Bristol-Myers Squibb (NYSE:BMY) shareholders have endured a 33% loss from investing within the inventory a 12 months in the past

It is easy to match the general market return by shopping for an index fund. If you purchase particular person shares, you can also make increased earnings, however you additionally face the danger of under-performance. Traders in Bristol-Myers Squibb Firm (NYSE:BMY) have tasted that bitter draw back within the final 12 months, because the share worth dropped 35%. That is disappointing when you think about the market returned 26%. Even should you look out three years, the returns are nonetheless disappointing, with the share worth down32% in that point. Sadly the share worth momentum continues to be fairly damaging, with costs down 16% in thirty days. This could possibly be associated to the latest monetary outcomes – you may make amends for the latest information by studying our company report.

So let’s take a look and see if the long run efficiency of the corporate has been according to the underlying enterprise’ progress.

See our latest analysis for Bristol-Myers Squibb

To cite Buffett, ‘Ships will sail all over the world however the Flat Earth Society will flourish. There’ll proceed to be large discrepancies between worth and worth within the market…’ One imperfect however easy technique to think about how the market notion of an organization has shifted is to check the change within the earnings per share (EPS) with the share worth motion.

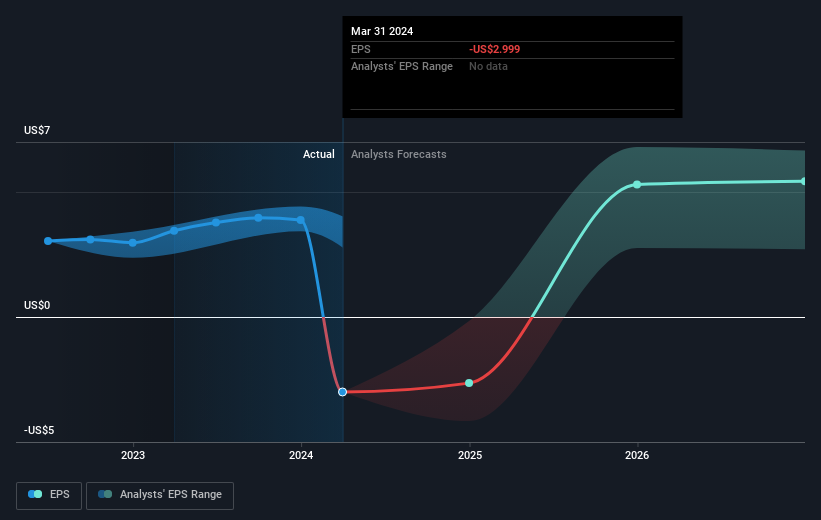

Bristol-Myers Squibb fell to a loss making place in the course of the 12 months. Whereas this will likely show momentary, we might think about it a damaging, so it would not shock us that the inventory worth is down. We hope for shareholders’ sake that the corporate turns into worthwhile once more quickly.

You’ll be able to see how EPS has modified over time within the picture beneath (click on on the chart to see the precise values).

We like that insiders have been shopping for shares within the final twelve months. Having stated that, most individuals think about earnings and income development traits to be a extra significant information to the enterprise. This free interactive report on Bristol-Myers Squibb’s earnings, revenue and cash flow is a good place to begin, if you wish to examine the inventory additional.

What About Dividends?

You will need to think about the entire shareholder return, in addition to the share worth return, for any given inventory. Whereas the share worth return solely displays the change within the share worth, the TSR consists of the worth of dividends (assuming they have been reinvested) and the good thing about any discounted capital elevating or spin-off. So for firms that pay a beneficiant dividend, the TSR is usually quite a bit increased than the share worth return. Because it occurs, Bristol-Myers Squibb’s TSR for the final 1 12 months was -33%, which exceeds the share worth return talked about earlier. That is largely a results of its dividend funds!

A Completely different Perspective

Bristol-Myers Squibb shareholders are down 33% for the 12 months (even together with dividends), however the market itself is up 26%. Nevertheless, remember the fact that even one of the best shares will typically underperform the market over a twelve month interval. Long term buyers would not be so upset, since they might have made 2%, every year, over 5 years. It could possibly be that the latest sell-off is a chance, so it could be value checking the basic information for indicators of a long run development development. Whereas it’s properly value contemplating the totally different impacts that market circumstances can have on the share worth, there are different elements which can be much more vital. Think about for example, the ever-present spectre of funding threat. We’ve identified 2 warning signs with Bristol-Myers Squibb , and understanding them ought to be a part of your funding course of.

Bristol-Myers Squibb just isn’t the one inventory that insiders are shopping for. For individuals who like to seek out successful investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please notice, the market returns quoted on this article replicate the market weighted common returns of shares that at present commerce on American exchanges.

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to convey you long-term centered evaluation pushed by basic information. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.