Beacon (BECN), focuses on Ambition 2025 amid Inflation woes

Beacon Roofing Supply, Inc. BECN has benefited from strong acquisitions, strategic growth plans and cost-reduction initiatives.

The company is well on its way to achieving its Ambition 2025 strategic goals. By 2025, sales are expected to exceed $9 billion. Adjusted EBITDA will be $1 billion. The company works to reduce its expenses and increase its margins every year.

This Zacks Rank #3 Hold company has seen higher expenses and costs due to persistently high labor and material inflation. Concerns include economic risks such as volatile interest rates and economic instability.

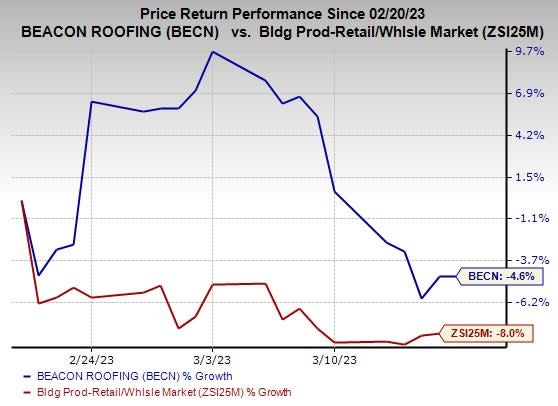

Image Source: Zacks Investment Research

Although BECN outperformed Zacks Building Products Retail industry, it has dropped 4.6% in the last month.

Growth drivers

Ambition 2025: The Best Targets Beacon’s focus on Ambition 2025 strategic planning is helping it gain. The company announced the plan on February 24, 2022. It anticipates that sales will reach $9 billion (8% compound annual growth rate). EBITDA will be $1 billion (10% CAGR), resulting in a 11% EBITDA margin, up 100 basis points over 2021.

Beacon added 16 new branches in 2022, exceeding its goal of 10 per year. The company also opened 16 Greenfields across 12 states. As part of the plan, 130 employees were also eligible for restricted stock units and special awards.

The company’s focus on four key strategic initiatives — organic growth, digital, OTC (On-Time and Complete) and branch operating performance — bodes well. The company is focusing on improving sales performance and operating performance at both exterior and inner branches. They also plan to enhance the overall customer experience by expanding their business and specializing in more areas. The company’s OTC strategy makes use of the branch network’s density to better serve customers.

Strong Acquisitions Beacon has focused on business growth through bolt-on acquisitions or divestitures. In 2022, Beacon made five acquisitions. In 2023, it has already acquired one.

It completed two acquisitions in the second half 2022. Beacon purchased First Coastal Exteriors, LLC, a distributor for complementary residential and commercial building materials, on January 4, 2023. Whitney Building Products, LLC was acquired by the company on Dec 30, 2022. One of its branches is located in Massachusetts. On Nov 1, 2022, Coastal Construction Products, a subsidiary of Beacon, was acquired in the United States. It has 18 branches primarily in Southeast.

BECN made three acquisitions in the first half 2022. Complete Supply, Inc., Willowbrook, IL, was acquired by the company in June 2022. It acquired Wichita Falls Builders Wholesale, Inc. Builders Wholesale, a distributor of residential exterior building supplies, on April 29, 2022. Crabtree Siding and Supply was acquired by it on January 1, 2022. It is a wholesale distributor for residential exterior building materials.

Downsizing Costs: Beacon invests in various initiatives to reduce costs and expenses. It is working on the integration of Allied Building Products, and the employee transition. Beacon started consolidating procurement programmes to ensure the best supply arrangements from vendors. These efforts have resulted in a decrease in company operating costs.

The result of higher prices in volatile markets and a more diverse product mix, which led to operating and adjusted EBITDA margins increasing 140 bps each year and 70 bps respectively in 2022, respectively, was an increase of 140 bps. In 2022, the company reduced its operating expenses by 160bps to increase margins.

The company anticipates that the gross margin will be 25% for the first quarter 2023. The company expects adjusted EBITDA to be in the $810-$870 range for 2023.

Headwinds

High-Cost Inflation: Beacon’s growth prospects are being affected by increased inflationary pressure across most product categories, despite undertaking various cost-saving initiatives. Macroeconomic risk is also affecting the input cost.

In the fourth quarter 2022, adjusted operating expenses increased by 18.5%. This was due to an increase in headcount, inflationary pressure, wages, fuel, and lease related expenses like rents, real property taxes, utilities, maintenance costs, and higher incentive compensation.

Economic Risks As most of Beacon’s work is performed outdoor and is based on repair and remodeling activity, it is vulnerable to COVID-induced economic disruptions. COVID-19 directly impacted the cost of selling, administration and general expenses by causing a $2 million increase in 2022.

The company is heavily dependent on new residential construction. Inflationary pressure, affordability problems, and rises in interest rates have all slowed growth in new residential construction over the last few months. Beacon predicts that there will be little demand for residential construction in 2023.

Here are some key picks

Here are some stocks investors might consider buying in the Zacks Retail Wholesale Sector. See also: the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chuy’s Holdings, Inc. CHUY currently holds a Zacks Rank #1. CHUY delivered an average trailing four-quarter earnings surprise (in the range of 19.1%) CHUY shares rose 48.9% over six months.

The Zacks Consensus Estimate for CHUY’s 2023 sales and EPS suggests growth of 10.8% and 19%, respectively, from the corresponding year-ago period’s levels.

Arcos Dorados Holdings Inc. ARCO has a Zacks Rank #1. ARCO has an 11.6% long-term earnings growth. In the last six months, shares have risen by 2.5%

The Zacks Consensus Estimate for ARCO’s 2023 sales suggests growth of 8.7% buts EPS suggests a decline of 11.6%, from the year-ago period’s levels.

Brinker International, Inc. EAT has a Zacks Rank #2. (Buy). EAT’s long-term earnings growth rate is 7.1%. In the past six months, the stock price has increased 26.9%

The Zacks Consensus Estimate for EAT’s fiscal 2023 sales suggests growth of 8.2% but EPS suggests a decline of 12%, from the year-ago period’s reported levels.

Want the most recent Zacks Investment Research recommendations? Download 7 Best Stocks in the Next 30 Days Today Click to get this free report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN) : Free Stock Analysis Report

Chuy’s Holdings, Inc. (CHUY) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report