Here’s How to Make the Most Of Best & Less Group Holdings’ (ASX.BST) Decelerating Returns

What are the key trends to look for in a business that will yield a multi-bagger stock? A business should show two trends. Return on capital employed (ROCE), and secondly, an increasing The amount Capital employed. This is a sign that the company is a compounding machine. It can reinvest its earnings into the business to generate higher returns. The ROCE is high, however. Best & Less Group Holdings (ASX:BSTWe’re not going to get up and run because of the declining returns.

Understanding Return On Capital Employed (ROCE)

ROCE, or the return on capital employed by a business, is a measure that measures a company’s annual pre-tax profit (or its return). The formula for this calculation on Best & Less Group Holdings is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.23 = AU$56m ÷ (AU$377m – AU$130m) Based on the trailing twelve month to July 2022.

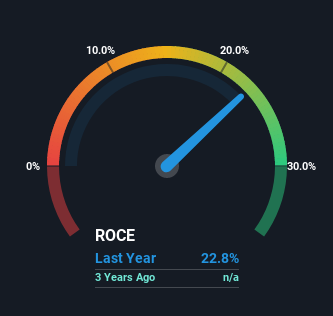

Thus, Best & Less Group Holdings has an ROCE of 23%. Absolute terms, that’s quite a respectable return. It’s also pretty comparable to the 19% average for the Specialty Retail sector.

Check out our latest analysis for Best & Less Group Holdings

In the above chart we have measured Best & Less Group Holdings’ prior ROCE against its prior perFormance, but the future is arguably more important. If you’d like, you can check out the forecasts from the analysts covering Best & Less Group Holdings here for free.

What is the current trend in returns?

Things have been pretty stable at Best & Less Group Holdings, with its capital employed and returns on that capital staying somewhat the same for the last one year. This is not unusual for a stable, mature business that doesn’t reinvest its earnings. It has probably passed the business cycle. While the current operations deliver respectable returns, we would be hard-pressed not to believe that it will continue to be a multi-bagger. That probably explains why Best & Less Group Holdings has been paying out 68% of its earnings as dividends to shareholders. These older businesses have stable earnings, and there are not many places where they can be reinvested. Therefore, the best thing to do is to transfer the earnings to shareholders.

What We Can Learn From Best & Less Group Holdings’ ROCE

It is allocating capital efficiently to produce impressive returns but it isn’t compounding it’s base of capital. This is what we would expect from a multibagger. Investors seem hesitant that trends will pick-up, as the stock has dropped 50% over the past year. The inherent trends aren’t typical for multi-baggers so if you’re looking for that, you may have more success elsewhere.

Like most companies, Best & Less Group Holdings does come with some risks, and we’ve found 3 warning signs You should be aware.

Check out our website to see how other companies are earning high returns. No cost list of companies earning high returns with solid balance sheets here.

Give feedback about this article Have a question about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article is general in nature by Simply Wall St. Our commentary is based on historical data, analyst forecasts and other unbiased information. We do not intend to provide financial advice. It is not a recommendation not to buy or sell any stocks and does not consider your objectives or financial situation. Our goal is to provide you with long-term, focused analysis based on fundamental data. Our analysis may not take into account the most recent price-sensitive company announcements and qualitative material. Simply Wall St does not hold any position in the stocks mentioned.

Participate in a Paid User Research Session

You’ll receive a Amazon Gift Card: US$30 Give us 1 hour of your time and help us create better investing tools for individual investors like you. Sign up here