Bruker’s new tie-up to expand its U.S. CRO business

Bruker Corporation BRKR announced a strategic partnership recently with Biognosys. The financial details of the deal were not disclosed. It has allowed Bruker to invest a majority in Biognosys.

Moreover, several of Biognosys’ earlier investors have sold their shares to Bruker in a secondary transaction. Bruker will now make secondary investments in Biognosys’ Switzerland-based Biognosys.

The latest partnership is expected to significantly solidify Bruker’s Life-Science Mass Spectrometry business in the United States.

The Reasons Behind the Partnership

Bruker’s latest collaboration with Biognosys is expected to create unique synergies between Biognosys’ versatile portfolio of proprietary proteomics services, software and kits and Bruker’s pioneering timsTOF platform. Biognosys plans to open the first advanced proteomics contract research organisation (CRO) in Massachusetts as a result this strategic partnership.

Bruker’s management believes that its tie-up with Biognosys will likely enable it to expand its CRO business in the United States. The company currently serves many biomarker- and biopharma customers. Potential customers may choose Biognosys as a CRO service provider for proteomics. This allows them to quickly and easily insert proteomics into their biomarker, biopharma discovery, and development. Management believes that the partnership will offer unique data-science and proteomics expertise due to its rapid scientific acceptance of diaPASEF workflows. According to Bruker, this partnership will benefit more biopharmaceutical and diagnostics companies that use unbiased proteomics for decision making.

Biognosys’ management feels that the collaboration with Bruker will enable it to leverage the companies’ unique synergies to allow customers to explore the depth of the proteome from early research to clinical development.

Industry Prospects

Precedence Research’s report states that the global proteomics market is expected to grow at 12.41% annually by 2030. It was $26.1 billion in 2021, according to Precedence Research. The market will be driven by factors such as the rising demand for personalized medicine, the increase in the number and quality of diagnostic tools that target specific diseases and treatments, and the increase in research activities.

Given the market potential, the latest partnership is likely to provide a significant boost to Bruker’s business in the United States.

Notable agreements

Last month, Bruker announced that its Bruker Energy & Supercon Technologies division and majority-owned RI Research Instruments GmbH had received multi-year contracts to supply key technology components for major fusion projects in Europe and Asia, together valued at approximately $50 million.

Bruker, a provider ultralight fiber-bundle Multiscopes that enable simultaneous multi-region optical functional neuroimaging, announced in November the signing of a definitive agreement to buy 100% of Neurescence Inc.’s shares.

Bruker also announced that Inscopix, Inc., a pioneering provider of miniaturized microscopes, was being acquired by them. This miniscopes allows for freely moving brain imaging of animals.

Price Performance

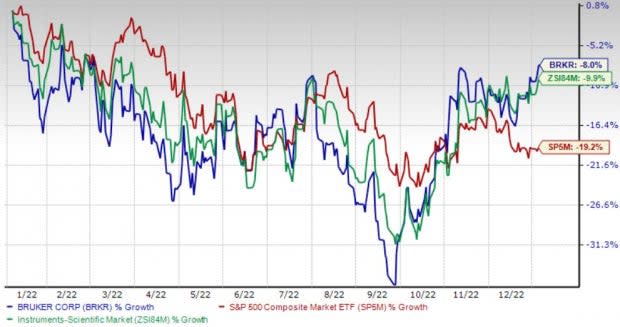

Shares of Bruker have lost 8% in the past year compared with the industry’s 9.9% decline and the S&P 500’s 19.2% fall.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Bruker currently carries a Zacks Rank 3 (Hold).

There are some stocks that rank higher in the wider medical space. AMN Healthcare Services, Inc. AMN, Boston Scientific Corporation BSX Merit Medical Systems, Inc. MMSI.

AMN Healthcare is a Zacks Rank #2 Buy at the moment. It has an expected long-term rate of growth of 3.3%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 10.9%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has lost 11.9% compared with the industry’s 29.2% decline in the past year.

Boston Scientific currently has a Zacks Rank #2 and an expected long-term growth rate 10.3%. BSX’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average beat being 1.9%.

Boston Scientific has gained 9.2% against the industry’s 41.3% decline over the past year.

Merit Medical currently has a Zacks Rank 2 and an expected long-term growth rate 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 15.7% against the industry’s 6.8% decline over the past year.

Get the most recent Zacks Investment Research recommendations. Download 7 Best Stocks in the Next 30 Days Today Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Bruker Corporation (BRKR) : Free Stock Analysis Report