (including retail investors) and cannot be overlooked. Although this ownership is not enough to influence a policy decision, it can have a significant impact on the company’s policies.

Next Steps

It is always worthwhile to think about who holds shares in a company. We need to take into account many other factors in order to better understand Huntington Ingalls Industries. One example: We have spotted 2 warning signs for Huntington Ingalls Industries You should be aware, and 1 cannot be ignored.

You may be like me and want to know if the company will grow or shrink. You can check! this free report showing analyst forecasts for its future.

NB: The figures in this article were calculated using data from twelve months ago. This refers to the 12-month period that ended on the date of the financial statement. This could not be consistent with full-year annual report figures.

Give feedback about this article Are you concerned about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article is general in nature by Simply Wall St. Our commentary is based on historical data, analyst forecasts and other unbiased information. We do not intend to provide financial advice. This analysis does not represent a recommendation to purchase or sell any stock and it does not consider your objectives or financial situation. Our aim is to give you long-term focused analysis that is based on fundamental data. Please note that our analysis might not include the most recent announcements from price-sensitive companies or qualitative material. Simply Wall St holds no position in any of the stocks mentioned.

Participate in a Paid User Research Session

You’ll receive a Amazon Gift Card: US$30 Give us 1 hour of your time and help us create better investing tools for individual investors like you. Sign up here