Estimating the Intrinsic Value Of Acomo N.V.

What is the distance to Acomo N.V.AMS:ACOMO(or its intrinsic value)? We will use the most up-to-date financial data to assess whether the stock price is fair. By taking the expected cash flows for the future and then discounting them to the current value, we can determine if it is priced fairly. For this purpose, we will use the Discounted cash flow (DCF), model. It’s not complicated at all, although it may seem complex.

A company can be valued in many different ways. Therefore, a DCF may not work for everyone. The following resources are available for those interested in equity analysis. Simply Wall St analysis model here You might be interested in these topics.

View our latest analysis for Acomo

Is Acomo Fairly Valued?

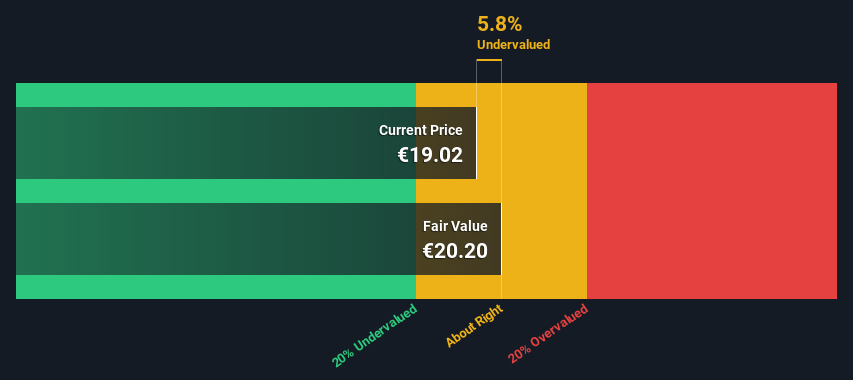

Acomo is a retailer in the consumer retailing industry, so we have to calculate intrinsic value differently. Instead of using cash flows that are difficult to calculate and not reported by analysts, we use dividends per share (DPS). This method can underestimate the stock’s value if a company does not pay out the majority of its FCF in dividends. The Gordon Growth Model assumes that the dividend will grow at a steady rate. A conservative growth rate that does not exceed the company’s Gross Domestic Products (GDP) is used for a variety of reasons. In this example, we used the 5-year-old average of the 10-year Treasury Bond Yield (0.2%). The expected dividend per shares is then reduced to the current value using a cost-of-equity of 4.6%. Compared to the current share price of €19.0, the company appears about fair value at a 5.8% discount to where the stock price trades currently. As assumptions can have a significant impact on valuation, it is better not to get down to the cent.

Value Per Share = Expected Dividend/ (Discount rate – Perpetual growth Rate)

= €0.9 / (4.6% – 0.2%)

= €20.2

The Assumptions

We believe that the two most important inputs for a discounted cash flow are the actual cash flows and the discount rate. Try the calculations yourself and experiment with the assumptions if you aren’t satisfied with them. The DCF does not take into account the potential cyclicality or future capital requirements of an industry. It does not provide a complete picture of a company’s potential performance. Acomo is being considered as potential shareholders. Therefore, we use the cost-of-equity as our discount rate. This is in addition to the cost capital (or weighted average capital cost, WACC), which accounts for debt. We used 4.6%, which was based on a leveraged beta of 0.800. Beta is the measure of a stock’s volatility relative to the entire market. Our beta is determined from the industry’s average beta of globally comparable businesses. There is an imposed limit between 0.8% and 2.0. This is a reasonable range to consider stable business.

SWOT Analysis of Acomo

Strength

Weakness

Opportunity

Threat

Look Ahead

While the company’s valuation is an important aspect of company analysis, it shouldn’t be the only piece. DCF models aren’t the sole source of investment valuation. The best use of a DCF model to evaluate assumptions and theories is to determine whether they will lead to undervaluation or overvaluation. The output of a company can be very different if it grows at a different pace or if its cost-of-equity or risk free rate rises sharply. Three important factors are worth further investigation by Acomo.

-

There are risks: For example, we have identified 2 warning signs for Acomo (1 is significant) You should be aware.

-

Other solid businessesA strong business is built on low debt, high returns of equity and solid past performance. Explore! our interactive list of stocks with solid business fundamentals To find out if there are any other companies that you might have not considered.

-

Other Top Analyst Picks: Curious to see the thoughts of analysts? Take a look our interactive list of analysts’ top stock picks Find out their thoughts on what might make a positive future!

PS. PS. You can also find the calculations for other stocks here search here.

Give feedback about this article Have a question about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St has a general nature. We only provide commentary on historical data and analyst projections. Our articles are not meant to be considered financial advice. This does not constitute a recommendation for you to buy or sell any stock. It also does not take into account your financial situation or objectives. Our goal is to provide you with long-term, focused analysis based on fundamental data. Please note that our analysis might not include the most recent announcements from price-sensitive companies or qualitative material. Simply Wall St holds no position in any of the stocks mentioned.

Participate in a Paid User Research Session

You’ll receive a Amazon Gift Card – US$30 Spend an hour helping us to create better tools for individual investors. Sign up here